Gold Weekly Forecast: Advances to multi-week high ahead of Powell’s testimony, US inflation

- Gold benefited from broad-based USD weakness and advanced beyond $2,380.

- Fed Chairman Powell’s testimony and US CPI data could significantly impact Gold’s performance next week.

- XAU/USD’s near-term technical outlook points to a bullish tilt.

Following another indecisive start to the week, Gold (XAU/USD) gathered bullish momentum and climbed to its highest level since early June, above $2,380, as disappointing macroeconomic data releases from the US weighed on the US Dollar (USD). Federal Reserve (Fed) Chairman Jerome Powell’s two-day testimony on the monetary policy and June inflation data from the US could drive Gold’s action next week.

Gold rises as US yields drop after weak US data

Gold registered small gains on Monday as the USD struggled to find demand at the beginning of the week. The ISM Manufacturing Purchasing Managers Index (PMI) edged lower to 48.5 in June from 48.7 in May, and the Prices Paid Index, the inflation component of the survey, declined sharply to 52.1 from 57.

As the benchmark 10-year US Treasury bond yield edged lower following Fed Chairman Powell’s remarks on the policy outlook on Tuesday, XAU/USD managed to hold its ground. While speaking at a panel at the European Central Bank’s Forum on Central Banking in Sintra, Powell acknowledged that the disinflation trend showed signs of resuming and added that recent data pointed to significant progress.

On Wednesday, the USD came under renewed selling pressure and opened the door for another leg higher in XAU/USD. The Automatic Data Processing (ADP) reported that private sector payrolls rose 150,000 in June, falling short of analysts' estimate of 160,000. Meanwhile, the weekly data published by the Department of Labor showed that there were 238,000 first-time applications for unemployment benefits in the week ending June 29, up from 234,000 in the previous week. Finally, the ISM Services PMI fell to 48.8 in June from 53.8 in May, pointing to a contraction in the service sector's economic activity. Furthermore, the Employment Index and the Prices Paid Index of the PMI survey dropped to 46.1 and 56.3, respectively. Gold gathered bullish momentum following the dismal US data and rose above $2,360 for the first time in two weeks.

With financial markets in the US remaining closed in observance of the Independence Day holiday on Thursday, trading volume thinned out, causing Gold to enter a consolidation phase.

The US Bureau of Labor Statistics (BLS) announced on Friday that Nonfarm Payrolls rose by 206,000 in June. Although this figure surpassed the market expectation of 190,000, the downward revision to May’s NFP increase, from 272,000 to 218,000, made it difficult for the USD to regather its strength. Other details of the jobs report showed that the Unemployment Rate edged higher to 4.1% from 4%, while the annual wage inflation softened to 3.9% from 4.1%. XAU/USD continued to push higher with the immediate reaction and reached its highest level since early June above $2,380.

Gold investors’ focus shifts to Powell testimony, US inflation data

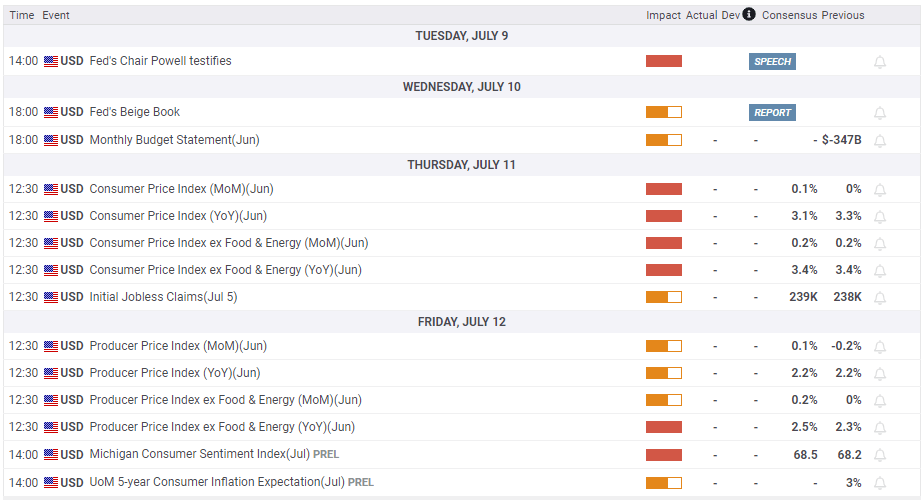

The US economic calendar will not offer any high-impact data releases in the first half of the week. Nevertheless, investors will pay close attention to Fed Chairman Powell’s two-day testimony before the Senate Banking Committee and House Financial Services Committee on Tuesday and Wednesday, respectively.

Powell is unlikely to offer any fresh clues on the monetary policy outlook in his prepared remarks. Because this two-day testimony will take place before the November Presidential election, lawmakers’ questions could be focused on politics. Immigration, inflation, and unemployment will be among hot topics that lawmakers are likely to touch on. Powell will not comment on politics or fiscal policy. Even if that’s the case, changes in risk perception could still impact the USD’s performance. A risk-on rally could cause the USD to lose interest, while a negative shift in market mood could help the currency benefit from safe-haven flows.

