Gold: XAU/USD run higher has been put on ice ahead of the FOMC [Video]

![Gold: XAU/USD run higher has been put on ice ahead of the FOMC [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/safe-investment-gm147322399-17568598_XtraLarge.jpg)

Gold

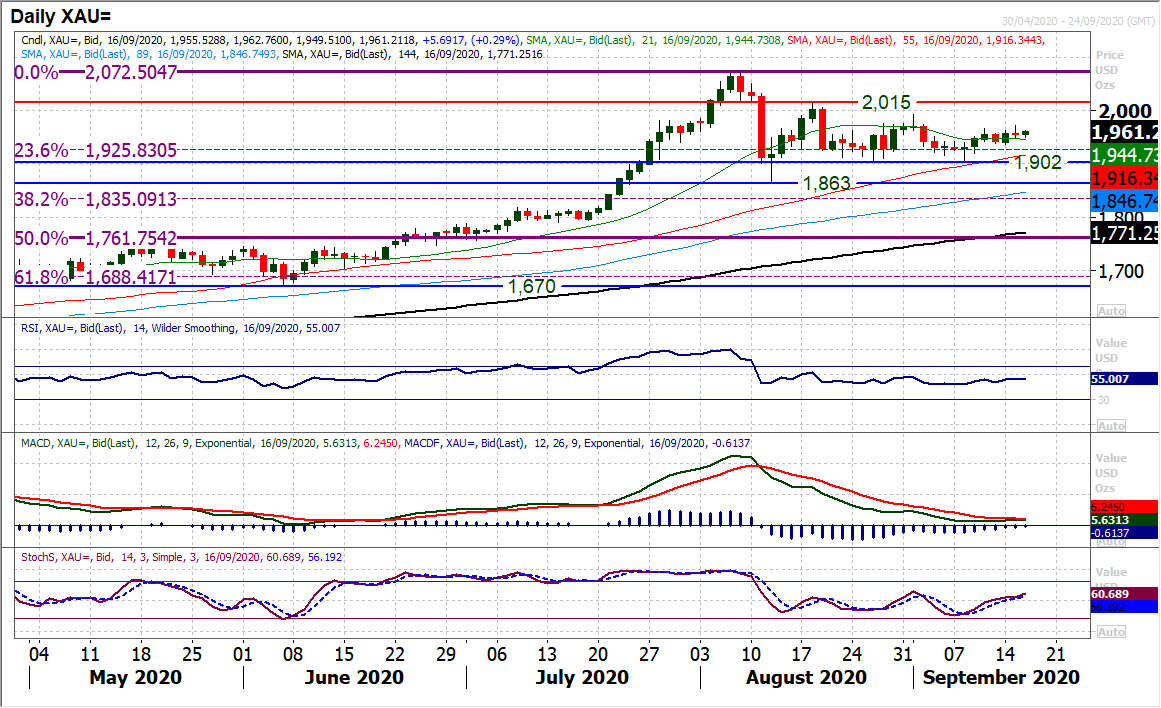

A renewed gold run higher has just been put on ice for now as markets begin to consolidate ahead of the FOMC meeting. Initial gains were tempered yesterday and a “doji” candlestick (denotes uncertainty) was completed. We have seen a more constructive outlook for gold in the past week, but the shackles are still on the run higher. A dovish FOMC shift would allow gold to release higher. Technically, the indicators are primed for upside, with MACD lines ready to cross higher, whilst Stochastics and RSI are tentatively positioned for a bull run. Initial resistance is now $1972. The hourly chart shows a run of higher lows forming in recent sessions, where we see any supported weakness into $1940/$1955 band being a chance to buy for pressure towards $1992/$2015. Below $1937 we see the immediate bullish outlook is put on hold, A close below $1926 would be a worrying signal for the bulls.

Author

Richard Perry

Independent Analyst