- Gold capitalized on safe-haven flows throughout this week.

- A de-escalation of geopolitical tensions could trigger a deep correction in XAU/USD.

- A daily close above $1,910 could open the door for additional gains toward $1,925.

Gold started the week on a firm footing as investors sought refuge over heightened fears of a Russian invasion. Although reports claiming that Russian troops started to return to bases caused the yellow metal to lose interest as a safe haven on Tuesday, it managed to regain traction in the second half of the week and advanced beyond $1,900 for the first time since June 2021. With the market mood staying cautious on Friday, XAU/USD ended up rising nearly 2% on a weekly basis.

What happened last week

US President Joe Biden's national security adviser, Jake Sullivan, told CNN over the weekend that Russia could invade Ukraine before February 20. Markets turned risk-averse at the beginning of the week on this headline and XAU/USD registered strong daily gains on Monday.

On Tuesday, however, investors breathed a sigh of relief after Russian President Vladimir Putin announced that they had decided to partially withdraw troops. Global equity indexes shot higher and the benchmark 10-year US Treasury bond yield rose nearly 3%, forcing gold to erase Monday’s gains.

Once again, the market mood soured on Wednesday as US President Biden reiterated that a Russian attack on Ukraine was still very much a possibility. Furthermore, "so far we have not seen any de-escalation on the ground, not seen any signs of reduced Russian military presence on the borders of Ukraine," said NATO Secretary General Jens Stoltenberg.

Meanwhile, the data published by the US Census Bureau showed that Retail Sales in the US increased by 3.8% on a monthly basis in January. This reading surpassed the market expectation of 2% by a wide margin but it was largely ignored by market participants. Later in the day, the minutes of the US Federal Reserve’s January policy meeting revealed that most policymakers were in favor of a faster pace of increases in the target rate for the Federal Funds rate than in the post-2015 period.

Markets remained risk-averse on Thursday as investors remained on edge while trying to figure out whether or not there would be a military conflict between Ukraine and Russia. US Secretary of State Anthony Blinken told the UN Security Council that they couldn’t confirm Russia was drawing down its forces. With the 10-year US T-bond yield losing more than 3%, XAU/USD climbed above $1,900 for the first time in eight months.

On a positive development, Blinken has accepted an invitation to meet with Russian foreign minister Sergei Lavrov next week, reviving hopes of a diplomatic solution to the crisis and allowing risk flows to return to markets ahead of the weekend. Nonetheless, market participants adopted a cautious stance after the US Secretary of Defense said that Russia was still moving troops toward the border and that it was still capable of launching an attack.

Next week

Geopolitics is likely to remain the primary market driver next week. A de-escalation of tensions could trigger a risk rally and cause gold to come under heavy selling pressure. On the other hand, a prolonged threat of a Russian invasion could provide another boost to gold by forcing investors to stay away from risk-sensitive assets.

