- Gold retreated marginally from all-time highs as US T-bond yields edged higher.

- Near-term technical outlook shows XAU/USD is still overbought.

- The Fed will announce policy decisions and publish the dot plot next week.

Following the previous week’s record-setting rally, Gold staged a correction this week, pressured by recovering US Treasury bond yields. The Federal Reserve’s (Fed) policy announcements and the revised Summary of Projections (SEP) next week could help markets decide whether XAU/USD will target new all-time highs or extend its downward correction.

Gold price edged lower as US yields recovered on US data

Markets started the new week on a slow note and Gold struggled to gather directional momentum, closing with small gains on Monday. On Tuesday, the Bureau of Labor Statistics (BLS) announced that annual inflation in the US, as measured by the change in the Consumer Price Index (CPI), edged higher to 3.2% in February from 3.1% in January. On a monthly basis, the CPI and the Core CPI both rose 0.4%. The benchmark 10-year US Treasury bond yield rose more than 1% after the data and caused XAU/USD to snap a nine-day winning streak by losing over 1% on the day.

In the absence of high-tier data releases on Wednesday, Gold went into a consolidation phase and managed to erase a portion of Tuesday’s losses.

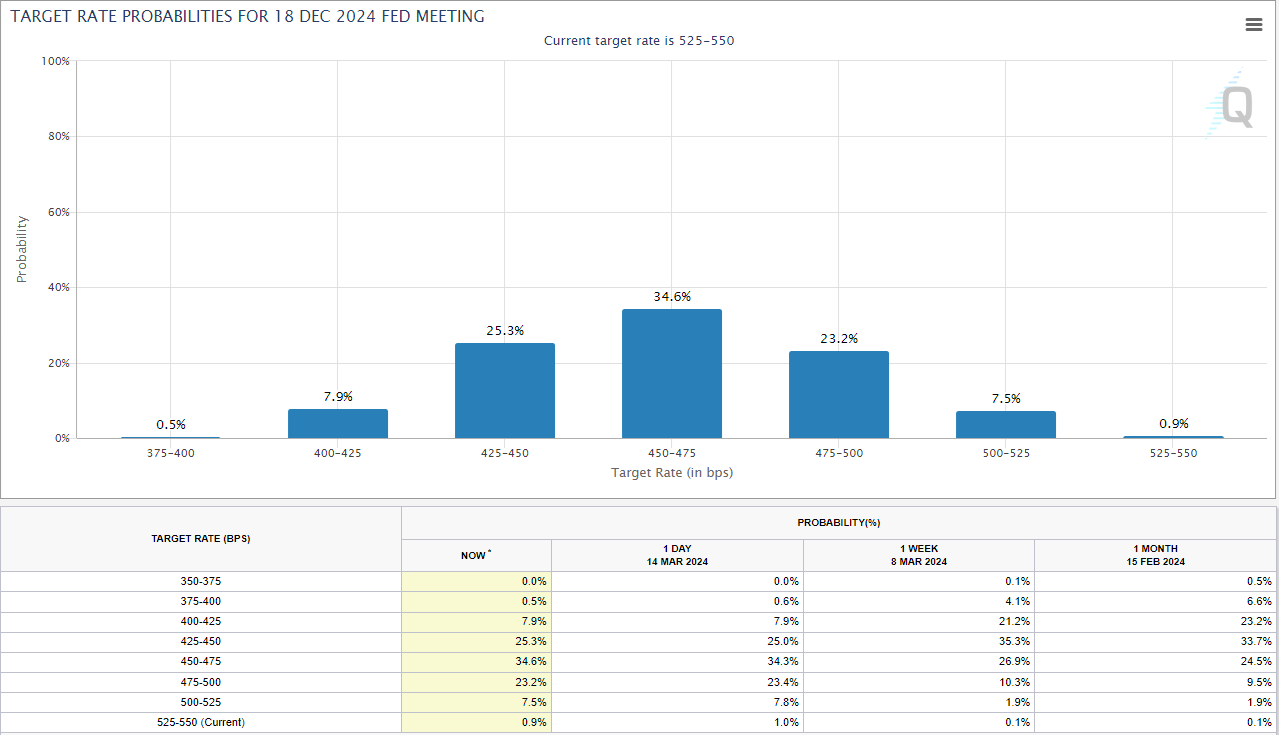

The BLS said on Thursday that the annual Producer Price Index (PPI) rose 1.6% in February, following the 1% increase recorded in January and surpassing the market expectation of 1.1% by a wide margin. Other data from the US showed that Retail Sales increased 0.6% on a monthly basis in February after falling 1.1% in January, while the number of first-time applications for unemployment benefits edged lower to 209,000 in the week ending March 9 from 210,000. Following these data releases, investors started reassessing the timing of the Federal Reserve (Fed) policy pivot. According to the CME FedWacth Tool, the probability of the Fed leaving the policy rate unchanged at 5.25%-5.5% range in June climbed to 40% from below 30% ahead of the data. The 10-year US yield extended its uptrend and advanced to its highest level in two weeks at 4.3%. In turn, Gold came under renewed bearish pressure and dropped below $2.160.

As the 10-year yield staged a downward correction early Friday, Gold regained its traction and recovered to the $2,170 area. Later in the session, however, XAU/USD retraced its daily rebound to end the week in negative territory.

