- Gold's inverse correlation with US Treasury bond yields stays intact.

- Risk aversion ahead of the weekend helped the precious metal find demand.

- Buyers managed to hold XAU/USD above several key SMAs.

With the sharp upsurge witnessed in US Treasury bond yields, gold broke below the previous week’s trading range and continued to push lower in the first half of the week. After falling to its lowest level since early November at $1,778 on Wednesday, XAU/USD has staged a decisive rebound ahead of the weekend and settled near $1,800 but ended up closing the second straight week in the negative territory.

What happened last week

The benchmark 10-year US Treasury bond yield gained traction during the American session on Monday and rose more than 5% on a daily basis. In the absence of high-tier macroeconomic data releases, the weak demand seen at the 2-year Treasury note auction fueled another leg higher in yields. Additionally, US President Joe Biden announced that he had nominated Jerome Powell for a second four-year term as the Fed chair, cementing the view that the Fed could go for a rate hike by June 2022.

On Tuesday, data published by IHS Markit revealed that the economic activity in the private sector continued to expand in early November, albeit at a softer pace than in October with the Composite PMI edging lower to 56.5 from 57.6. Nevertheless, the 7-year Treasury note auction, once again, highlighted dismal demand and the 10-year US T-bond yield continued to push higher toward 1.7%.

The US Bureau of Economic Analysis reported on Wednesday that the Core Personal Consumption Expenditures (PCE) Price Index climbed to 4.1% on a yearly basis in October from 3.7%. Ahead of the Thanksgiving break, the dollar preserved its strength and didn’t allow XAU/USD to erase its losses. In the meantime, San Francisco Fed President Mary Daly said that there was a case for the Fed to speed up the asset tapering while noting that she wouldn’t be surprised if the Fed were to hike the policy rate twice next year.

Following Thursday’s dull market action, gold surged higher Friday with investors shifting their focus to coronavirus headlines.

Reports suggesting that current vaccines might not be effective against the highly-mutated COVID variant detected in South Africa triggered a flight to safety ahead of the weekend. Many countries decided to temporarily suspend flights from several African countries and Pfizer said that it will take them around 100 days to produce an adjusted vaccine.

Reflecting the dismal market mood, global equity indexes suffered heavy losses and the 10-year US Treasury bond yield turned negative on the week by losing more than 7%, on Friday. Moreover, the CME Group FedWatch Tool’s probability of the Fed leaving the policy rate unchanged by June 2022 increased to 34% from 18% earlier in the week.

