- XAU/USD closed the week deep in the negative territory.

- Gold's near-term outlook remains bearish despite Friday's rebound.

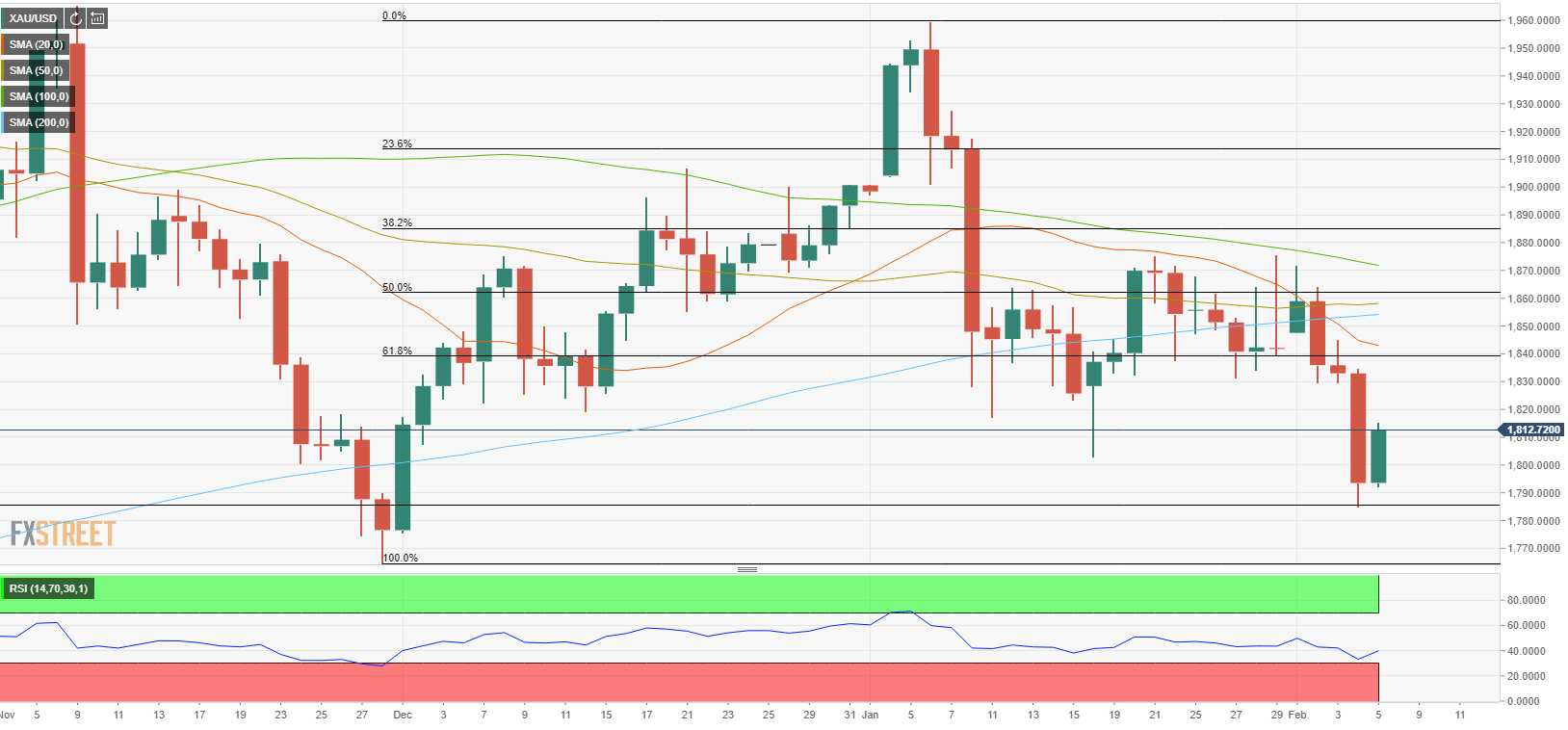

- The 200-day SMA forms strong resistance at $1,855.

The XAU/USD pair started the week with a bullish gap and rose above $1,870 on Monday before coming under steady bearish pressure for the remainder of the week. After losing more than 1% on Tuesday, the pair fluctuated in a relatively tight range on Wednesday but lost its traction, once again, on Thursday and slumped to its worst level in more than two months at $1,785. Even after staging a strong rebound and rising above $1,810 following the disappointing US jobs report on Friday, XAU/USD lost more than 1% on a weekly basis.

