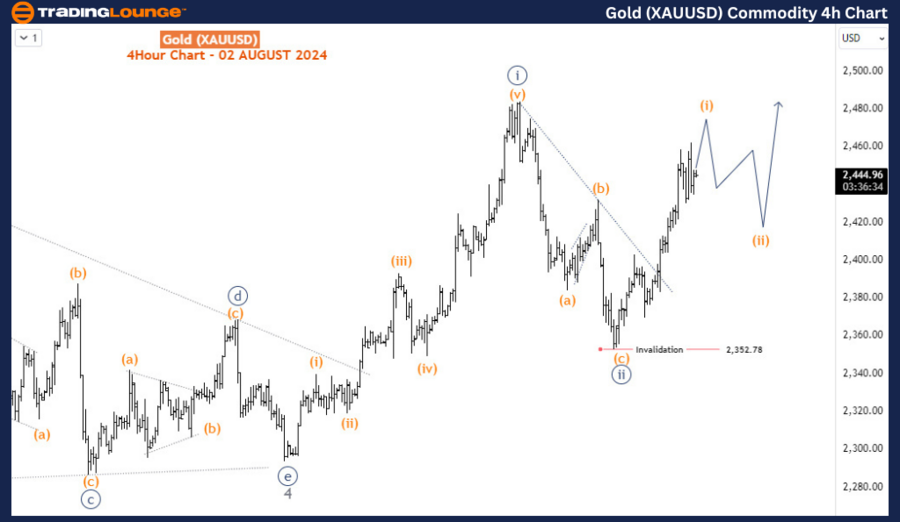

Gold Elliott Wave analysis

Function - Trend.

Mode - Impulse.

Structure - Impulse for wave (3) still emerging.

Position -Wave 5.

Direction - Wave 5 is still in play.

Gold has added to gains after breaking out of a two-month range, and it now appears poised for a fresh all-time high. Across all time frames, the market remains bullish, providing opportunities for buyers to enter on dips at various degrees, anticipating a continued rally.

Daily chart analysis

On the daily chart, Gold completed the supercycle wave (IV) of the long-term bullish trend that began in December 2015. This completion set the stage for a new impulse wave (V). Within this wave (V), waves I and II were completed in May and October 2023, respectively. Gold is currently advancing in wave (3) of 3 (circled) of III, with the potential to push beyond 2500 before this wave concludes. The sideways consolidation that occurred between April 12th and June 26th represents wave 4 of (3). The ongoing upward movement is part of wave 5 of (3), which is expected to break through previous highs and set new records. The bullish outlook for Gold remains strong, offering buyers a chance to enter positions on pullbacks.

Four-hour chart analysis

On the H4 chart, we zoom in on the sub-waves of wave 5 of (3). The price completed waves i (circled) and ii (circled) of 5 on July 17th and July 25th, respectively. The current upward movement, wave iii (circled) of 5, is underway and is projected to reach at least 2617 before the next significant pullback, provided the price stays above 2352. This suggests that Gold will likely continue to favor the buy side in the weeks ahead, presenting attractive buying opportunities.

Conclusion

In summary, Gold's building up on gains after a strong breakout indicates that it is gearing up for a new all-time high. The Elliott Wave analysis shows a bullish trend across all time frames, with the potential for further gains. Traders should look to capitalize on this by buying dips, especially as the market progresses towards key levels like 2500 and beyond.

Gold (XAU/USD) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended Content

Editors’ Picks

US Dollar runs with December Nonfarm Payrolls – LIVE

Nonfarm Payrolls in the US rose by 256,000 in December, while the Unemployment Rate fell to 4.1%. Even further, wage pressures eased, with Average Hourly Earnings at 3.9% YoY. Wall Street's futures plunge and the US Dollar firms up with the news.

EUR/USD nears 1.0200 after solid US NFP report

EUR/USD trades at its lowest since November 2022, approaching the 1.0200 mark after a solid United States December Nonfarm Payrolls report smashed the odds for Federal Reserve interest rate cuts.

GBP/USD battles 1.2200 amid broad US Dollar demand

The British Pound extends its bearish route to fresh multi-month lows against the Greenback. GBP/USD battles to retain 1.2200 as UK bond market turmoil and a solid US employment report led the pair lower.

Gold retreats from around $2,680, risk aversion limits the slide

Gold price (XAU/USD) peaked above $2,680 on Friday, retreating after the NFP release amid broad US Dollar demand. Ruling risk aversion, however, limits the downside for the safe-haven metal.

Think ahead: Mixed inflation data

Core CPI data from the US next week could ease concerns about prolonged elevated inflation while in Central and Eastern Europe, inflation readings look set to remain high.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.