Next week

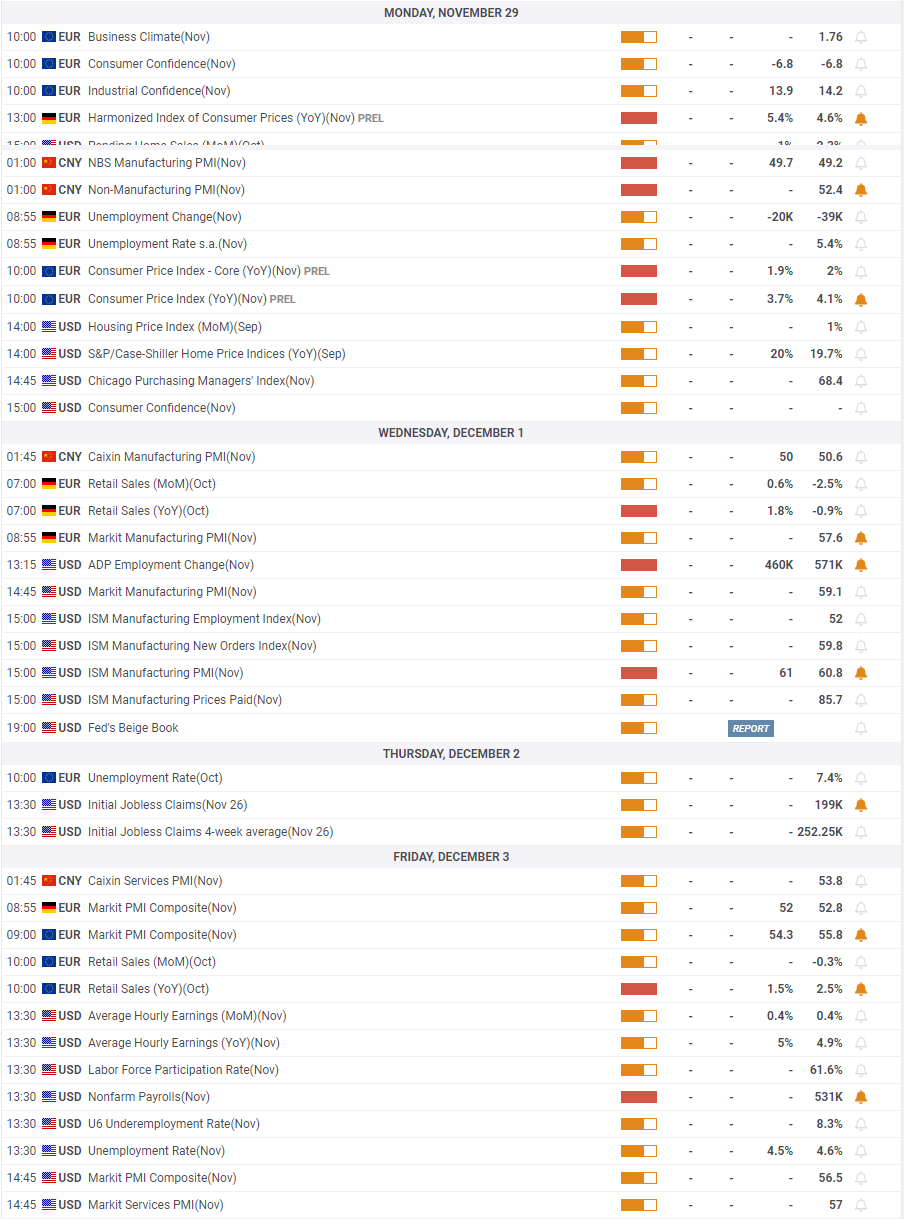

The Conference Board’s Consumer Confidence data will be featured in the US economic docket on Tuesday. Investors will look for details surrounding the impact of high inflation on consumer sentiment.

The ADP Employment Change and the ISM Manufacturing PMI on Wednesday will be looked upon for fresh impetus ahead of Friday’s November jobs report. Although a better-than-expected increase in Nonfarm Payrolls could provide a boost to the dollar, the market reaction could remain limited unless vaccine producers reassure markets that they will be able to handle the new variant.

Before the Fed goes into the blackout period on Saturday, December 4, comments from FOMC policymakers will be critical as well. In case Fed officials refrain from suggesting that they will need to stay patient in the face of renewed coronavirus fears, US T-bond yields could regain traction and cap XAU/USD’s upside. On the other hand, gold could continue to gather strength if safe-haven flows continue to dominate the financial markets.

Gold technical outlook

On the daily chart, gold managed to close above the 50-day, 100-day and 200-day SMAs on Friday. Moreover, the Relative Strength Index edged higher to 50, suggesting that sellers are staying on the sidelines for the time being.

On the upside, $1,815 (Fibonacci 38.2% retracement of the latest uptrend) aligns as first resistance ahead of $1,825 (20-day SMA). In case the latter turns into support, XAU/USD could target $1,840 (Fibonacci 23.6% retracement).

On the other hand, the bearish pressure could increase with a daily close below $1,790 (50-day SMA, 100-day SMA, 200-day SMA) and cause gold to fall toward $1,780 (Fibonacci 61.8% retracement), $1,770 (static level).

Gold sentiment poll

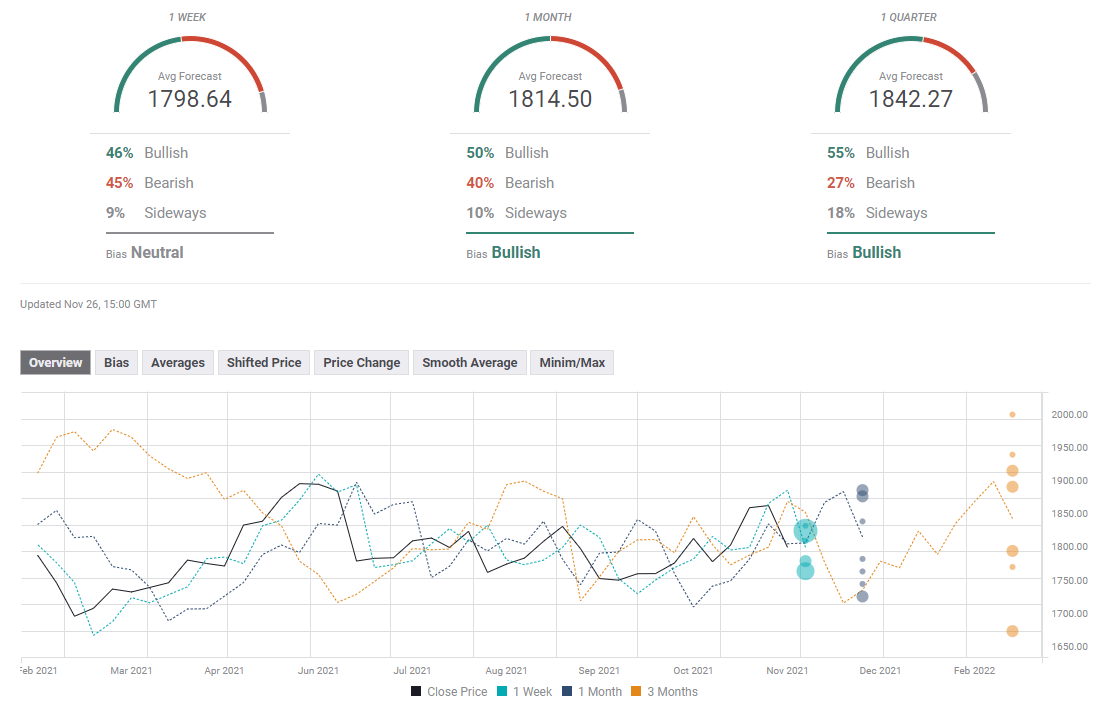

The FXStreet Forecast Poll shows that gold is expected to stay in a consolidation phase around $1,800 in the near term. The one-month outlook points to a slightly bullish bias.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.