Gold Weekly Forecast: Geopolitical tensions, Chinese growth set to drive price action

- Gold recovered from multi-week low set below $2,020.

- Technical picture points to a bullish tilt in the near term outlook.

- Markets will scrutinize data from China and geopolitical headlines in the coming week.

Gold started the week under modest bearish pressure but managed to erase its losses ahead of the weekend. Investors still see a strong probability that the Federal Reserve (Fed) will opt for a rate cut in March, not allowing US bond yields to push higher and supporting XAU/USD. Next week’s calendar will not offer any high-tier data releases from the US, but Chinese growth figures and geopolitical headlines could influence the precious metal’s valuation.

Gold price gains traction ahead of the weekend

The negative shift seen in risk appetite allowed the US Dollar (USD) to gather strength at the beginning of the week and caused Gold to push lower. Major equity indexes in Asia suffered large losses on news of Chinese wealth manager Zhongzhi Enterprise Group filing for bankruptcy liquidation after failing to repay debt. Later in the day, however, XAU/USD managed to erase a portion of its losses as the market mood improved. US stocks gained traction on growing optimism about the US government avoiding a shutdown after leaders of the House and Senate announced a broad agreement on a $1.59 trillion spending deal late Sunday. In the meantime, the Federal Reserve Bank of New York's monthly survey showed that consumers' year-ahead inflation expectation dropped to its lowest level since January 2021 at 3%, causing US Treasury bond yields to push lower and supporting the pair.

In the absence of high-tier macroeconomic data releases, markets turned choppy on Tuesday. While Wall Street’s main indexes corrected lower following Monday’s rally, the USD started to strengthen and made it difficult for XAU/USD to gather recovery momentum. Improving risk mood limited the USD’s gains mid-week and helped the pair find a foothold.

Inflation in the US, as measured by the change in the Consumer Price Index (CPI), climbed to 3.4% on a yearly basis in December from 3.1% in November, the Bureau of Labor Statistics (BLS) reported on Thursday. The Core CPI, which excludes volatile food and energy prices, rose 0.3% on a monthly basis to match the market expectation and November’s increase. Following some wild fluctuations with the immediate reaction, Gold touched a fresh multi-week low below $2,020 as the benchmark 10-year US Treasury bond yield advanced above 4%.

Commenting on December inflation data, “the CPI report helps to underscore that the path toward inflation normalization is likely to be prolonged,” said TD Securities analysts. “Barring a meaningful deterioration of the economy and the labor market, the Fed won't be easing policy until they're certain inflation is on a clear and "sustainable" path toward the 2% objective.”

Nevertheless, mixed inflation readings failed to convince investors that the Fed will delay the policy pivot toward the end of the second quarter. The CME FedWatch Tool’s probability for a Fed rate cut in March remained virtually unchanged at around 70%. As a result, Gold recovered back above $2,040 by Friday morning. In the meantime, escalating geopolitical tensions on news of the US and UK forces carrying out attacks against multiple Houthi targets in Houthi-controlled regions of Yemen further supported Gold ahead of the weekend.

The final data release of the week from the US showed on Friday that the Producer Price Index (PPI) rose 1% on a yearly basis in December, below the market expectation of 1.3%. On a monthly basis, the Core PPI remained unchanged for the third straight month. As a result, XAU/USD advanced to a weekly top above $2,050, while the USD struggled to find demand.

Gold price could react to Chinese data, geopolitical headlines

Gold is likely to stay calm to start the week, with US markets remaining closed in observance of Martin Luther King, Jr. Day on Monday.

Retail Sales and Industrial Production figures for December, alongside the fourth-quarter Gross Domestic Product (GDP) data from China will be watched closely by market participants in the Asian session on Wednesday. In case these data suggest that the Chinese economy ended the year on a strong note, Gold could edge higher with the first reaction.

The US economic docket will offer December Retail Sales and weekly Initial Jobless Claims data on Wednesday and Thursday, respectively. Retail Sales are forecast to rise by 0.3% on a monthly basis in December. Because this data is not adjusted for price changes, investors are unlikely to react to it if it arrives near the market consensus. A negative print could, however, hurt the USD. The number of first-time applications for unemployment benefits declined to 202,000 in the week ending January 6. A reading below 200,000 next week could highlight tight labor market conditions and support the USD in the near term.

The Fed’s blackout period will start on Saturday, January 20. Policymakers could deliver comments next week, but they are unlikely to offer any guidance on the possible timing of the first rate reduction.

