Gold Weekly Forecast: XAU/USD indecisive as investors assess central banks' rate outlook

- Gold registered small weekly gains but struggled to make a decisive move.

- Dollar shook off the bearish pressure after January jobs report.

- Next week's US CPI data could trigger a big reaction in XAU/USD.

Following the previous week’s sharp decline, gold managed to stage a rebound during the first half of the week with the dollar struggling to find demand. Rising US Treasury bond yields capped XAU/USD’s upside on Thursday and the upbeat January jobs report from the US didn't allow the pair to gather bullish momentum. Gold is likely to remain inversely correlated with the benchmark 10-year US T-bond yield next week as investors will await the US January Consumer Price Index (CPI) data, which could impact the market odds of a 50 basis points (bps) Fed rate hike in March.

What happened last week

The positive shift witnessed in market sentiment made it difficult for the greenback to find demand on Monday. Reflecting the improving mood, the S&P 500 Index rose nearly 2% on Monday. Moreover, several FOMC policymakers voiced their support for a 25 bps rate increase in March while noting a bigger hike was unlikely.

On Tuesday, the data from the US showed that the economic activity in the manufacturing sector continued to expand at a robust pace in January. The dollar stayed on the back foot with Wall Street’s main indexes continuing to push higher and gold climbing above $1,800.

The dollar sell-off stayed intact on Wednesday after the ADP reported that the employment in the private sector declined by 301,000 in January, reviving concerns over worsening conditions in the US labour market. XAU/USD closed the third straight day in positive territory and stayed relatively quiet early Thursday with investors moving to the sidelines while awaiting the Bank of England’s (BOE) and the European Central Bank’s (ECB) policy announcements.

The BOE hiked its policy rate by 25 bps to 0.5% following the February policy meeting. The policy statement revealed that four members of the Monetary Policy Committee voted for a 50 bps rate hike. With the initial reaction, GBP/USD surged higher and the lack of demand for the dollar allowed XAU/USD to cling to its weekly gains.

ECB President Christine Lagarde’s surprisingly hawkish remarks, however, triggered a rally in global bond yields and forced gold to lose its traction.

Lagarde did not repeat her previous comment that interest rates were not likely to increase in 2022 when asked about it. Additionally, she acknowledged that inflation in the euro was seen staying high for longer than expected. Despite the heavy selling pressure surrounding the dollar, gold snapped a three-day winning streak on Thursday, pressured by a 3% increase in the benchmark 10-year US T-bond yield.

On Friday, the US Bureau of Labor Statistics (BLS) announced that Nonfarm Payrolls increased by 467,000 in January, surpassing the market expectation of 150,000. Additionally, the December print got revised higher to 510,000 from 199,000. Underlying details of the jobs report showed that annual wage inflation climbed to 5.7% from 5% and the Labor Force Participation rate improved to 62.2% from 61.9%. The US Dollar Index edged higher after the data and the 10-year US T-bond yield rose to 1.9%, causing gold to return to the $1,800 area.

Next week

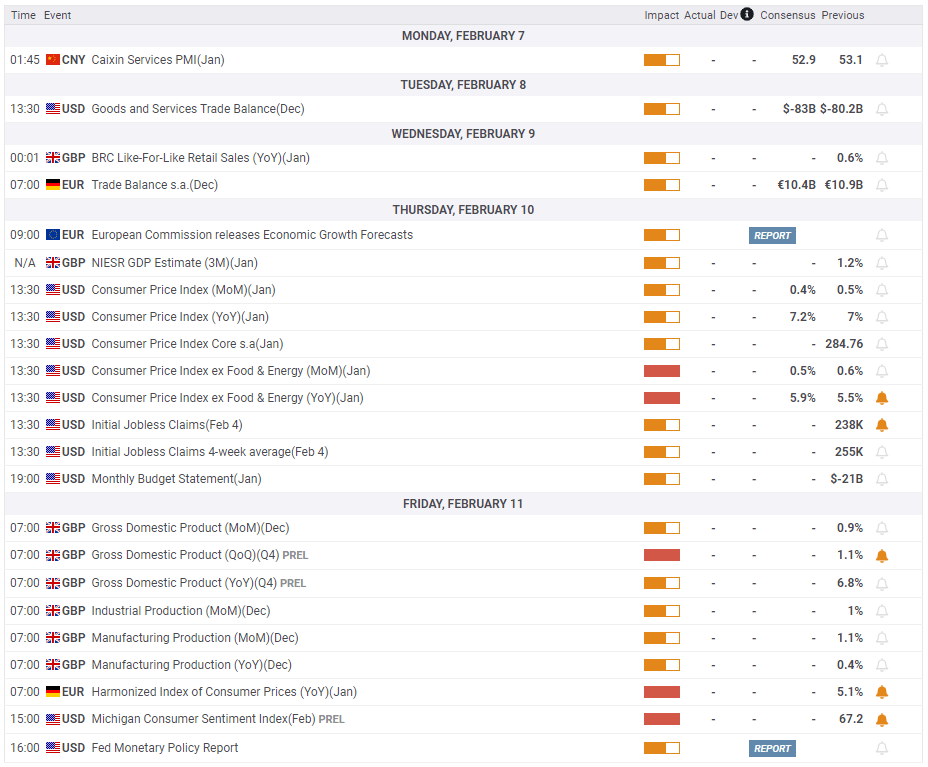

There won’t be any high-tier data releases in the first half of next week. The inverse correlation with US Treasury bond yields is likely to continue to impact the precious metal’s valuation. With major central banks turning more hawkish than anticipated to battle inflation, global bond yields are likely to continue to edge higher.

On Thursday, the US Bureau of Labor Statistics will release the January Consumer Price Index (CPI) data. On a yearly basis, the CPI is forecast to rise to 7.2% from 7% in December. A stronger-than-expected reading could ramp up the probability of a 50 bps hike in March, which currently stands at 25% according to the CME Group FedWatch Tool – and weigh on XAU/USD.

Ahead of the weekend, the Fed will submit its semi-annual Monetary Policy Report to the Senate Committee on Banking, Housing, and Urban Affairs. Market participants will look for fresh clues on the rate outlook and the timing of balance sheet reduction.

Gold technical outlook

Gold's technical outlook shows that the yellow metal is struggling to make a decisive move in either direction. The Relative Strength Index (RSI) indicator on the daily chart is moving sideways around 50 and the pair is trading near the 200-day SMA while holding above the 100-day SMA.

In case the price stays above $1,805 (200-day SMA) and starts using this level as support, the next target on the upside is located at $1,820 (20-day SMA, Fibonacci 38.2% retracement of December-February uptrend) before $1,830 (Fibonacci 23.6% retracement).

In case $1,805 is confirmed as resistance, gold needs to make a daily close below $1,800 (100-day SMA, Fibonacci 61.8% retracement) to convince bears. In that case, $1,780 (static level) aligns as the next support.

Gold sentiment poll

The FXStreet Forecast Poll shows that gold's bullish bias is unchanged in the near term but the one-week target of $1,809 suggests that there isn't a lot of room on the upside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.