What happened last week

Since the coronavirus crisis became the primary driver of financial markets last March, the greenback adopted the role of a safe-haven and formed a strong inverse correlation with major equity indexes in the US. Whenever stock markets staged a rally, the US Dollar Index, which tracks the USD’s performance against a basket of six major currencies, turned south and vice versa.

However, with investors looking to price a normalization amid strong upbeat macroeconomic data releases and the coronavirus vaccine rollout, the above-mentioned correlation seems to have started to weaken lately. For the first time in nearly a year, better-than-expected data releases from the US provided a boost to the USD and weighed on XAU/USD despite the fact that Wall Street’s main indexes edged higher to new all-time highs. Additionally, the USD began to outperform its rivals as the US economy looks to be on a firmer path to a steady recovery, especially when compared to major European economies.

On Monday, the Markit Manufacturing PMI and the ISM Manufacturing PMI reports from the US for January reaffirmed that the business activity in the manufacturing sector continued to expand at a robust pace. On Tuesday, the IBD/TIPP Economic Optimism Index improved to 51.9 in February from 50.9 in January.

Wednesday’s data revealed that the ISM Services PMI rose to its highest level in nearly two years at 58.7 in January and the ADP Employment Change arrived at 174,000, beating analysts’ estimate of 49,000 by a wide margin. Furthermore, the US Department of Labor announced that Initial Jobless Claims fell by 33,000 to 779,000 last week.

Finally, the US Bureau of Labor Statistics’ monthly publication showed that Nonfarm Payrolls in December increased by 49,000. Although this reading came largely in line with the market expectation of 50,000, December’s print of -140,000 got revised down to -227,000 and triggered a USD selloff.

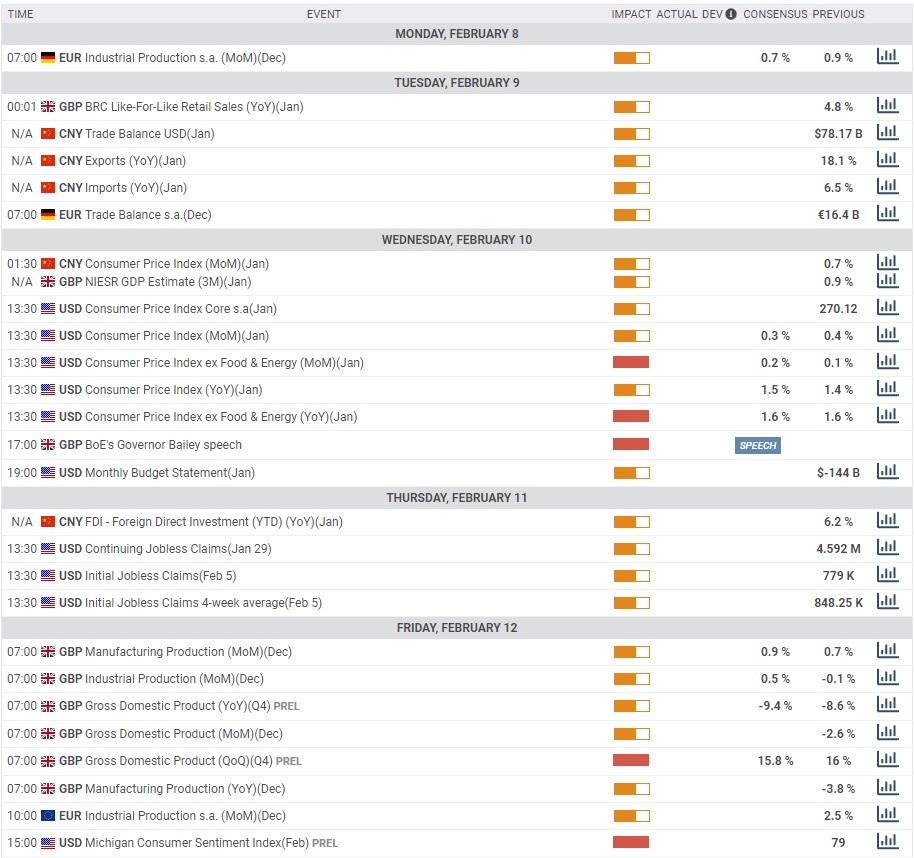

Next week

The economic docket will be relatively eventless with regards to high-impact macroeconomic data releases. Trade Balance data from China and Industrial Production report from Germany will be looked upon for fresh catalysts at the start of the week.

