Gold: A potential new leg higher in the longer term

Gold

-

Gold we have a potential new leg higher in the longer term 20 year bull trend just starting. Yesterday we hit the first new target of 2525/28, but then collapsed to 2501.

-

Despite this small short term correction we remain in a bull trend of course & holding above 2509/05 today allows a recovery to 2525/28.

-

On a break above 2533 look for 2539/43, perhaps as far as 2554/56. We could eventually reach 2565 & 2578/82. Even 2599/2602 is possible.

-

A break below 2500 risks a slide to a buying opportunity at 2494/91. Longs need stops below 2485.

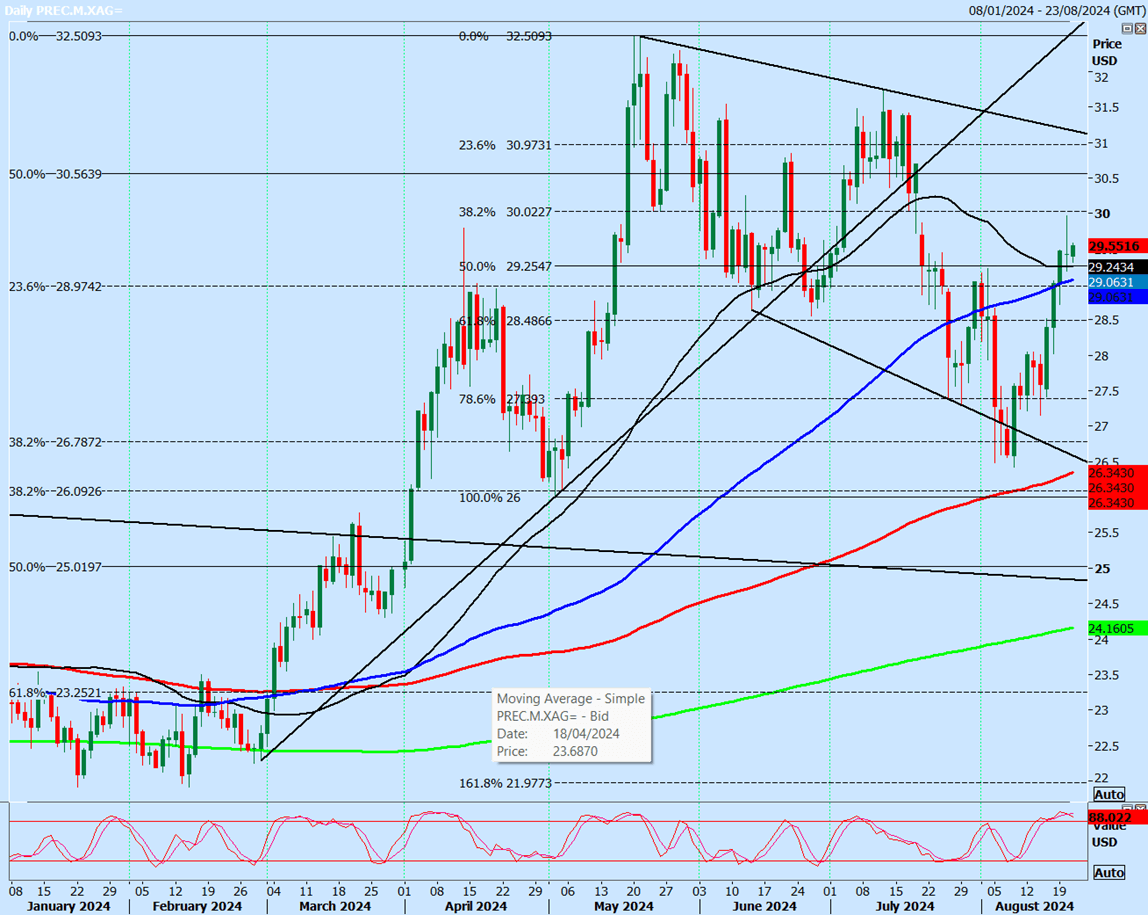

Silver

-

Silver break above 2920 was another buy signal for this week targeting 2940/45 & 2970/75 which was hit yesterday as predicted before we reversed from 2996.

-

My first buy level is at 2920/2900 & longs need stops below 2875. Targets: 2940, 2960, 2980

-

A break above 3000 is a buy signal targeting 3035 & 3060.

WTI Crude OCTOBER future

Last session low & high for the October contract: 7254 - 7438.

(To compare the spread with the contract that you trade).

-

WTI Crude remains caught in a longer term sideways channel, around 2 years old with moving averages flatlining & converging for 6 months. For the last 11 months WTI Crude has been consolidating in a narrowing triangle pattern as the monthly ranges decrease.

-

It's impossible to gauge direction in this random sideways trend, but holding below; ;first resistance at 7360/7400 can target 7220/7200, perhaps as far as 7170/40. Further losses retest the August low at 7100/7088.

-

First resistance at 7360/7400 & shorts need stops above 7445.

-

Bulls need a push higher through 7490 to target resistance at 7560/90 & shorts need stops above 7640.

Author

Jason Sen

DayTradeIdeas.co.uk