- XAU/USD struggled to make a decisive move in either direction this week.

- Near-term technical outlook suggests that sellers remain in control.

- Additional losses are likely with a daily close below $1,800.

The XAU/USD pair started the week on a firm footing and climbed to a weekly high of $1,855 on Wednesday supported by the broad-based selling pressure surrounding the greenback. However, with the USD regaining its strength in the second half of the week, XAU/USD came under heavy bearish pressure, lost nearly 1% on Thursday and extended its slide on Friday. Following a rebound in the late American session ahead of the weekend, the pair closed the week with little changed near $1,820.

What happened last week

In the absence of significant macroeconomic data releases and fundamental developments, the sharp decline witnessed in the US Treasury bond yields weighed on the USD and allowed XAU/USD to gain traction during the first half of the week. Reflecting the greenback’s poor performance, the US Dollar Index lost more than 0.5% and touched a fresh two week low of 90.25 on Wednesday. The relatively cautious market mood and a rebound seen in the 10-year US T-bond yield helped the USD limit its losses and forced XAU/USD to reverse its direction on Thursday.

The data published from the US showed on Tuesday that the NFIB Business Optimism Index in January declined to 95 from 95.9 in December. On Wednesday, the inflation report revealed that the Core Consumer Price Index (CPI) in January fell to 1.4% on a yearly basis from 1.6% and came in lower than the market expectation of 1.5%. This reading reaffirmed the view that the US Federal Reserve is likely to preserve its dovish stance with consumer prices struggling to pick up.

While speaking at an event on Wednesday, FOMC Chairman Jerome Powell reiterated that the Fed remains committed to providing support to the economy. Powell noted that they will not look to tighten the policy solely in response to an improving labor market and reiterated that the policy rate will be kept near-zero until they reach employment and inflation goals.

On Thursday, the US Department of Labor in its weekly report said that Initial Jobless Claims declined to 793,000 in the week ending February from 812,000. Although this reading came in worse than analysts’ estimate of 757,000, it received little to no reaction from market participants.

Finally, the University of Michigan's Consumer Sentiment Index dropped to 76.2 (preliminary) in February from 79 in January and fell short of the market expectation of 80.8, capping USD's gains on Friday.

