Gold Weekly Forecast: XAU/USD could stage a correction before targeting $1,900

- Gold reached a fresh multi-month high at $1,890 on Wednesday.

- XAU/USD posted gains for the third straight week.

- Technical picture suggests there could be a downward correction before the next leg up.

The XAU/USD pair started the week on a firm footing and extended its rally with the technical buying pressure building up following the break above the critical 200-day SMA, which is currently located around $1,840. After renewing its highest level since early January at $1,890 on Wednesday, the pair lost its bullish momentum and retreated to the $1,870 area before regaining its traction and posting modest gains on Thursday. Although gold struggled to push higher and settled below $1,880 ahead of the weekend, it closed the third straight week in the positive territory.

What happened last week

In the absence of significant macroeconomic data releases and fundamental developments, the risk-positive market environment made it difficult for the greenback to find demand at the start of the week. Additionally, gold attracted buyers after rising above the 200-day SMA for the first time since early February.

On Tuesday, the benchmark 10-year US Treasury bond yield lost nearly 1% and caused the USD to continue to lose interest. Reflecting the broad-based USD weakness, the US Dollar Index (DXY) dropped to its worst level in nearly three months at 89.69 and allowed XAU/USD to post modest daily losses.

During the first half of the day on Wednesday, the USD selloff remained intact and gold climbed to $1,890. During the American session, the hawkish tone seen in the FOMC’s April meeting minutes provided a boost to US T-bond yields and helped the greenback regathering its strength.

The FOMC’s publication revealed that a couple of Fed policymakers raised risks of inflation building to unwanted levels before providing sufficient evidence to induce a policy reaction. Additionally, some participants thought it would be appropriate to start discussing a plan for adjusting the pace of asset purchases in the upcoming meetings if the economy continued to make progress toward the Fed’s goals. The 10-year US T-bond rose nearly 3% and forced XAU/USD to retrace its daily rally.

Nevertheless, the positive impact of the FOMC’s remarks on the USD and T-bond yields remained short-lived as Wall Street’s main indexes managed to register impressive gains on Thursday. Consequently, XAU/USD rose 0.4% on the day.

On Friday, the data from the US showed that the economic activity in the private sector continued to expand at a robust pace in May with the IHS Markit’s Manufacturing and Services PMIs reaching new series highs. The publication also highlighted a sharp increase in input prices and assisted the USD ahead of the weekend while limiting gold’s upside.

Next week

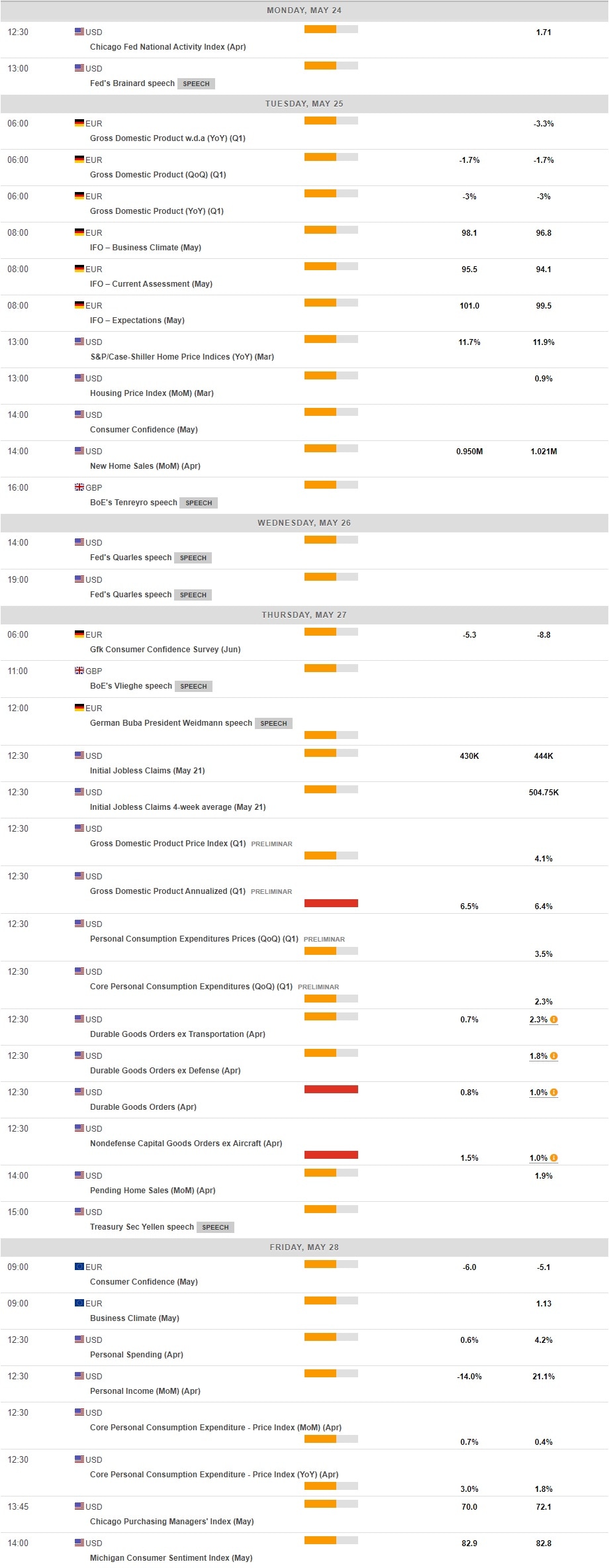

There will not be any high-tier macroeconomic data releases at the start of the next week and XAU/USD is likely to continue to move technically. On Tuesday, the Conference Board’s US Consumer Confidence Index could trigger a market reaction, especially if it shows a deterioration in consumer sentiment. A decline in US stocks could help the USD stay resilient against its rivals and keep XAU/USD’s upside restricted.

On Thursday, the US Bureau of Economic Analysis will publish its second estimate for the first-quarter GDP growth, which is unlikely to diverge significantly from the first estimate of +6.4%. Later in the day, US Treasury Secretary Janet Yellen will be testifying before the House Appropriations Subcommittee on Financial Services. Market participants will look for fresh clues regarding inflation expectations and Biden’s administration’s proposed changes to taxes. The inverse correlation between the US T-bond yields and gold could remain intact during that speech.

Finally, investors will pay close attention to the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, data on Friday. Earlier in the month, the sharp upsurge witnessed in the Consumer Price Index (CPI) caused XAU/USD to lose more than 1% on a daily basis. The Core PCE Price Index is expected to rise to 2.4% in April from 1.8% in March and a higher-than-expected reading could trigger a similar reaction and vice versa.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart stayed above 70 for the third straight day on Friday, suggesting that XAU/USD remains technically overbought and could stage a correction before the next leg up.

On the downside, the initial support is located at $1,850 (Fibonacci 61.8% retracement of the January-March downtrend) ahead of $1,840 (200-day SMA). As long as the latter support holds, buyers could see this as an opportunity to add long positions. Below that level, $1,820 (20-day SMA, Fibonacci 50% retracement) could be seen as the next support.

On the other hand, a near-term resistance seems to have formed at $1,890 (May 19 high) ahead of $1,900 (psychological level). A daily close above $1,900 could open the door for additional gains toward $1,930 (static resistance).

Gold sentiment poll

The FXStreet Forecast poll shows that 54% of experts expect gold to continue to rise next week. However, the average target of $1,870 suggests that some experts see a deep correction in that time frame. On a one-month view, the bullish outlook remains intact with an average target of $1,897.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.