On Thursday, the BLS will release the Consumer Price Index (CPI) data for June. On a monthly basis, the CPI is forecast to rise 0.1% after staying unchanged in May. The core CPI, which excludes volatile food and energy prices, is expected to increase 0.2% to match May’s growth. A bigger-than-expected increase in monthly core CPI could cause investors to reassess the chances of a Fed rate cut in September and provide a boost to the USD with the immediate reaction. On the other hand, a negative surprise in this data could trigger a leg lower in the US Treasury bond yields and pave the way for another leg higher in XAU/USD.

Gold technical outlook

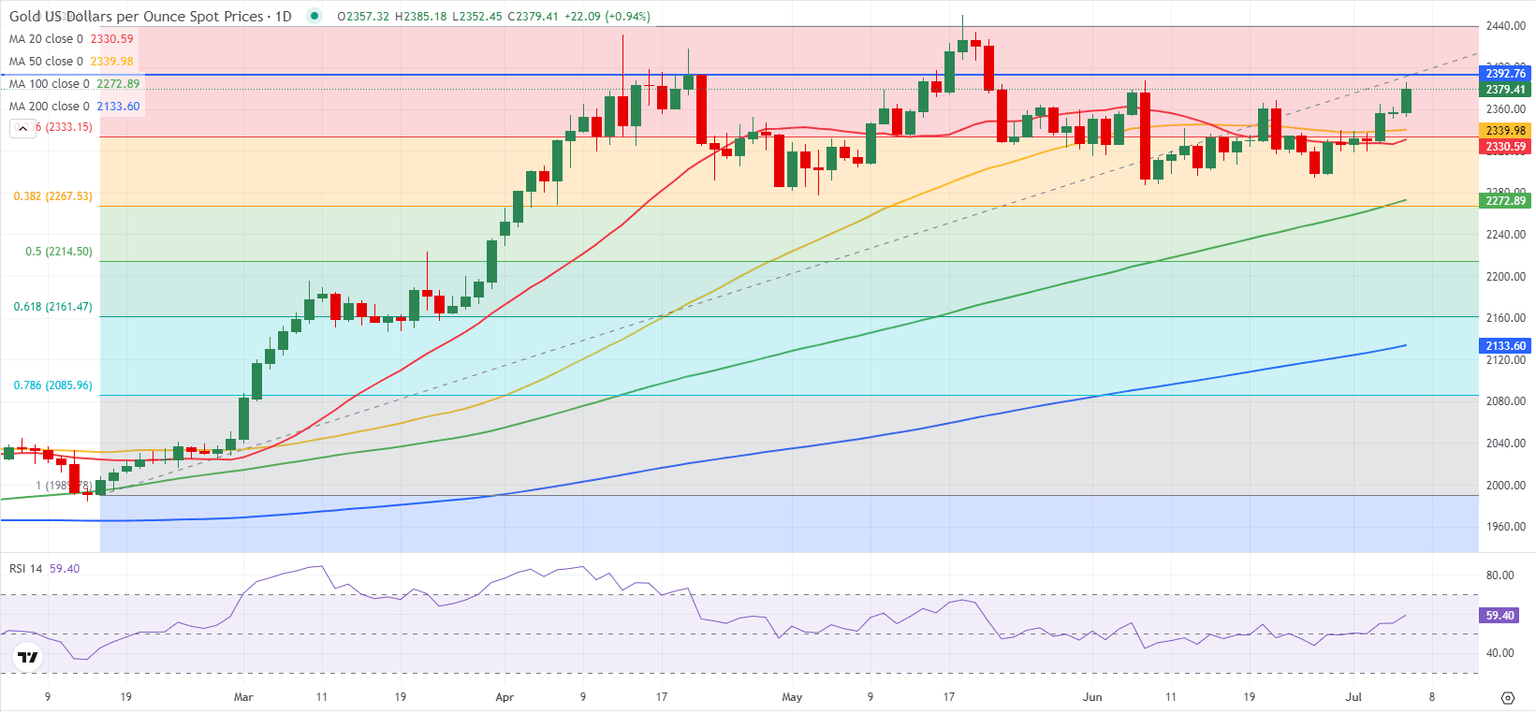

The Relative Strength Index (RSI) indicator on the daily chart rose toward 60, and Gold price closed above the 50-day and the 20-day Simple Moving Averages (SMA) for three consecutive days, reflecting a buildup of bullish momentum.

On the upside, $2,390 (static level) aligns as interim resistance before $2,400 (psychological level, static level). Once Gold climbs above the latter and confirms it as support, it could target the all-time high of $2,450.

Key support area seems to have formed at $2,340-$2,330, where the 20-day SMA, the 50-day SMA and the Fibonacci 23% retracement of the mid-February-June uptrend converge. In case XAU/USD returns below that level and starts using it as resistance, $2,300 (psychological level, static level) and $2,270 (100-day SMA) could be seen as next support levels.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.