On Wednesday, the US Bureau of Labor Statistics will publish the January Consumer Price Index (CPI) figures. However, the market reaction is likely to be short-lived as the Federal Reserve uses the Personal Consumption Expenditures (PCE) Price Index as its preferred gauge of inflation.

On Friday, the fourth-quarter Gross Domestic Product (GDP) data from the UK and the University of Michigan’s Consumer Sentiment Index from the US will be the last data releases of the week.

Meanwhile, political developments surrounding additional fiscal stimulus in the US will be watched closely by market participants. Earlier in the week, US President Biden’s administration kicked off negotiations with House Republicans on the aid bill and a positive outcome could help XAU/USD rebound as it would point out to an increase in the money supply. On Friday, the US Senate approved the budget plan allowing Democrats to pass the $1.9 trillion coronavirus aid bill in the coming weeks without Republican support.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart edged higher on Friday but stays below 50, suggesting that the near-term outlook remains bearish. Furthermore, XAU/USD remains on track to close below the 100-day and the 200-day SMAs for the fourth straight day, suggesting that Friday's rebound is likely to remain limited unless the pair manages to break above those SMAs.

On the downside, $1,800 (psychological level) aligns as the initial support ahead of $1,785 (Feb. 4 low). With a daily close below the latter, the pair could extend its slide toward $1,765 (Nov. 30 low/starting point of December rally).

Resistances, on the other hand, are located at $1,845 (Fibonacci 61.8% retracement of the latest uptrend/20-day SMA), $1,855 (200-day SMA) and $1,870 (Fibonacci 50% retracement).

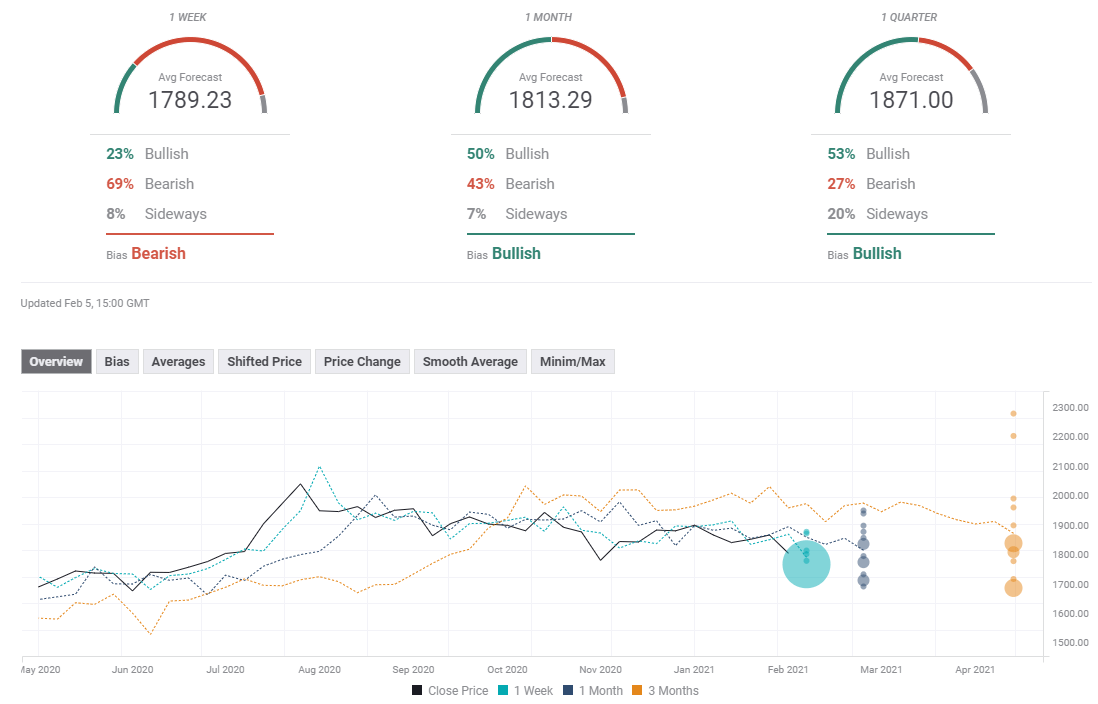

Gold sentiment poll

This week's price action seems to have caused a bearish shift in experts' short-term outlook with FXStreet Forecast Poll pointing out to an average target of $1,780 in the one-week view. The one-month outlook paints a mixed picture with 50% of experts staying bullish, compared to 43% bearish.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.