Gold Weekly Forecast: Geopolitics and US CPI data to influence XAU/USD action

- Gold lost its bullish momentum after setting a new record high in the previous week.

- The technical outlook suggests that sellers remain on the sidelines.

- Investors will keep a close eye on geopolitics and US inflation data next week.

Gold (XAU/USD) struggled to make a decisive move in either direction this week as the broad-based US Dollar (USD) strength offset the increasing safe-haven demand for the precious metal. Developments surrounding the conflict in the Middle East and US inflation data could drive XAU/USD’s action next week.

Gold ignores renewed USD strength

Gold started the new week under bearish pressure and lost nearly 1% on Monday. While speaking at the National Association for Business Economics Annual Meeting, Federal Reserve (Fed) Chairman Jerome Powell refrained from providing any fresh hints regarding the next policy step. Powell reiterated that risks are two-sided and that they will take policy decisions on a meeting-by-meeting basis. “The Fed is not in a hurry to cut rates quickly, will be guided by data,” he added. These comments allowed the USD to hold its ground and forced XAU/USD to stay on the back foot.

Although the USD preserved its strength on Tuesday after the US Bureau of Labor Statistics (BLS) reported that the JOLTS Job Openings rose to 8.04 million in August from 7.71 million in July, Gold benefited from escalating geopolitical tensions and gained over 1% to erase all of Monday’s losses. Reports of the Israeli army mounting a ground invasion of Lebanon revived fears over a deepening and widening conflict in the Middle East.

Early Wednesday, news of Iran firing about 200 ballistic missiles on Israel and Israel vowing to retaliate against the attack helped Gold find demand. Israel's Prime Minister Benjamin Netanyahu said that Iran had made a “big mistake” and “will pay,” further escalating tensions. As the USD recovery picked up steam in the second half of the day, however, XAU/USD struggled to gather bullish momentum and closed the day little changed. The Automatic Data Processing (ADP) reported that employment in the private sector rose by 143,000 in September, surpassing the market expectation of 120,000 and supporting the USD.

The data published by the Institute for Supply Management (ISM) showed on Thursday that the business activity in the service sector continued to expand at an accelerating pace in September, with the ISM Services Purchasing Managers Index (PMI) improving to 54.9 from 51.5 in August. The USD capitalized on this report and made it difficult for Gold to rebound.

On Friday, the BLS announced that Nonfarm Payrolls (NFP) rose by 254,000 in September, surpassing the market expectation of 140,000 by a wide margin. Additionally, August’s NFP growth of 142,000 was revised higher to 159,000. Other details of the employment report showed that the Unemployment Rate edged lower to 4.1%, while the annual wage inflation, as measured by the change in the Average Hourly Earnings, ticked up to 4% from 3.9% in August. Gold failed to stage a rebound after upbeat US labor market data.

Gold investors stay focused on geopolitics, await US inflation data

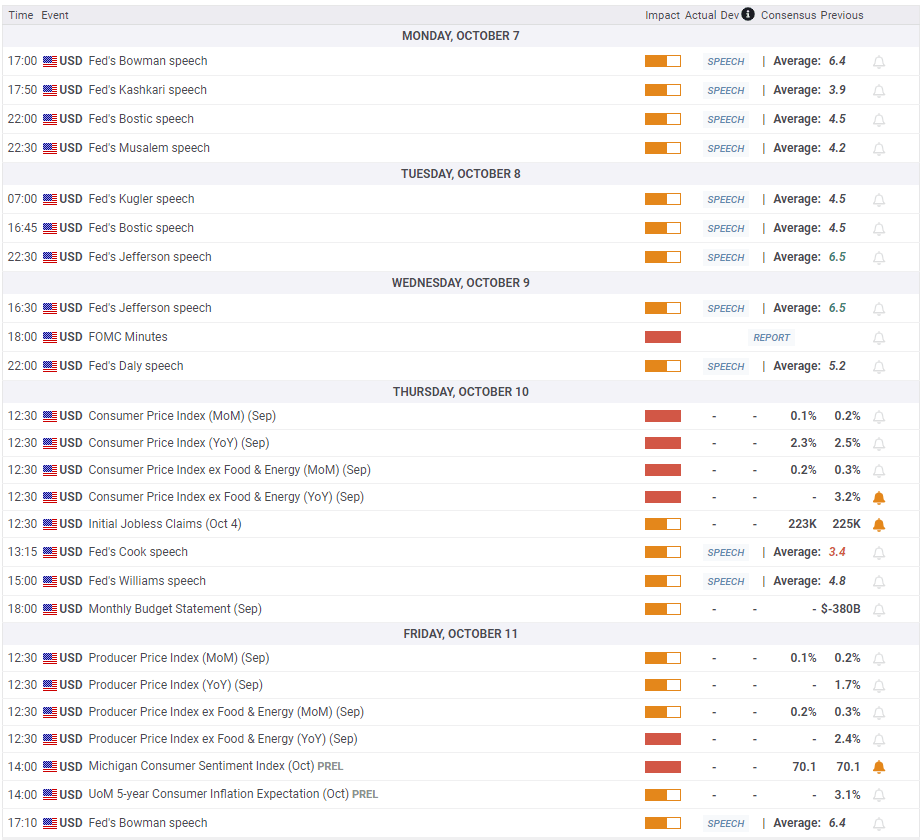

The US economic calendar will not offer any high-tier macroeconomic data releases in the first half of next week. On Wednesday, The Fed will release the minutes of the September policy meeting.

Investors will scrutinize the discussions surrounding the decision to lower the policy rate by 50 basis points (bps). In case the publication reveals that policymakers preferred a large reduction in the interest rate as a first step to a gradual policy-easing, rather than as a response to growing signs of cooling conditions in the labor market, the immediate reaction could boost the USD. The CME Group FedWatch Tool shows that markets are still pricing in a more than 30% probability that the Fed will opt for one more 50 bps cut at the next policy meeting in November, suggesting that the USD has more room on the upside if investors lean toward a 25 bps cut.

On the flip side, the USD could come under pressure and allow Gold to turn north if the minutes reflect that policymakers will keep an open mind about additional big rate cuts in case data points to an economic downturn or a worsening labor market outlook.

On Thursday, the BLS will release the Consumer Price Index (CPI) data for September. The monthly core CPI reading, which excludes prices of volatile items and is not distorted by base effect, could trigger a reaction in Gold. Markets expect the core CPI to rise 0.2% in September, following the 0.3% increase recorded in August. A reading of 0.2%, or smaller, could weigh on the USD. While an increase of 0.5% or more could cause investors to doubt the disinflation process and lift the USD, causing XAU/USD to turn south.

Market participants will also pay close attention to headlines coming out of the Middle East. If the crisis deepens with Israel retaliating against Iran and Iran not taking a step back, Gold could continue to take advantage of the safe-haven demand.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart retreated slightly below 70, reflecting sellers’ reluctance to bet on an extended decline. On the downside, the mid-point of the ascending regression channel coming from late June forms first support at $2,640. In case this level fails, the next support could be seen at $2,605-$2,600 (20-day Simple Moving Average (SMA), static level) before $2,575 (lower limit of the ascending channel).

Looking north, interim resistance seems to have formed at $2,675 (static level) ahead of $2,700-$2,705 (round level, upper limit of the ascending channel).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.