Gold Weekly Forecast: Technicals turn bearish after weekly decline

- Gold registered its largest one-week loss since November.

- Surging US Treasury bond yields weighed heavily on the yellow metal mid-week.

- A daily close below $1,920 could open the door for additional losses.

Gold started the week under heavy bearish pressure and fell to its lowest level in more than two weeks at $1,895 late Wednesday. Following a recovery toward $1,950 in the second half of the week, the yellow metal lost its traction and ended up dropping more than 2% on a weekly basis.

What happened last week?

Heightened hopes for a diplomatic solution to the Russia-Ukraine conflict allowed risk flows to dominate the financial markets at the beginning of the week and made it difficult for gold to find demand. Ukrainian negotiator and presidential adviser Mykhailo Podolyak said on Sunday that Russia was talking constructively and added that they could achieve some results in a matter of days. Similarly, Russian delegate Leonid Slutsky noted that substantial progress had been made in the latest round of negotiations.

On Tuesday, the data from the US showed that the Producer Price Index (PPI) stayed unchanged at 10% on a yearly basis and rising US Treasury bond yields caused XAU/USD to continue to edge lower. Meanwhile, the market mood remained upbeat after Ukrainian President Volodymyr Zelenskyy's adviser said that they were expecting to reach a peace agreement with Russia within a couple of weeks at the earliest or in May at the latest.

Following its two-day policy meeting, the US Federal Reserve announced on Wednesday that it would hike the policy rate by 25 basis points (bps). The revised Summary of Projections revealed that policymakers were expecting six more rate hikes by the end of the year. The initial market reaction to the Fed’s hawkish rate outlook lifted the 10-year US Treasury bond yield to its highest level since May 2019 at 2.23% and forced gold to decline below $1,900. During FOMC Chairman Jerome Powell’s press conference, yields started to retreat and the dollar lost interest, triggering a rebound in XAU/USD.

Powell noted they were still expecting inflation to come down in the second half of the year despite heightened uncertainty. The chairman adopted a confident tone and reassured markets that they will tackle inflation without hurting economic activity. "We are strongly committed to not allowing high inflation to become entrenched," Powell said. "The good news is that the economy and labor market is quite strong, can handle interest rate increases."

The negative shift witnessed in risk sentiment on Thursday helped gold extend its rebound. Officials from Russia and Ukraine both rejected reports claiming that they were moving closer to a peace agreement. Later in the day, Reuters reported that there still was a very big gap between the positions of Ukraine and Russia. On a more concerning note, ''Russia may be contemplating a chemical-weapons attack,'' US Secretary of State Antony Blinken said.

With investors staying cautious ahead of the weekend, gold fluctuated in a relatively tight range on Friday…

Next week

February Durable Goods Orders and Markit Manufacturing PMI on Thursday will be the only high-tier data releases from the US. Hence, market participants will stay focused on headlines surrounding the Russia-Ukraine crisis.

Gold’s reaction to changes in risk mood has been pretty straightforward since late February. In case next week’s developments point to a further escalation of the conflict, gold should gather strength and start erasing this week’s losses.

On the other hand, the precious metal could come under renewed selling pressure if markets remain hopeful of a ceasefire. It’s difficult to say whether or not we will have a clear picture of what will happen on the geopolitical front next week but a prolonged Russia-Ukraine conflict should force investors to stay away from risk-sensitive assets. “Russian delegation to Ukraine peace talks has expressed readiness to work much faster than now,” a Kremlin spokesperson said on Friday. “Ukraine delegation has not shown similar readiness to speed talks up but those negotiations continue.”

Gold technical outlook

Gold broke below the ascending trend line coming from early February and closed the last three days below the 20-day SMA, pointing to a bearish shift in the technical outlook. Additionally, the Relative Strength Index (RSI) indicator on the daily chart fell below 50 for the first time in more than a month, suggesting that sellers started to dominate XAU/USD's action.

On the downside, $1,920 (Fibonacci 50% retracement of the latest uptrend) aligns as the first support. With a daily close below that level, gold is likely to test the $1,890/$1,900 area (Fibonacci 61.8% retracement, psychological level) before extending the decline to $1,880 (50-day SMA).

In case buyers manage to lift gold back above $1,950 (Fibonacci 38.2% retracement), next resistances could be seen at $1,975 (February 24 high) and $1,990 (Fibonacci 23.6% retracement).

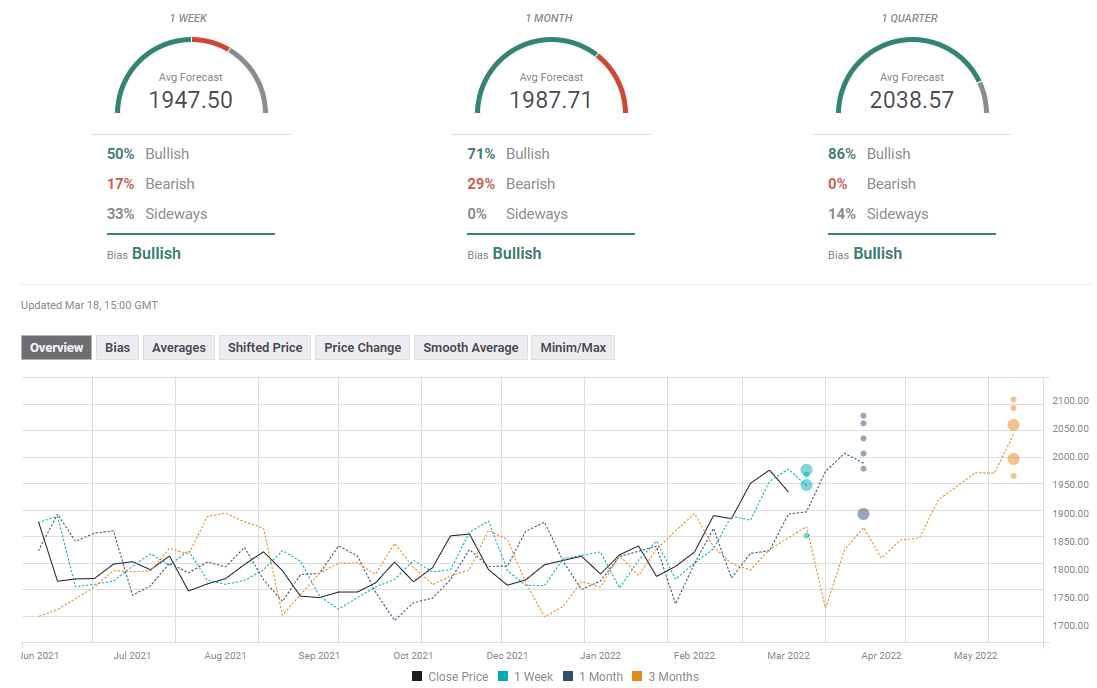

Gold sentiment poll

Despite the bearish shift in the near-term technical outlook, FXStreet Forecast Poll shows that experts see the yellow metal rebounding toward $1,950 next week. One-month view points to an overwhelmingly bullish bias with an average target of $1,987.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.