Next week

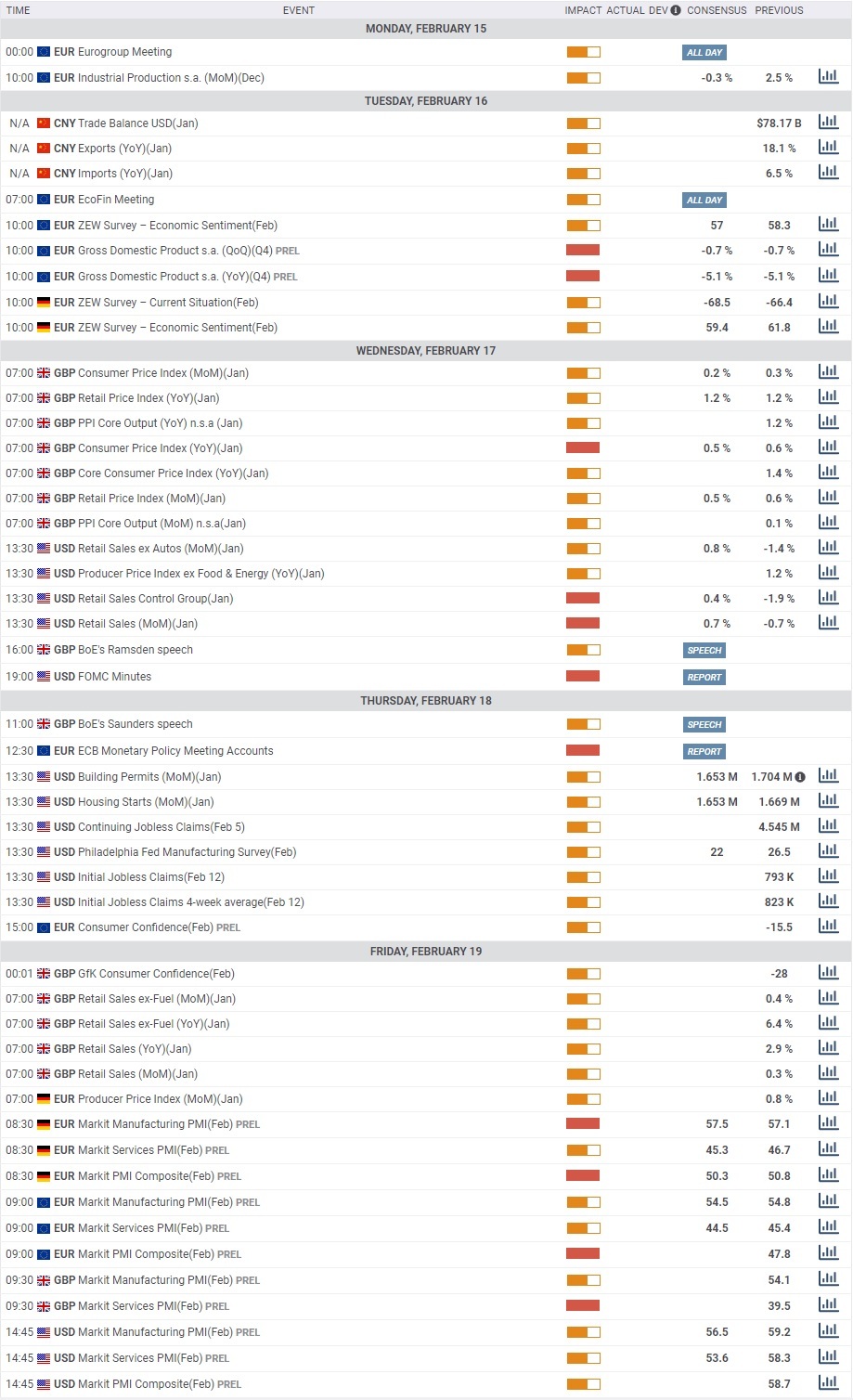

There won’t be any significant macroeconomic data releases next Monday and the USD’s market valuation is likely to continue to impact XAU/USD’s movements at the start of the week.

On Tuesday, the ZEW Survey - Economic Sentiment reports for the euro area and Germany will be watched closely by investors alongside the fourth-quarter Gross Domestic Product (GDP) figures for the eurozone. If these data point out to further weakness in the euro area economy, the greenback could start attracting investors and weigh on XAU/USD.

On Wednesday, January Retail Sales data will be featured in the US economic docket. The market consensus points out to a 0.7% increase following December’s 0.7% contraction. A better-than-expected print could help the USD outperform its rivals. Later in the day, the FOMC will release the minutes of its February meeting.

On Friday, the IHS Markit will publish its preliminary Manufacturing and Services PMI reports for Germany, the euro area, the UK and the US.

