Gold, The Chart of the Week: XAU/USD is front side of the trend ahead of the Fed

- Gold price rallies to 11-month highs ahead of the Fed.

- A correction could be on the cards but momentum is with the bulls.

Gold price ended the week significantly higher as it approached the psychological $1,990 mark on Friday and the highest level in 11 months while safe-haven buying continued.

The collapse of two US banks and a liquidity crisis at Credit Suisse has made for strong physical demand ahead of this week's Federal Open Market Committee meeting.

Analysts at TD Securities explained that bank liquidity concerns will constrain central banks' war on inflation, which in turn would breathe life into investment flows. ´´The bar is low for additional trend follower purchases to ensue as prices continue to rally into the FOMC. Subsequent buying activity is likely to ensue above the $1,985 and $1,995 marks, which could see algos add more than +8% of their max size,´´ the analysts argued.

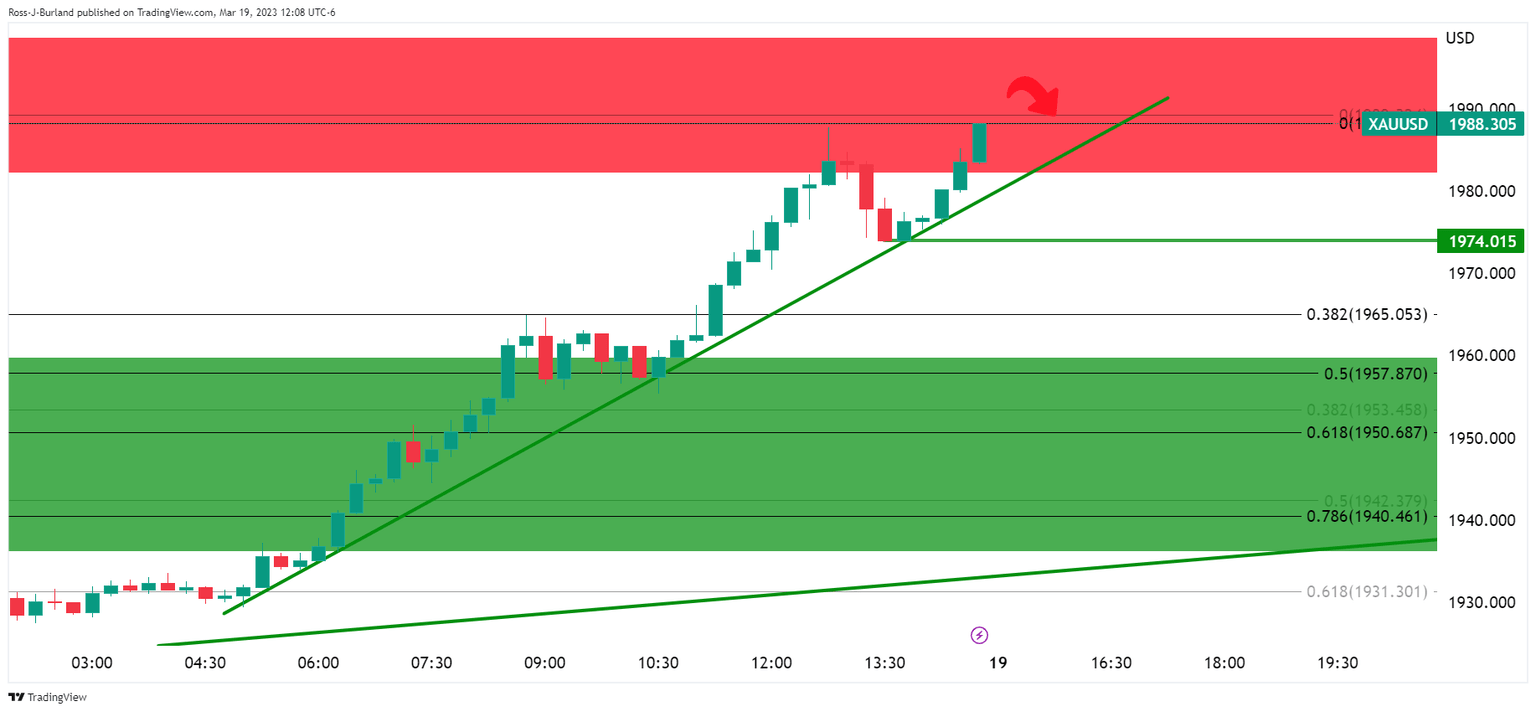

The following is a series of charts that illustrate the current resistance areas and potential support structure as Gold heads into the extremities of the $1,980s with prospects of a meanwhile correction ahead of the Fed:

The daily chart, above, shows prospects of a correction towards trendline support.

Zooming in, the 50% mean reversion aligns with dynamic support.

Drilling down to these lower time frames, we have $1,974 as a key support structure:

While being on the front side of the trend, the bias is bullish but a break of support could be the beginning of a significant move lower for the days ahead.

In terms of the Fed, the analysts at TD Securities are expecting a 25bp rate hike, taking the Fed Funds rate to 4.75%-5.00%. ´´Post-meeting communication is likely to emphasize that the Fed is not done yet in terms of tightening (also reflected in a slightly more hawkish dot plot), with officials also flagging the more uncertain economic environment, resulting in an even larger emphasis on data dependence.´´

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.