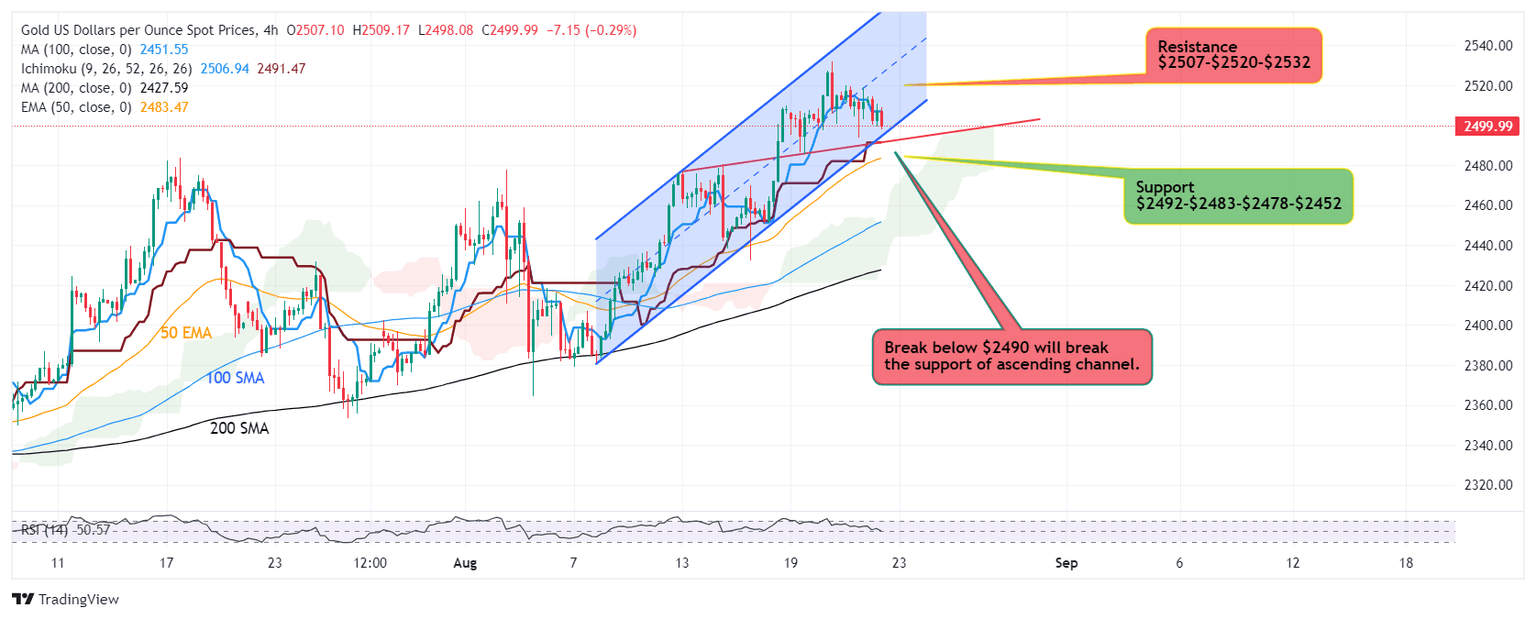

Gold traders cautious ahead of key data – $2,490 to be monitored as turning point

-

Gold shows retracement to $2498, Important support at $2491.

-

Traders cautious ahead of Jobless Claims and PMI.

-

Uptrend needs break above $2507-$2520.

-

Better than expected numbers may drag Gold to $2491-$2483-$2478.

-

Major Support seen at $2451.

Gold shows sideways to bearish bias as price breaks below psychological handle $2500 briefly testing $2496 as traders look cautious ahead of upcoming Initial Jobless Claims as well as Manufacturing and Services PMI data that is likely to impact short term range.

Better numbers are supposed to put Gold under pressure and reaction to $2491 will be worth monitoring as break below this zone will be seen as break of ascending channel support and will be a turning point for further decline which may find next support at $2483-$2478.

Major support is seen located at $2451.

If Gold manages to break above $2507, way opens to further advance towards next resistance $2512-$2520 which is essential check point for reclaiming uptrend and retesting $2532.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.