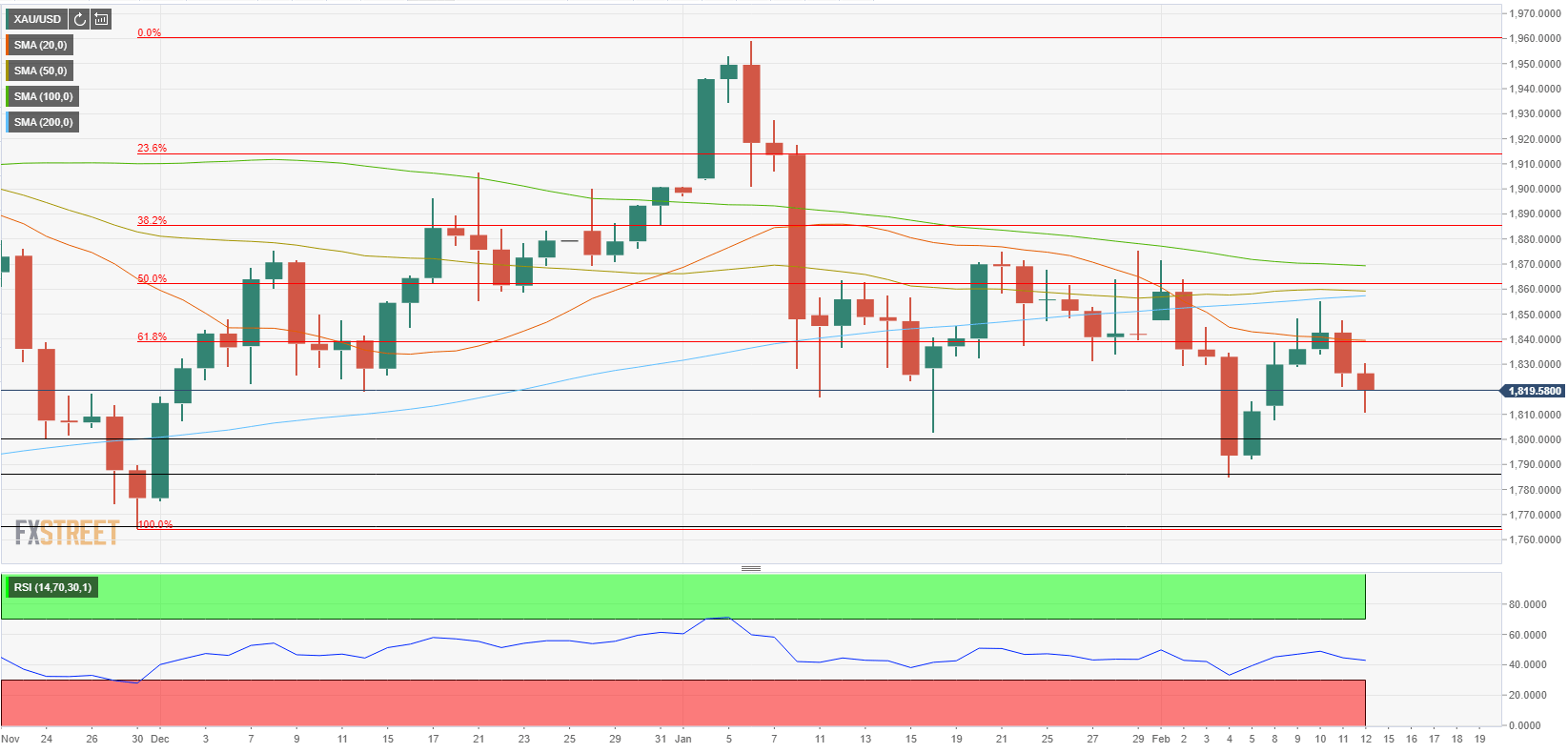

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart edges lower toward 40, suggesting that buyers struggle to dominate gold's price action. Additionally, the four-day rebound witnessed earlier in the month lost its momentum near the 200-day SMA and XAU/USD closed below that key level for the eighth straight trading day on Friday.

On the downside, $1,800 (psychological level) could be seen as the first support. A daily close below that level could open the door for additional losses toward $1,785 (Feb. 4 low) ahead of $1,765 (Nov. 30 low/starting point of December rally).

The initial resistance aligns at $1,845 (Fibonacci 61.8% retracement of the latest uptrend/20-day SMA). Even if gold manages to clear that hurdle, buyers could remain hesitant to return unless XAU/USD breaks above $1,855 (200-day SMA). Finally, the 100-day SMA around $1,870 is likely to act as the next dynamic resistance.

