Gold trade idea: How to play the long term trend accelerating lower

Introduction

VolatilityMarkets suggests top quant trade ideas to take advantage of trending markets.

Market summary

Price

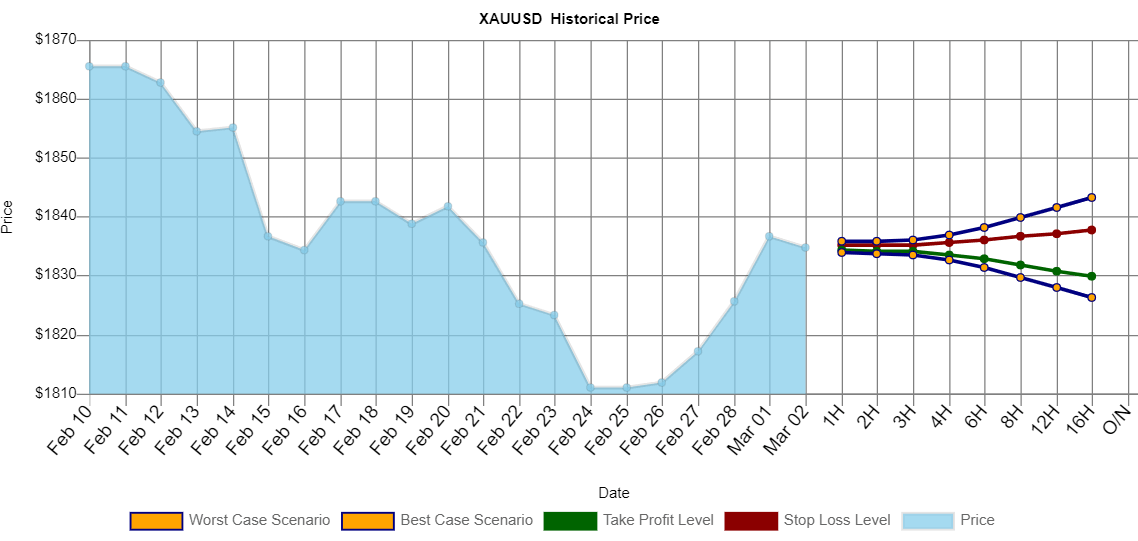

XAUUSD last price was $ 1,834.8287.

Trend analysis

In the short term Gold has been negatively accelerating lower. In the long term Gold has been accelerating lower.

Value analysis

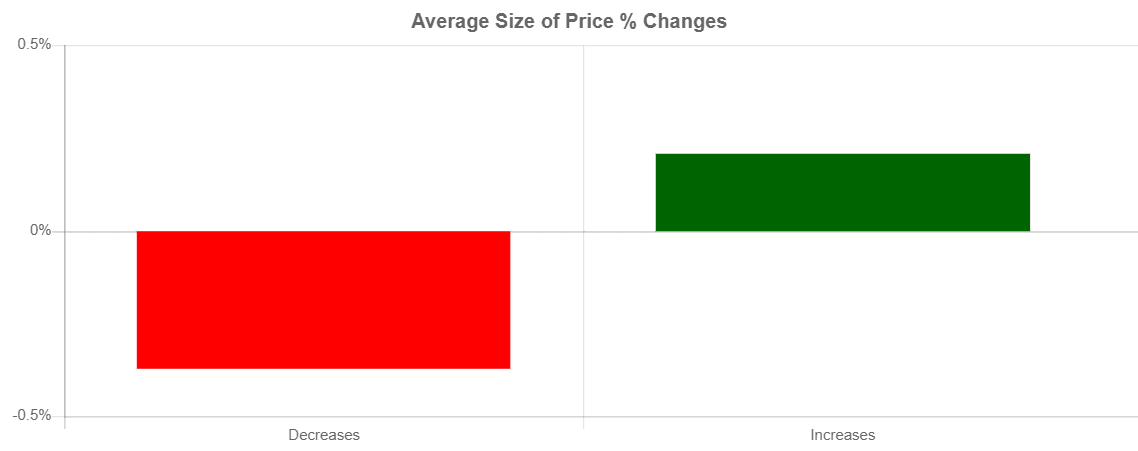

Over the past 20 days, the XAUUSD price increased 10 days and decreased 10 days.

For every up day, there were 1.0 down days.

The average return on days where the price increased is 0.2064%.

The average return on days where the price decreased is -0.3706%.

Performance

Over the past 20 Days, the price has decreased by -1.64% percent.

Over the past 20 days, the average return per day has been -0.082% percent.

Trade idea

With the long term trend being the stronger of the two, we propose a short trade idea with an overnight time horizon.

The trade idea

Sell $ 626,763 USD of Gold, take profit at $ 1,829.8286 level with 25.0% odds for a $ 1,708 USD gain, stop out at $ 1,837.7562 with 50.03% odds for a $ 1,000 USD loss through O/N time horizon

Intraday predictions

XAU/USD trend analysis

XAUUSD last price was $ 1,834.8287. The long term trend accelerating lower is stronger than the short term trend negatively accelerating lower. This trade goes short when the price was moving lower and accelerating over the past 20 days.

XAU/USD value analysis

Over the past 20 days, the XAUUSD price increased 10 days and decreased 10 days. For every up day, there were 1.0 down days. The average return on days where the price increased is 0.2064% The average return on days where the price decreased is -0.3706% Over the past 20 Days, the price has decreased by -1.64% percent. Over the past 20 days, the average return per day has been -0.082% percent.

XAU/USD worst/best case scenario analysis

Within 1 week, our worst case scenario where we are 95% certain that this level won't trade for XAUUSD, is $ 1,826.3009 , and the best case scenario overnight is $ 1,843.3565 . levels outside of this range are unlikely, but still possible, to trade. We are 50% confident that $ 1,837.7562 could trade and that $ 1,829.8286 could trade. These levels are within statistical probability.

Expected range

Within 1 week, our worst case scenario where we are 95% certain that this level won't trade for XAUUSD, is $ 1,826.3009 , and the best case scenario overnight is $ 1,843.3565 . levels outside of this range are unlikely, but still possible, to trade.

We are 50% confident that $ 1,837.7562 could trade and that $ 1,829.8286 could trade. These levels are within statistical probability.

Probability vs payout chart

This graph contrasts the percentage payout of holding a position vs the probability that the payout occurs. The red and green columns represent the probability of stopping out and taking profit and their associated payouts.

Key takeaways

-

Price today $ 1,834.8287.

-

Over the past 20 days, the XAUUSD price increased 10 days and decreased 10 Days.

-

For every up day, there were 1.0 down days..

-

The average return on days where the price increased is 0.2064%.

-

The average return on days where the price decreased is -0.3706%.

-

Over the past 20 Days, the price has decreased by -1.64% percent.

-

Over the past 20 days, the average return per day has been -0.082% percent.

-

Over the past 20 days, The price has on average been accelerating: $ 0.1029 per day lower.

-

Over the last session, the price decreased by $ -1.954706.

-

Over the last session, the price decreased by -0.1065 %.

-

Over the last session, the price decelerated by $ -9.145.

Author

Barry Weinstein

Volatility Markets Newswire

Barry Weinstein was a forex derivatives trader at BlueCrest Capital which was one of the largest hedge funds in Europe and then joined Credit Suisse where he assisted in running one of the largest FX Options portfolios in Europe.