Gold Weekly Forecast: XAU/USD fails to clear key resistance at $1,790

- Gold closed the last three days of the week in the positive territory.

- Key near-term resistance located at $1,790 remains intact.

- FOMC will release June meeting minutes on Wednesday.

Following a consolidation phase in the previous week, gold stayed relatively calm on Monday but came under renewed bearish pressure on Tuesday. After slumping to its lowest level since mid-April at $1,750, however, XAU/USD managed to stage a decisive rebound and gained nearly 1% in a two-day span. Although the lack of fundamental drivers behind gold’s strength suggested that the rebound was likely triggered by quarter-end flows, the broad USD weakness allowed the precious metal to extend its recovery on Friday. Nevertheless, gold ended up closing the week little changed slightly above $1,780.

What happened last week

In the absence of high-tier macroeconomic data releases in the first half of the week, hawkish Fed commentary helped the greenback stay resilient against its major rivals.

Richmond Fed President Thomas Barkin argued that inflation has reached substantial further progress and added that they can start tapering as soon as they see the same progress on employment. Federal Reserve's Vice Chairman for Supervision Randal Quarles said that the Fed is very mindful that they could be wrong on inflation pressures being temporary.

Moreover, Dallas Fed President Robert Kaplan reiterated that he would prefer to start reducing asset purchases before the end of the year. On a similar note, Philadelphia Fed President Harker told the Wall Street Journal that he was in favour of the Fed starting to pull back on bond-buying later this year.

On Wednesday, the monthly data published by the Automatic Data Processing (ADP) Research Institute revealed that the private sector employment in the US increased by 692,000 in June, beating the market expectation of 600,000. The Institute for Supply Management (ISM) announced on Thursday that the Manufacturing PMI inched slightly lower to 60.6 in June from 61.2. However, the Prices Paid Index component of the PMI report reached a new all-time high of 92.1, reminding investors of the fact that underlying price pressures continue to increase. Additionally, the Initial Jobless Claims for the week ending June 26 arrived at its lowest level since the beginning of the coronavirus pandemic at 364,000.

Following these data, the US Dollar Index, which tracks the USD’s performance against a basket of six major currencies, advanced to its strongest level in nearly three months.

Finally, the US Bureau of Labor Statistics reported on Friday that Nonfarm Payrolls in the US rose by 850,000 in June, surpassing analysts’ estimate of 700,000. On a negative note, the Unemployment Rate edged higher to 5.9% while the Labor Force Participation Rate remained unchanged at 61.6%. The USD struggled to preserve its strength following the jobs report and helped XAU/USD post modest daily gains.

Next week

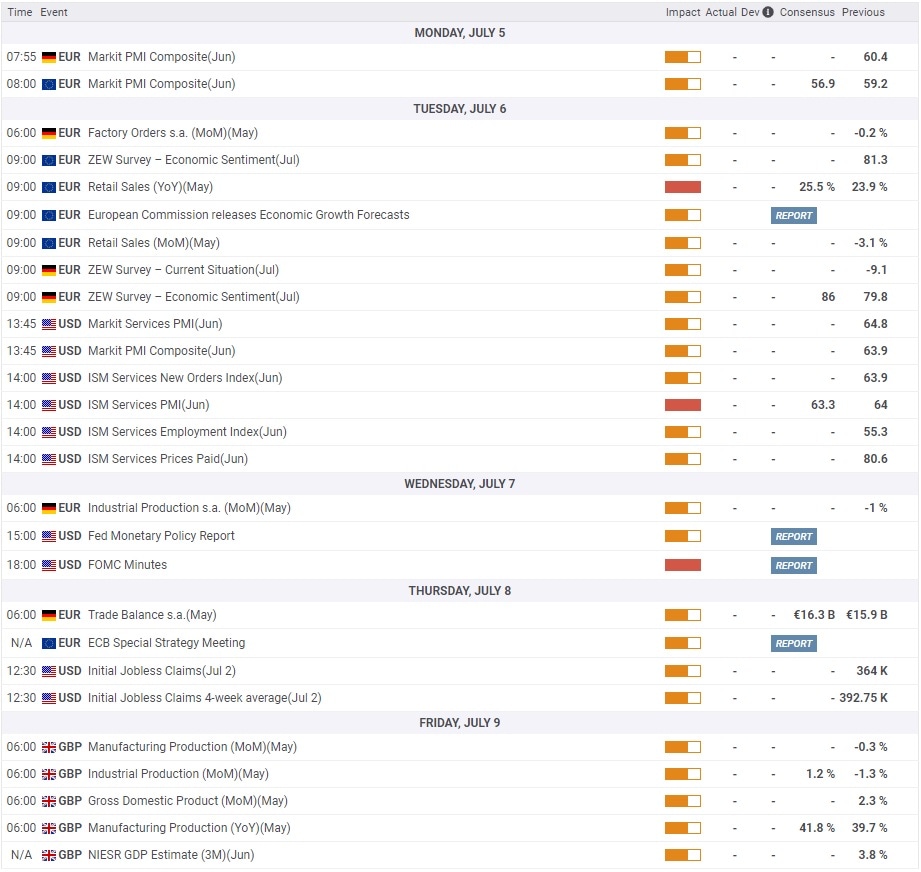

There will not be any data releases on Monday that could potentially impact the USD’s market valuation and XAU/USD is likely to fluctuate between technical levels at the start of the week. On Tuesday, the ISM Services PMI data will be looked upon for fresh impetus. Investors are likely to ignore the headline figure unless there is a big divergence from the market consensus of 62.3. The Prices Paid Index, once again, will be the key figure to watch. A stronger-than-expected print could allow the greenback to continue to gather strength.

On Wednesday, the FOMC will release the minutes of its June meeting, during which policymakers have made a hawkish shift in the policy outlook. Unless this publication offers a dovish surprise, the USD should be able to keep its firm footing and limit XAU/USD’s rebound.

Gold technical outlook

Gold rose above the 100-day SMA on Friday but failed to close the day above that level, suggesting that sellers continue to defend that key resistance. On the daily chart, the Relative Strength Index (RSI) indicator stays below 50, confirming the view that XAU/USD hasn’t yet gathered enough momentum to reverse its direction.

Nonetheless, a daily close above $1,790 (100-day SMA) could open the door for additional gains toward $1,800 (psychological level, Fibonacci 50% retracement of April-June uptrend) ahead of $1,815 (20- day SMA)

On the flip side, the initial support is located at $1,770 (Fibonacci 61.8% retracement) before $1,750 (June 29 low). In case sellers drag the price below the latter, the next target is located at $1,735 (static level).

Gold sentiment poll

The FXStreet Forecast Poll points to a consolidation phase next week with experts splitting evenly between bullish and bearish expectations. The one-month view, however, points to recovery with an average target of $1,810.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.