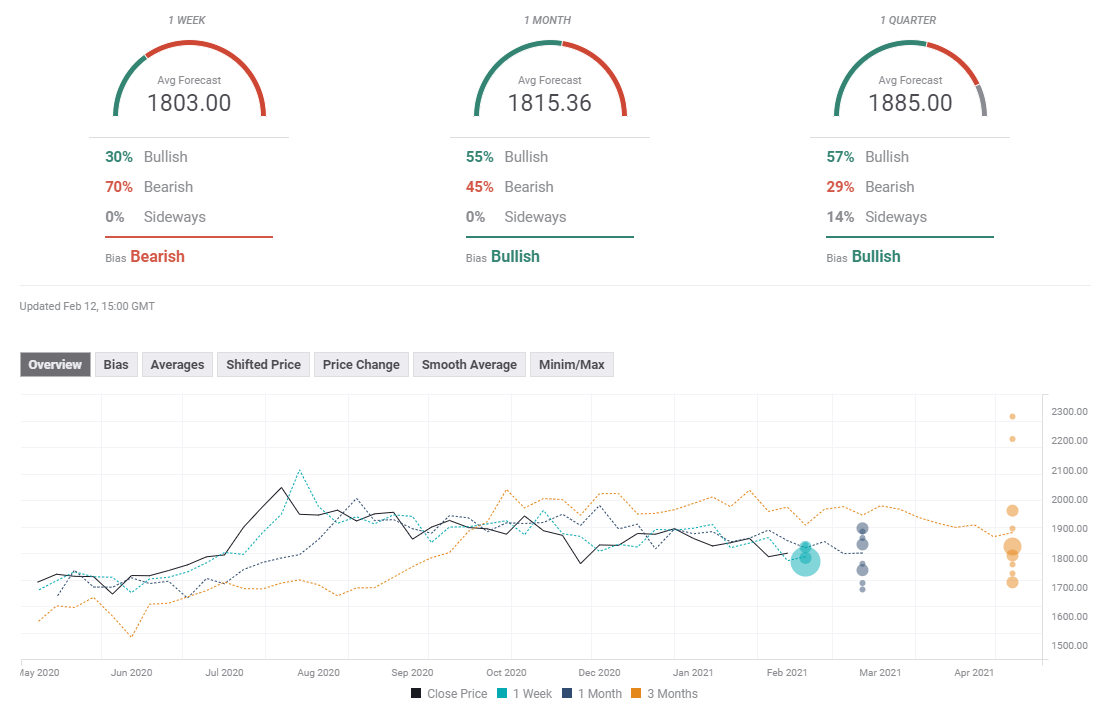

Gold sentiment poll

Gold's short-term outlook stays bearish according to the latest FXStreet Forecast Poll, which shows that the average price target on a one-week view currently stands at $1,803. Although 55% of experts remain bullish on a one-month view, the average target of $1,815 suggests that gains are likely to be limited.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD flirts with this year highs as USD resumes slide

The Australian Dollar surged against its American rival approaching the yearly high of 0.6437. The cautious tone of equities was not enough to help the Greenback, weighed by trade tensions between the US and China.

Gold extends gains towards $3,350

Gold price slowly advanced on Monday, starting the new day just ahead of the $3,350 amid broad US Dollar weakness. Caution kept market activity limited ahead of first-tier data releases next Wednesday.

EUR/USD drifts lower to near 1.1400 on tariff uncertainty

The EUR/USD pair edges lower to near 1.1415 during the early Asian session on Tuesday. The Euro weakens against the US Dollar amid rising bets for further rate cuts from the European Central Bank in June.

Bitcoin: Will Trump’s 100-Day speech propel BTC above $100,000?

Bitcoin rebounds as high as $95,490 on Monday, as Trump’s 100-day speech dominates macro news. On-chain data shows BTC deposits on exchanges declined by $4 billion in the past week. Here’s how these insights could impact Bitcoin $100,000 breakout prospects in the near-term.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.