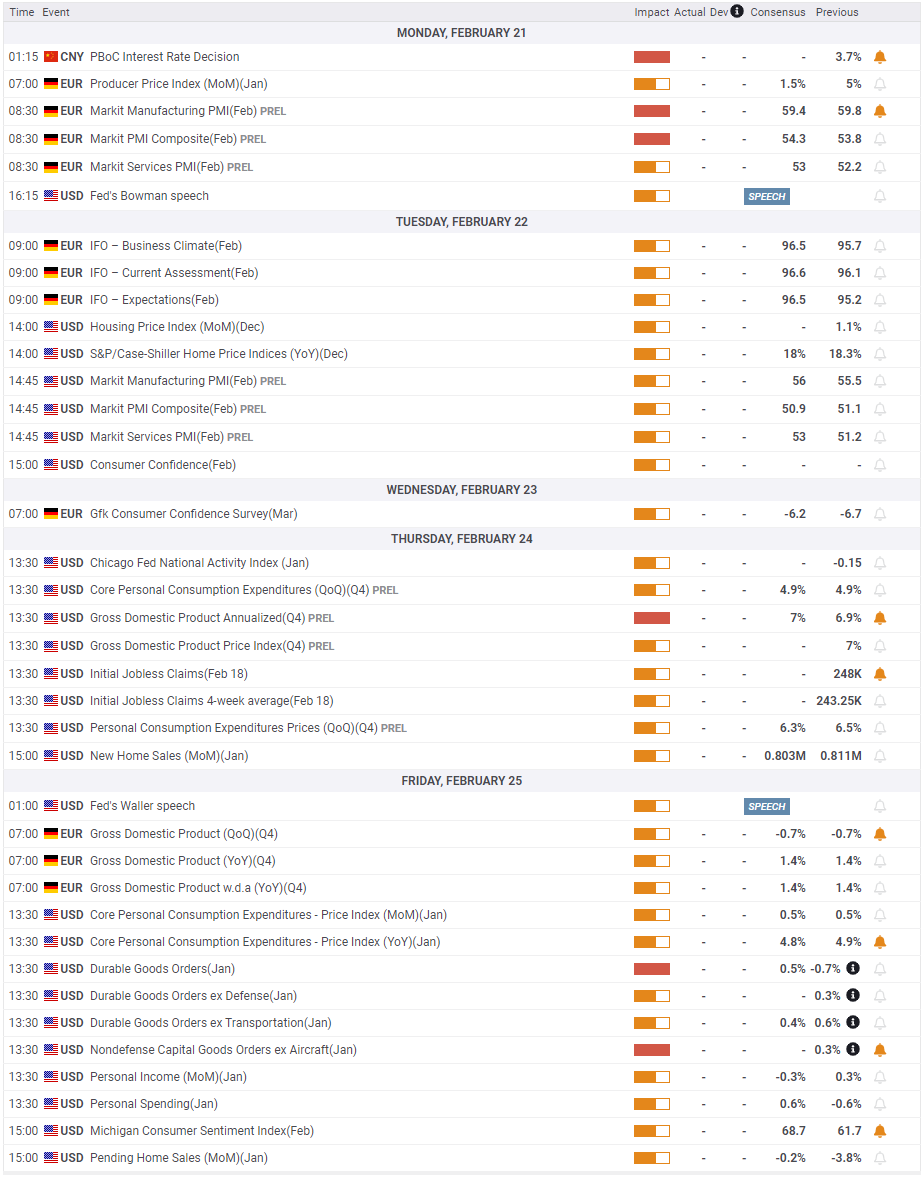

The US markets will be closed in observance of Presidents Day on Monday. IHS Markit will release the advanced February Manufacturing PMI on Tuesday and the Conference Board will publish the Consumer Confidence Index.

On Thursday, the US Bureau of Economic Analysis’ second estimate of fourth-quarter GDP growth will be looked upon for fresh impetus. Finally, the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, will be featured in the US economic docket on Friday. On a yearly basis, the Core PCE Price Index is expected to edge lower to 4.8% in January from 4.9% in February. A stronger-than-forecast print could help the greenback find demand and weigh on XAU/USD but the market reaction is likely to remain short-lived as long as geopolitical uncertainties persist.

Gold technical outlook

Gold needs to rise above $1,900 (static level, psychological level) and start using that level as support in order to extend its rally. On the upside, $1,910 (static level) aligns as the next bullish target ahead of $1,925 (static level).

It's worth noting that the Relative Strength Index (RSI) indicator on the daily chart is now above 70, pointing to overbought conditions. The last time the daily RSI climbed above 70 back in mid-November, gold staged a deep correction. A similar action could be expected next week but XAU/USD's losses are likely to remain limited unless risk flows dominate the markets with a resolution of the Russia-Ukraine conflict.

Support are located at $1,870 (former resistance, static level), $1,850 (static level) and $1,838 (20-day SMA).

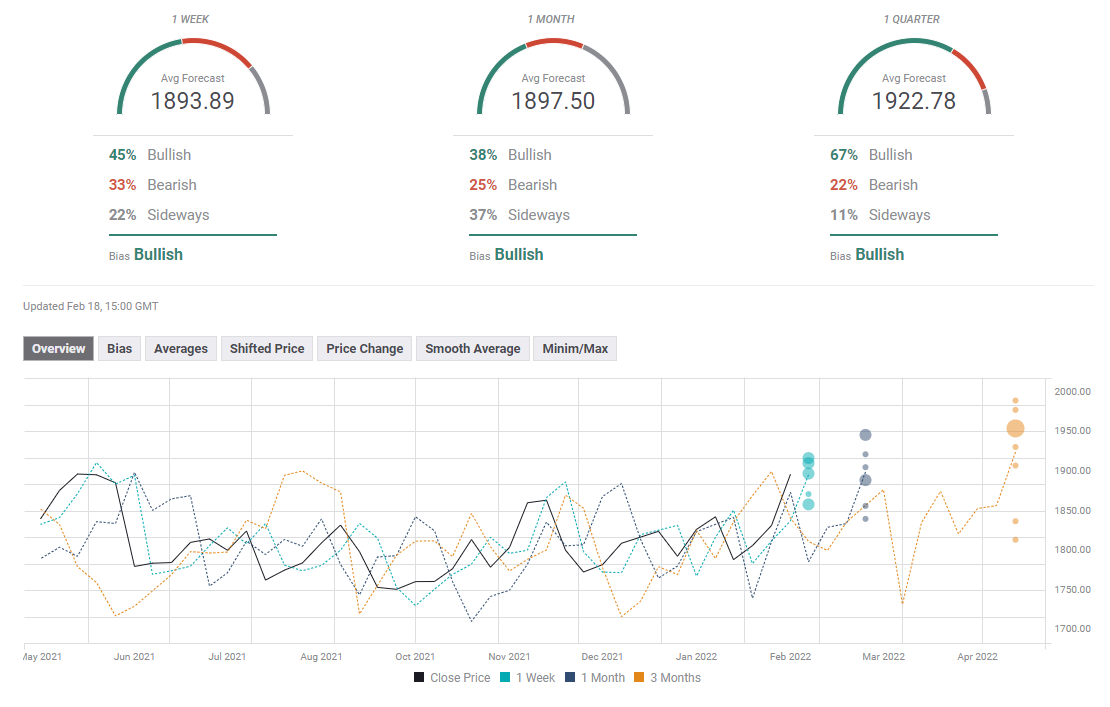

Gold sentiment poll

According to the FXStreet Forecast poll, gold could find it difficult to extend its rally next week. The one-week average of $1,893 is slightly below the weekly closing price. Over the medium term, a bullish tilt is witnessed among experts, several of whom see gold rising above $1,950 in that time frame.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.