Market participants will also keep a close eye on headlines surrounding the conflict in the Middle East. Gold has been able to benefit from heightened geopolitical tensions lately, but a prolonged crisis in the Red Sea could drive energy prices higher and slow major central banks’ progress on inflation. In turn, a leg higher in global bond yields could limit XAU/USD’s upside.

Gold technical outlook

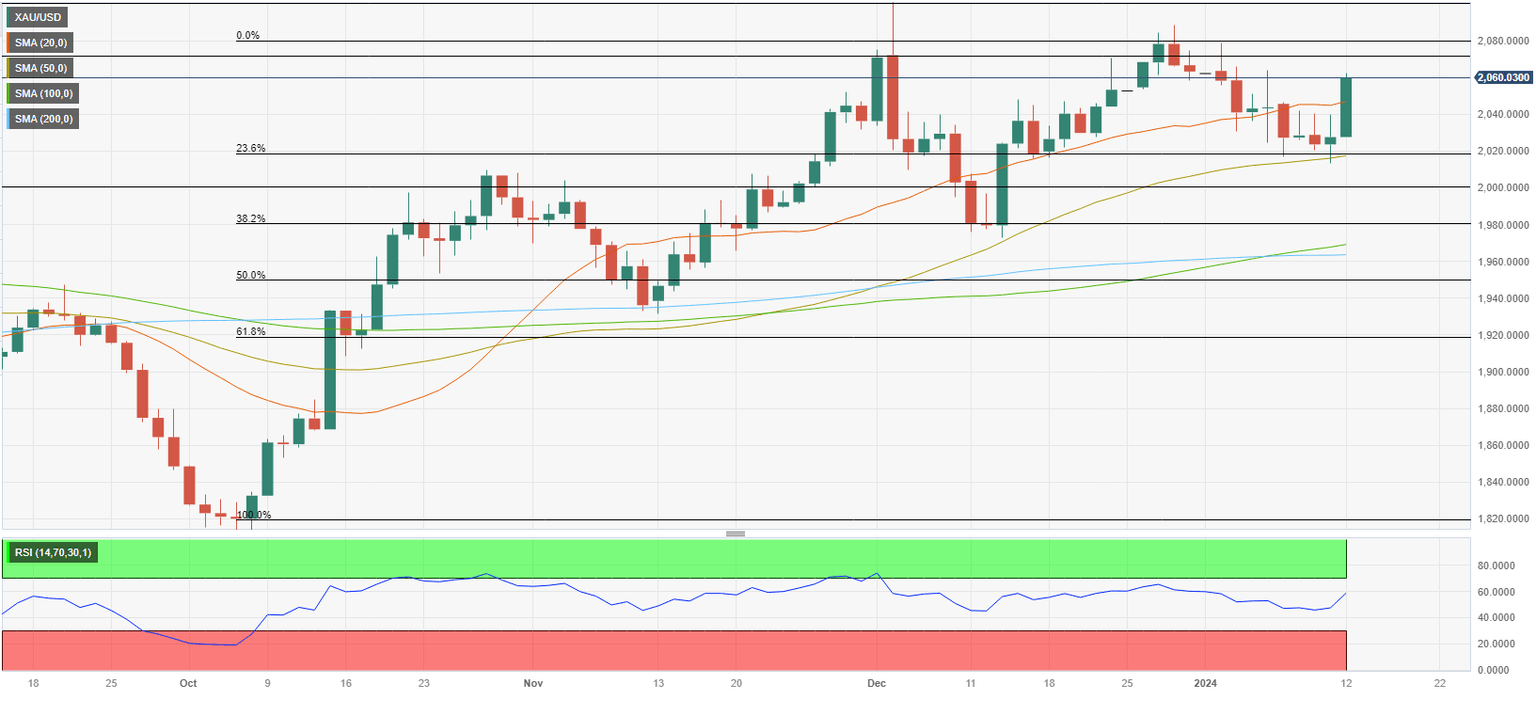

The Relative Strength Index (RSI) indicator on the daily chart rose to 60 on Friday and XAU/USD climbed above the 20-day Simple Moving Average (SMA) in a decisive way, pointing to a bullish tilt in the short-term outlook. $2,070 (static level) aligns as next resistance before $2,080 (end-point of the latest uptrend, static level) and $2,100 (psychological level, static level).

On the downside, first support is located at $2,050 (20-day SMA) ahead of $2,020 (50-day SMA, Fibonacci 23.6% retracement level of the latest uptrend). A daily close below the latter could attract technical sellers and open the door for an extended slide toward $2,000 (psychological level, static level).

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.