Gold Weekly Forecast: Attention shifts to central banks, geopolitics

- Gold managed to bounce off multi-week lows near $2,000.

- Further consolidation seems the name of the game so far.

- Geopolitics, macro data and central banks should rule the sentiment.

Prices of the ounce troy of gold (XAU/USD) managed to regain balance and reverse a negative start of the week, rebounding from five-week lows in the boundaries of the key contention zone around $2,000 to reclaim the vicinity of $2,040 towards the end of the trading week. Still, the precious metal lost some momentum on the week as investors scaled back Federal Reserve (Fed) rate cut bets amid another badge of upbeat economic data.

Gold meets support near $2,000

The yellow metal kicked off the week in a bearish fashion, dragged lower by the strong resumption of the demand for the Greenback along with the equally strong pick-up in US yields across different timeframes.

Chinese data releases during the first half of the week disappointed market participants once again, further reinforcing the perception that an economic recovery in that country remains a wishful thinking for the time being.

That scenario in China prompted both Gold and the risk-linked galaxy to extend their weekly declines at a time when the upside momentum in the US Dollar was running hot and the USD Index (DXY) was climbing to fresh yearly peaks around 103.70 (January 17).

Another driver that motivated the steep knee-jerk in the precious metal was the persistent resilience in the US economy, underpinned once again by strong data readings, this time from firmer-than-estimated Retail Sales, Industrial Production and the Philly Fed Manufacturing gauge, all impacting on (over-optimistic?) bets on an interest rate cut by the Federal Reserve at its March 20 meeting.

According to FedWatch Tool tracked by CME Group, the probability of the latter development dropped from over 80% at the beginning of the week to just over 50% on Friday.

Additionally, dwindling speculation of a rate cut in Q2 boosted US yields across the curve, a move that was also exacerbated by the return of the tighter-for-longer narrative among some Fed officials. On this, Atlanta Fed President Raphael Bostic has stated that he is open to implementing interest rate cuts prior to July if there is "compelling" evidence of inflation decelerating faster than anticipated. While affirming the plan to start rate reductions in the third quarter, he underscored the importance of exercising caution to prevent premature cuts that could lead to a resurgence of demand and price pressures.

The unexpected uptick in UK inflation figures also supported the view of a longer-than-anticipated tight stance. Hot UK inflation also pushed back market chatter of a probable rate cut by the “Old Lady” at some point in H1.

European Central Bank (ECB) President Christine Lagarde joined the club after suggesting that the central bank might start reducing its policy rates at some point during the summer, a view that was also propped up by other policymakers throughout the week.

Gold price could react to Chinese data, geopolitical headlines

A look at next week’s events allows us to infer that Gold prices should keep the cautious stance against the backdrop of interest rate decisions by the BoJ, BoC and the ECB. All of them are predicted to keep their interest rates unchanged.

Another potential driver for the non-yielder metal comes from the release of advanced Manufacturing and Services PMIs on both sides of the Atlantic, as well as another estimate of the Q4 US GDP Growth Rate and the publication of US inflation figures for the month of December, this time measured by the PCE.

On the geopolitical front, the deterioration of the Israel-Hamas conflict, the Red Sea crisis, and the involvement of major players as this scenario continues to spread are factors supportive of extra demand for the yellow metal.

Gold technical outlook

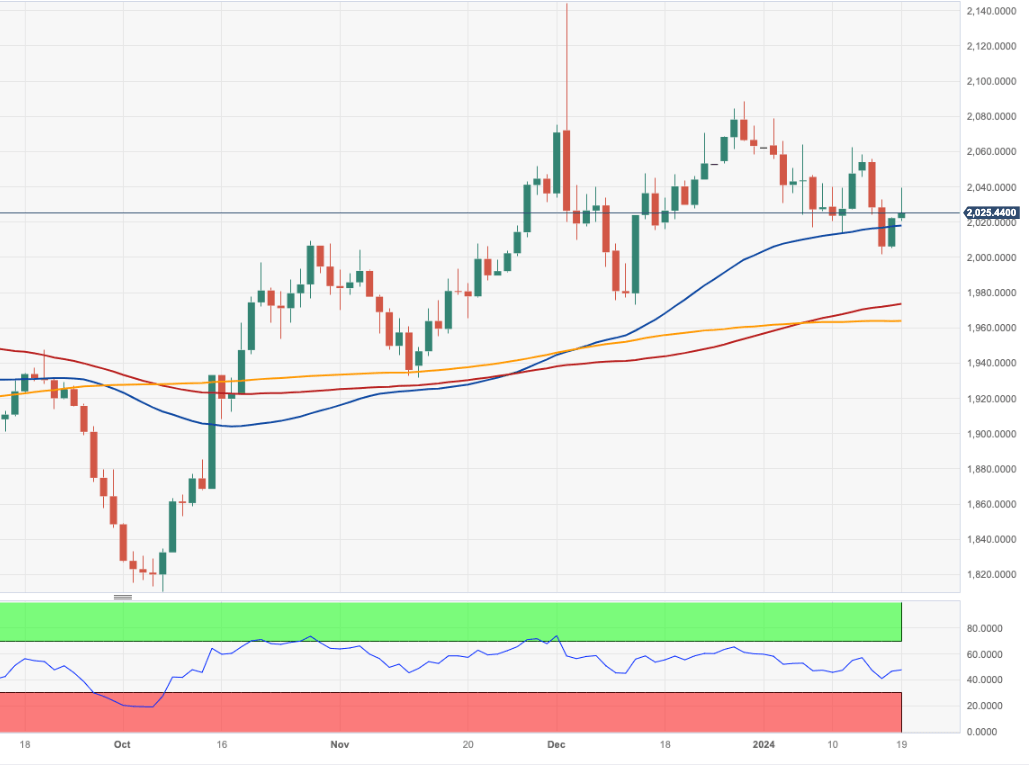

The so-far 2024 low of $2,001 reinforces the critical contention zone around $2,000 for the time being. If this region were to collapse, it could potentially lead to a further decline towards the December 2023 bottom of $1,973, followed by the 200-day Simple Moving Average (SMA) of $1,963 and the November 2023 low of $1,931. In the event of continued losses, the price may retest the October 2023 bottom of $1,810, followed by the 2023 low of $1,804 and potentially the $1,800 region.

The daily RSI rose past the 50 threshold, which should bolster extra recovery in the very near term.

On the upside, the first target would be the weekly high of $2,088, which was reached on December 28. Beyond that, the next target would be the all-time top of $2,150, which was recorded on December 4, 2023.

Gold daily chart

Economic Indicator

United States Personal Consumption Expenditures - Price Index (MoM)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US).. The MoM figure compares prices in the reference month to the previous month. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.