- Gold closed the week hitting a fresh all-time high despite markets doubting a large Fed rate cut in September.

- XAU/USD technical outlook suggests that the bullish bias remains intact.

- Investors will scrutinize PMI data and comments from Fed officials next week.

Gold (XAU/USD) reached a new record high of $2,500 despite struggling to gather bullish momentum in the first half of the week. Macroeconomic data releases from the US and Federal Reserve (Fed) Chairman Jerome Powell’s speech at the Jackson Hole Symposium next week could trigger the next big action in Gold.

Gold touches new record high on Friday

Following the rebound seen in the second half of the previous week, Gold preserved its bullish momentum on Monday and closed above $2,470. In the absence of high-tier macroeconomic data releases, the pullback seen in the US Treasury bond yields helped XAU/USD push higher at the beginning of the week. In the meantime, Gold benefited from high geopolitical tensions as the Israeli Defense Minister said over the weekend that they were still expecting Iran to launch an attack despite calls from Western nations to refrain from retaliation.

On Tuesday, the data from the US showed that the Producer Price Index (PPI) rose 0.1% on a monthly basis in July as expected. Markets largely ignored this data and Gold went into a consolidation phase, closing the day virtually unchanged.

The Bureau of Labor Statistics (BLS) reported on Wednesday that inflation in the US, as measured by the change in the Consumer Price Index (CPI), declined to 2.9% on a yearly basis in July from 3% in June. The core CPI, which excludes volatile food and energy prices, rose 3.2% on a yearly basis, while the CPI and the core CPI both increased 0.2% on a monthly basis. These figures came largely in line with market expectations but the probability of the Fed lowering the policy rate by 50 basis points in September declined below 40% from 52% ahead of the data release, per CME Group FedWatch Tool. As bets for a big rate cut faded, Gold erased a portion of its weekly gains.

More upbeat macroeconomic data releases from the US on Thursday caused investors to leaven further into a 25 bps Fed rate cut in September and made it difficult for Gold to gather bullish momentum. The Department of Labor reported that the weekly Initial Jobless Claims declined by 7,000 to 227,000 in the week ending August 10, while other data showed that Retail Sales rose 1% on a monthly basis in July, beating the market expectation for an increase of 0.3%. The odds of a 50 bps Fed rate cut in September fell below 30% after these releases.

As risk flows started to dominate the action in financial markets on Friday, the USD struggled to find demand, allowing XAU/USD to regain its traction and reach a new record high of $2,500.

Gold investors await US data, Fed Chairman Powell’s appearance at Jackson Hole

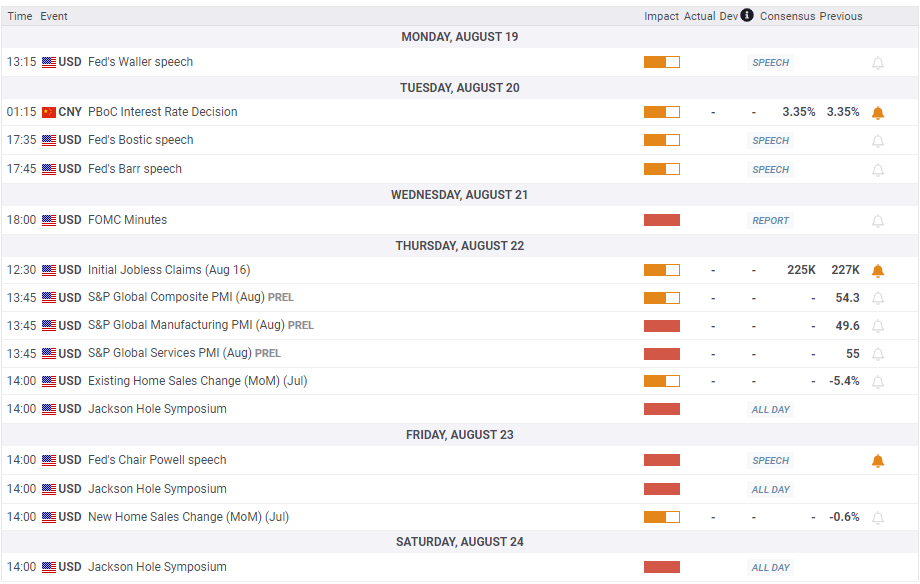

The US economic calendar will not feature any high-tier data releases in the first half of the week. On Wednesday, the Fed will publish the minutes of its July 30-31 meeting. In the post-meeting press conference, Fed Chairman Jerome Powell acknowledged that there was a “real discussion” about cutting the policy rate at the July meeting. Investors will scrutinize remarks surrounding the rate cut discussions. In case the publication shows that several policymakers advocated for a surprise rate cut in July, the USD could come under renewed selling pressure.

On Thursday, S&P Global will release the preliminary Manufacturing and Services Purchasing Managers Index (PMI) data for August. In case the S&P Global Services PMI falls into the contraction territory by coming in below 50, it could revive concerns over an economic downturn in the US and weigh on the USD, helping XAU/USD push higher.

The 2024 Jackson Hole Economic Policy Symposium titled "Reassessing the Effectiveness and Transmission of Monetary Policy" will be held on August 22-24. Fed Chairman Jerome Powell will deliver a speech at the second day of the event on Friday.

Even if Powell confirms a rate cut in September, it is unlikely to trigger a market reaction, since such a decision is already fully priced in. Powell could push back against market expectations about the Fed possibly lowering the policy rate by 50 bps at a future meeting and note that they are likely to ease policy at a steady pace. In this scenario, US T-bond yields could stretch higher and cause Gold to edge lower.

In a recently published report, TD Securities senior commodity strategist Daniel Ghali noted that the positioning in Gold markets is becoming technically bearish with Commodity Trading Advisors (CTAs) remaining “max-long.”

“Several of the major cohorts in Gold markets are now facing buying exhaustion, whereas the narrative that propelled prices to these all-time highs now appears stale. The risk of a positioning washout is at its highest levels of the year,” Ghali noted and added:

“A repricing in Fed expectations could be the catalyst to shake-out some complacent length, potentially catalyzing subsequent liquidations with several major cohorts simultaneously vulnerable. Jackson Hole is the next potential catalyst, but Nonfarm [Payrolls] data on the following week will be key.”

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart stays above 60, suggesting that the bullish bias remains intact.

On the upside, $2,500 (psychological level, static level, record high) could act as the next resistance. In case Gold manages to flip this level into support, the upper limit of the ascending channel could be seen as the next bullish target at $2,600.

Technical sellers could show interest if Gold drops into the lower half of the ascending regression channel by returning below $2,480 and using this level as resistance. In this scenario, the 20-day Simple Moving Average (SMA) could be seen as next support at $2,425 before $2,400 (psychological level, static level). A daily close below the latter could open the door for an extended correction toward the 100-day SMA, currently located at $2,380.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trims losses and approaches 1.1380

The US Dollar now succumbs to the re-emergence of the selling pressure and allows EUR/USD to recoup part of the ground lost and approach to the 1.1380 zone on Thursday. Earlier on Thursday, the ECB matched estimates and lowered its rates by 25 bps.

GBP/USD advances to daily highs past 1.3250

GBP/USD is picking up extra upside impulse and is revisiting the 1.3250 zone, or daily peaks, as the US Dollar is trimming part of its earlier advance. The move in Cable remains propped up by a firm tone in the risk complex.

Gold loses traction and revisits the $3,320 zone

Gold burst to another all‑time high, teasing the $3,360 mark per ounce before easing back to the $3,320 zone per troy ounce as the Greeback staged a comeback and Treasury yields firmed across the curve.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.