- Gold gathered bullish momentum and set a new record-high this week.

- The near-term technical picture highlights the dominance of buyers.

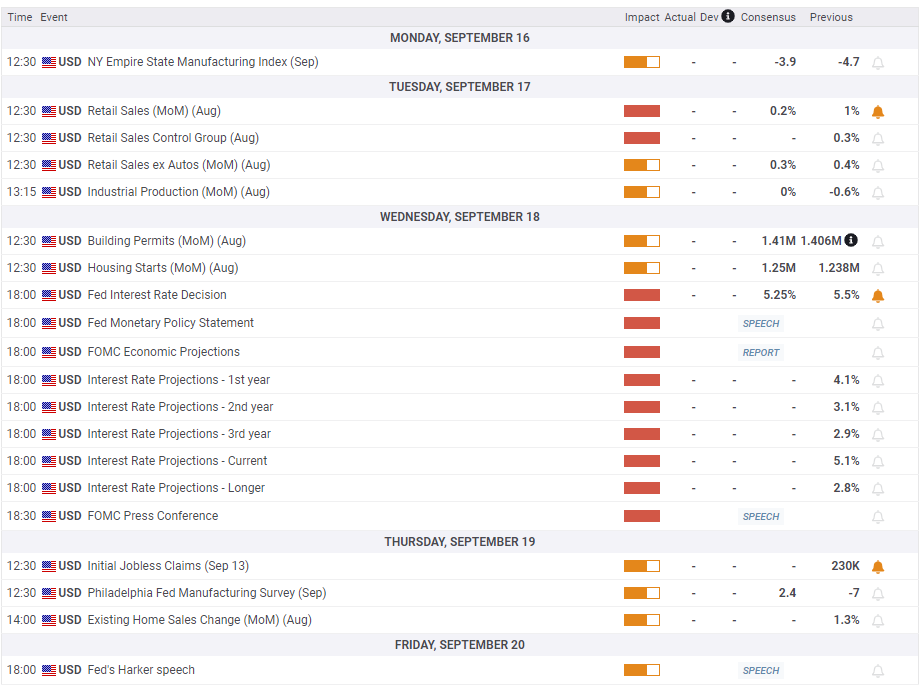

- The Fed will announce the interest rate decision and publish the revised dot plot next week.

Gold (XAU/USD) surged higher in the second half of the week and reached a new record high above $2,580, boosted by growing expectations for a large Federal Reserve (Fed) rate cut at the upcoming policy meeting. The Fed will also release the revised Summary of Economic Projections (SEP), which could offer important clues on the US central bank’s rate outlook and drive the precious metal’s valuation next week.

Gold buyers dominate the action

Following the sharp decline seen at the end of the previous week, Gold recovered back above $2,500 on Monday. In the absence of high-tier macroeconomic data releases, falling US Treasury bond yields weighed on the US Dollar (USD), allowing XAU/USD to continue to edge higher on Tuesday.

During the Asian trading hours on Wednesday, Bank of Japan (BoJ) board member Junko Nagakawa said that the BoJ is likely to adjust the degree of monetary easing if the economy and prices move in line with their projections. These comments triggered a sharp decline in the USD/JPY pair, further hurting the USD and opening the door for another leg higher in Gold. Later in the day, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 2.5% in August, down from the 2.9% increase recorded in July. However, the core CPI, which excludes volatile food and energy prices, increased 0.3% on a monthly basis, surpassing the market expectation of 0.2%. The US Treasury bond yields recovered with the immediate reaction and forced Gold to turn south in the second half of the day.

On Thursday, the BLS reported that the annual producer inflation, as measured by the change in the Producer Price Index (PPI), declined to 1.7% in August from 2.1% in July. Gold climbed above $2,530 after this data and gathered further bullish momentum. Additionally, the decisive upsurge seen in the XAU/EUR pair after the European Central Bank’s (ECB) decision to lower the benchmark interest rate by 25 basis points (bps) suggested that Gold was able to capture capital outflows out of the Euro as well.

In the meantime, The Wall Street Journal reporter Nick Timiraos, who is widely seen as a “Fed insider,” wrote in an article that the size of the Fed’s rate cut at next week’s meeting will be a close call. According to the CME FedWatch Tool, the probability of a 50 bps rate cut at the September meeting climbed above 40% from nearly 20% early Thursday. As a result, the benchmark 10-year US Treasury bond yield continued to stretch lower, allowing Gold to extend its rally to a new record high above $2,580 on Friday.

Gold investors await Fed policy announcements

The US economic calendar will feature Retail Sales data for August on Tuesday. Investors expect a monthly increase of 0.2% following the 1% growth recorded in July. A negative print could make it difficult for the USD to find demand and help XAU/USD edge higher. Nevertheless, the market reaction is likely to remain short-lived, with investors refraining from taking large positions ahead of the Fed’s monetary policy announcements on Wednesday.

The market positioning suggests that Gold faces a two-way risk heading into the Fed event. A 25 bps rate cut could boost the USD with the immediate reaction and cause XAU/USD to stage a correction. On the other hand, there is room for further USD weakness in case the Fed opts for a 50 bps rate reduction.

In addition to the rate decision, market participants will also scrutinize the revised SEP, also known as the dot plot. The CME FedWatch Tool shows that there is a stronger-than-90% chance that the Fed will lower the policy rate by a total of 100 basis points this year, including the rate cut in September. This positioning suggests that markets are forecasting at least one 50 bps and two 25 bps rate cuts in the last three policy meetings of the year. In case the dot plot shows that policymakers expect the policy rate to be at 4.25%-4.5%, 100 bps below the current rate, at the end of the year, XAU/USD would gather bullish momentum even if the Fed announces a 25 bps cut. On the other hand, a 25 bps rate cut, accompanied by a dot plot pointing to a total of 75 bps reduction in rates by the end of the year, could help US T-bond yields rebound and hurt Gold.

Investors will also pay close attention to growth projections. A significant downward revision to growth forecasts could revive fears over a recession next year and trigger a selloff in the US stock markets. In this scenario, the USD could hold its ground and limit its losses even if the Fed outcome is considered to be dovish.

In summary, the Fed’s rate decision, the revised dot plot, and Fed Chairman Jerome Powell’s comments during the post-meeting press conference will surely ramp up market volatility. There will be too many moving parts, and it might be too risky to take a position, at least until the dust settles by the European morning the next day.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart stays below 70, suggesting that Gold has more room on the upside before turning technically overbought. The next resistance could be seen at $2,600 (round level) before $2,660 (upper limit of the ascending regression channel coming from mid-February).

On the downside, $2,530 (static level, former resistance) aligns as first support before $2,500 (static level, round level) and $2,460 (50-day Simple Moving Average).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.