Gold price needs a dovish Fed surprise to target new record high

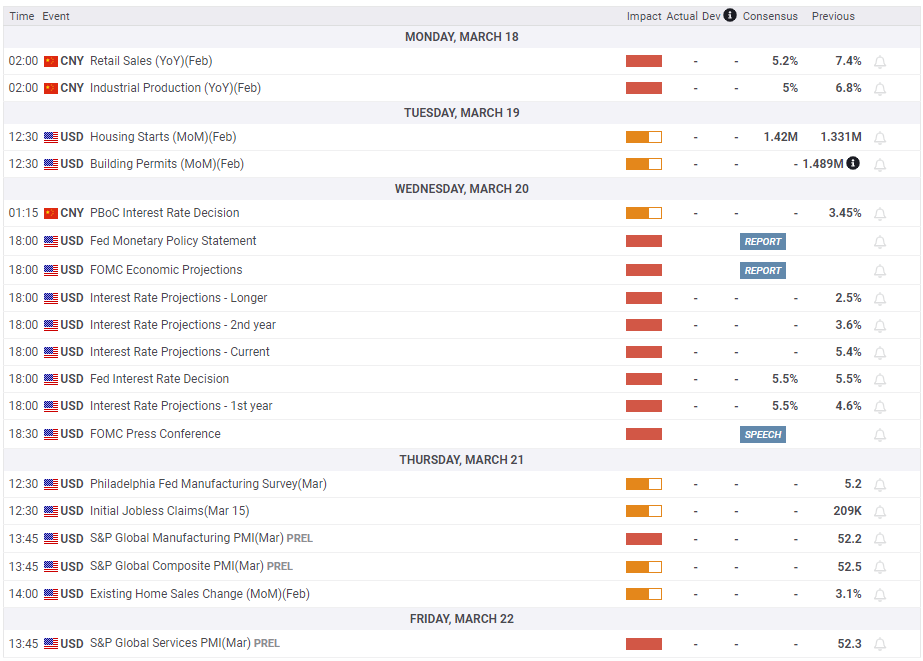

The Fed will announce monetary policy decisions and publish the revised Summary of Economic Projections (SEP), the so-called dot plot, on Wednesday. The Fed is widely expected to leave the monetary policy settings unchanged.

In December, the dot plot showed that Fed policymakers were forecasting a total of 75 basis points (bps) of rate cuts in 2024. The CME FedWatch Tool shows that markets are pricing in a nearly 70% probability that the policy rate will be lowered by at least 75 bps after the Fed’s policy meeting in December.

In case the SEP shows that policymakers are leaning toward a total of 50 bps rate cuts this year, the market positioning suggests that the initial reaction could provide a boost to the USD. Investors will also pay close attention to inflation forecasts. If the inflation projection for 2024, which was 2.4% in December’s SEP, is left unchanged or revised higher despite a shift toward 50 bps cuts, this could amplify the positive impact on the USD.

On the other hand, the USD could come under renewed selling pressure if the dot plot shows that policymakers still favor a total of 75 bps cuts in 2024. A downward revision to the inflation forecast could also be seen as a dovish development. In this scenario, a steady decline in the 10-year US yield could fuel another leg higher in XAU/USD.

Once the knee-jerk reaction to the Fed policy statement and the SEP fades away, investors will pay close attention to comments from Fed Chairman Jerome Powell in the post-meeting press conference. At this point, markets are fairly certain that the policy rate will remain unchanged in May. There is, however, uncertainty regarding a possible action in June. If Powell leaves the door open to a rate cut in June, the USD could struggle to stay resilient against its rivals even if the SEP points to a hawkish tilt in the near-term policy outlook. In case Powell adopts a cautious tone regarding the inflation outlook and refrains from signalling a policy pivot in June, XAU/USD is likely to stay under bearish pressure.

The Bank of Japan (BoJ) and the Bank of England (BoE) will also be announcing policy decisions next week. Although these events are unlikely to have a direct impact on Gold’s valuation, they could influence XAU/USD’s near-term action by driving the USD demand. There is growing speculation that the BoJ could end the negative interest rate policy. A rate hike by the BoJ early Tuesday could trigger capital outflows out of the USD and help XAU/USD edge higher during the Asian trading hours.

It’s a bit more tricky to assess the potential impact of the BoE decisions on XAU/USD because they will be released on Thursday after the Fed event. If both banks deliver hawkish surprises, XAU/USD is likely to stay on the back foot. In case the Fed stays hawkish while the BoE adopts a more cautious tone regarding a further extension of the restrictive policy, this could be seen as a policy divergence and provide an additional boost to the USD. In this scenario, however, Gold could also capture capital outflows out of Pound Sterling.

Gold technical outlook

Despite the recent correction, the daily Relative Strength Index (RSI) indicator on the daily chart stays above 70, suggesting that Gold is still technically overbought.

On the downside, static support seems to have formed at $2,150. In case XAU/USD drops below that level and starts using it as resistance, an extended correction toward $2,100 (midpoint of the ascending regression channel coming from October) could be seen.

Looking north, first resistance is located at $2,180 (upper limit of the ascending channel) before $2,200 (round level). A daily close above $2,200 could attract additional buyers, but it’s difficult to set a bullish target.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.