Gold Weekly Forecast: XAU/USD could stage a deep correction if $1,850 becomes resistance

- Gold reversed its direction after climbing to multi-week highs above $1,870.

- XAU/USD could come under renewed bearish pressure if $1,850 support fails.

- Markets are expected to turn quiet after high-tier data releases from the US on Wednesday.

Gold struggled to build on the previous week’s inflation-fueled rally and closed in negative territory on Monday and Tuesday. Although the yellow metal managed to regain its traction on Wednesday, it failed to gather enough bullish momentum to clear the $1,870 hurdle and dropped toward the lower limit of its weekly range before settling below $1,860 ahead of the weekend.

What happened last week

Rising US Treasury bond yields made it difficult for XAU/USD to continue to push higher at the start of the week. The benchmark 10-year US Treasury bond yield advanced to fresh multi-week tops near 1.65% and helped the dollar preserve its strength. The US Census Bureau reported on Tuesday that Retail Sales increased by 1.7% on a monthly basis in October, compared to the market expectation of 1.4%. This print reminded investors of the strong goods inflation

With XAU/USD rising 0.9% amid a 3% decline in the 10-year US T-bond yield on Wednesday, the inverse correlation between gold and yields became a driving factor once again. Confirming that view, the pair started to retreat as the 10-year yield steadied around 1.6% in the second half of the week.

The US Department of Labor’s weekly publication revealed that there were 268,000 initial claims for unemployment benefits in the week ending November 13. The Federal Reserve Bank of Philadelphia reported that business activity in the Third Federal Reserve District expanded at a strong pace in November with the Philly Fed Manufacturing Index improving to 39 from 23.8 in October.

In the meantime, Fed officials delivered mixed comments on the policy outlook that capped bond yields’ upside. San Francisco Fed President Mary Daly called for the Fed to remain patient when it comes to hiking the policy rate, arguing that tight policy would slow the economic recovery instead of fixing high inflation. On a hawkish note, St. Louis Fed President James Bullard said the Fed could accelerate the pace of the asset taper to $30B per month and open the door to a rate hike in the first quarter of 2022. Finally, Chicago Fed President Charles Evans noted the Fed’s policy was in a good place and added that it would be appropriate for asset purchases to end mid-2022.

Next week

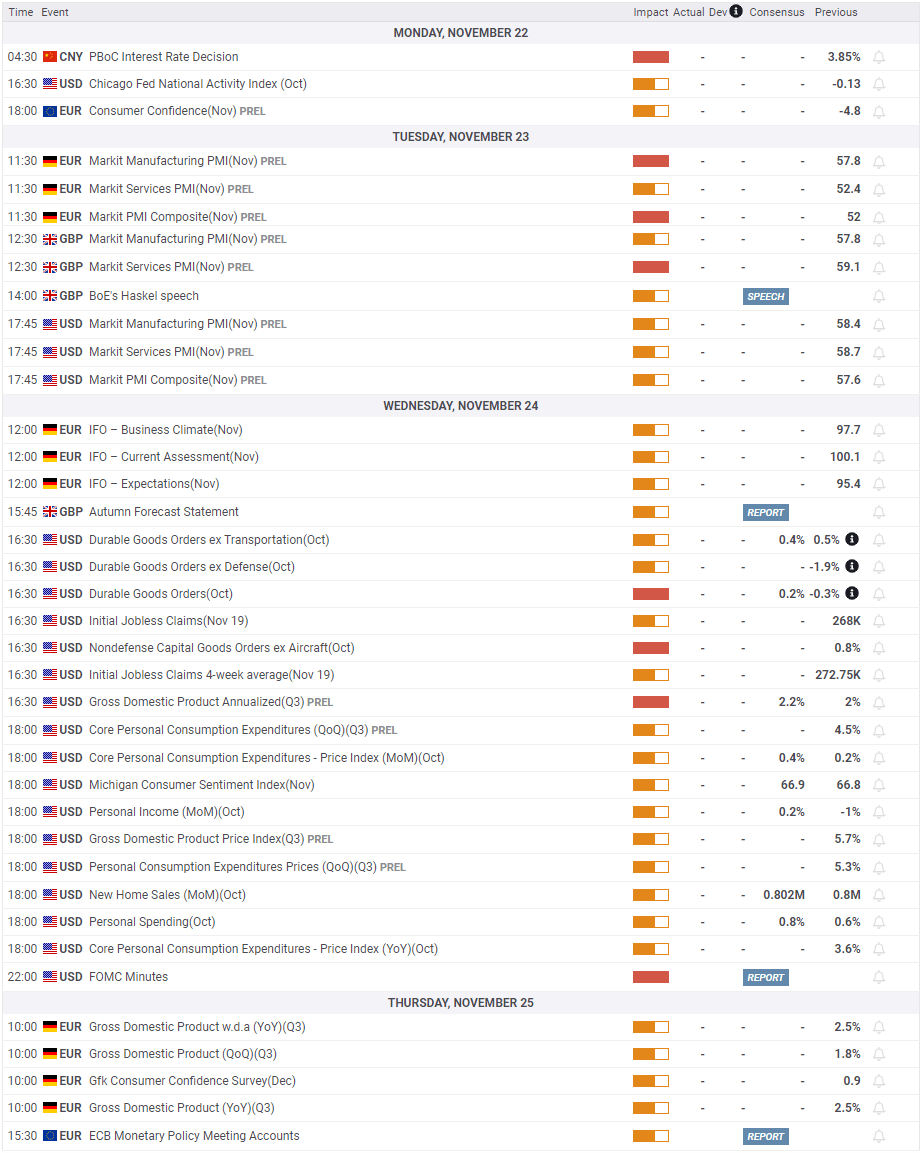

IHS Markit’s preliminary Manufacturing and Services PMI surveys for November will be featured in the US economic docket on Tuesday. Ahead of Wednesday’s data dump, the market reaction to these data is likely to remain subdued.

The US Bureau of Economic Analysis will release its second estimate of third-quarter Gross Domestic Product growth alongside the October Personal Consumption Expenditures (PCE) Price Index, Personal Income and Personal Spending figures. The US Census Bureau will publish the monthly Durable Goods Orders report as well.

It will be difficult for market participants to navigate through all these numbers and settle on a decision. The Core PCE Price Index is likely to have an impact on the US T-bond yields and gold. A higher-than-expected print could ramp up the probability of a 25 basis points Fed rate hike in June, which currently stands at 44% according to the CME Group’s FedWatch Tool, and weigh on XAU/USD. However, gold’s status as an inflation-hedge could allow the pair to find support.

In the second half of the week, trading conditions will thin out due to the Thanksgiving holiday in the US and XAU/USD could fluctuate between technical levels heading into the weekend.

Gold technical outlook

After the Relative Strength Index (RSI) indicator on the daily chart rose above 70, XAU/USD staged a technical correction. Currently, the RSI is staying near 60, suggesting that the pair has more room on the upside before it looks for another correction.

However, strong static resistance seems to have formed at $1,870 and unless the pair makes a daily close above that level, buyers could find it difficult to retain control. $1,880 (static level) aligns as the next hurdle ahead of $1,900 (psychological level).

On the downside, additional losses could be witnessed if the static support at $1,850 fails. Below that level, sellers could target $1,830 (static level) and $1,820 (20-day SMA).

Gold sentiment poll

Following this week's action, FXStreet Sentiment Poll suggests that gold is likely to continue to edge higher next week. The average target on the one-week view is located at $1,885. Towards the end of the year, experts see XAU/USD closing in on $1,900.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.