Gold: The positive near term outlook been gradually replaced by a corrective one [Video]

![Gold: The positive near term outlook been gradually replaced by a corrective one [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-7636265_XtraLarge.jpg)

Gold

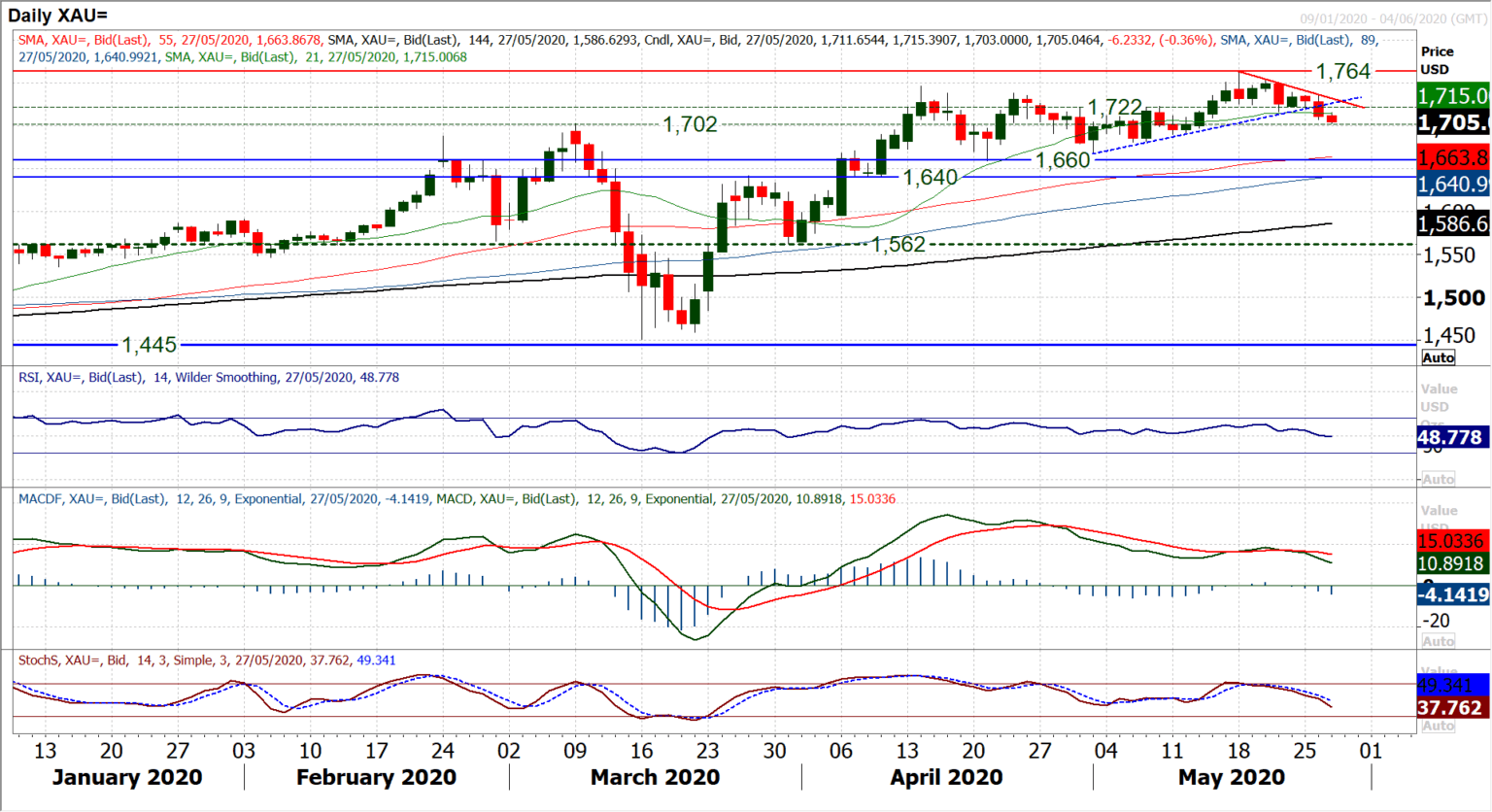

With broad risk appetite turning positive in recent sessions, we have seen gold slipping lower. The positive near term outlook been gradually replaced by a corrective one. The support of a three week uptrend was decisively broken by a strong negative candlestick yesterday. This is the third decisive negative move in the past seven completed sessions and is ushering in near term weakness which is continuing today. With these successive negative sessions, a new trend lower is forming, whilst momentum indicators have become corrective. The RSI is below 50 this morning (at least for now) which if closes below, would be the first time in eight weeks. Coupled with MACD and Stochastics accelerating lower, the supports are under pressure. An old pivot at $1702 has lost its support and resistance traits in recent weeks, but will be seen as a gauge for sentiment now. Gold trading back in the $1600s would be a considerable disappointment in the wake of the attempt to break to multi-year highs. Next real support is $1690 and then $1681 and reaction around those will determine whether the market has momentum for the key medium term support band $1660/$1668. The near term importance of resistance $1735/$1740 is growing.

Author

Richard Perry

Independent Analyst