Gold to test support at 2,626/24 on Monday? [Video]

![Gold to test support at 2,626/24 on Monday? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-on-weight-scale-gm165418687-21879510_XtraLarge.jpg)

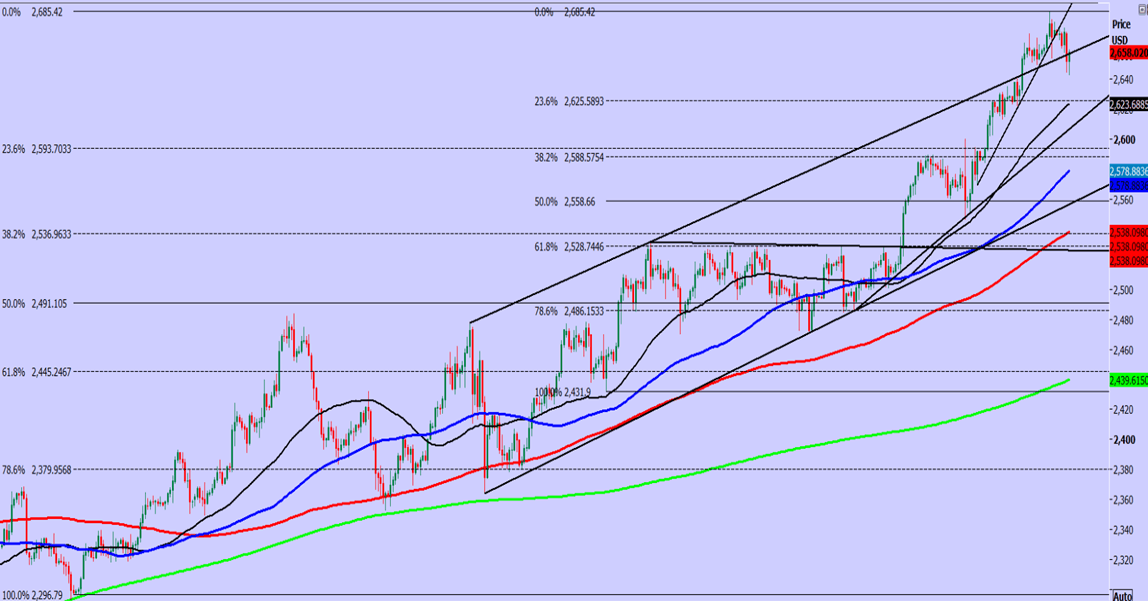

XAU/USD

Gold higher initially last week, exactly as predicted to my next targets of 2674, 2681/83 & almost as far as 2688.

On Friday Gold held just above first support at 2656/53 in the morning but broke lower on the US data in the afternoon holding less than a point above my next downside target & strong support at 2642/38.

Unfortunately therefore we did not get a chance to buy here but I think we may even break below here on Monday to target a buying opportunity at 2627/23.

Longs need stops below 2618.

Targets: 2635, 2645, 2655.

Just be aware that on a break above the new all time high at 2685 this week we look for my next targets of 2694 & 2699/2700.

However a break below 2618 risks a slide to a buying opportunity at 2595/90. A low for the week is likely here if tested but longs need stops below 2585.

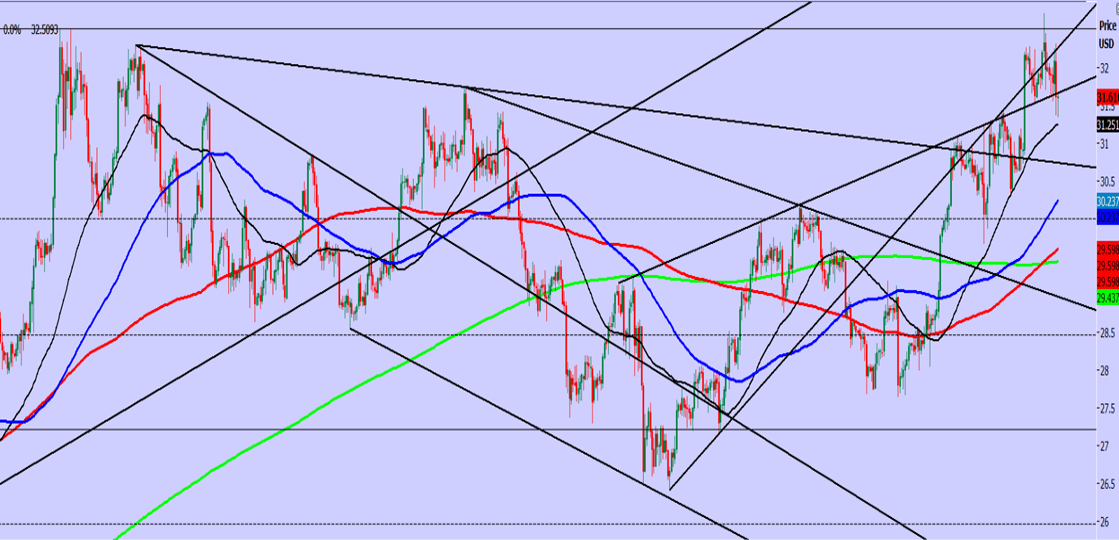

XAG/USD

Silver shot higher through the May high (also the 2024 high) at 3250 but collapsed from 3271.

We have significant risk of double top forming after rejecting the May high at 3250 & closing lower on Friday. The Doji candle on the weekly chart does not help bulls sentiment either.

(I was right to wait for weekly close confirmation because I just did not trust the price action).

However we did make a low for the day at strong support at 3160/40 so this was a good level & again today longs need stops below 3130.

Targets: 3195, 3220, 3240.

A break below 3130 risks a slide to minor support at 3090/80, but when you bear in mind the double top risk, now I am not confident in buying at support at this stage.

Just be aware that a break below 3060 targets 3020/3000.

WTI Crude November future

Last session low & high for the November contract: 6706 - 6865.

WTI Crude broke the next support at 6960/20 for a sell signal targeting 6850 & 6780/50, falling as far as 6695.

Further losses are likely towards very minor support at 6660/6640 this week.

If you want to try a long because we are oversold in the short term, Stop below 6610 & look for targets of 6695 then 6750.

A break below 6610 can target 6575/55 & 6520/00.

I would expect resistance at 6900/40 & shorts need stops above 6970.

Author

Jason Sen

DayTradeIdeas.co.uk