Gold: The bull rally is being unwound [Video]

![Gold: The bull rally is being unwound [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-7636265_XtraLarge.jpg)

Gold

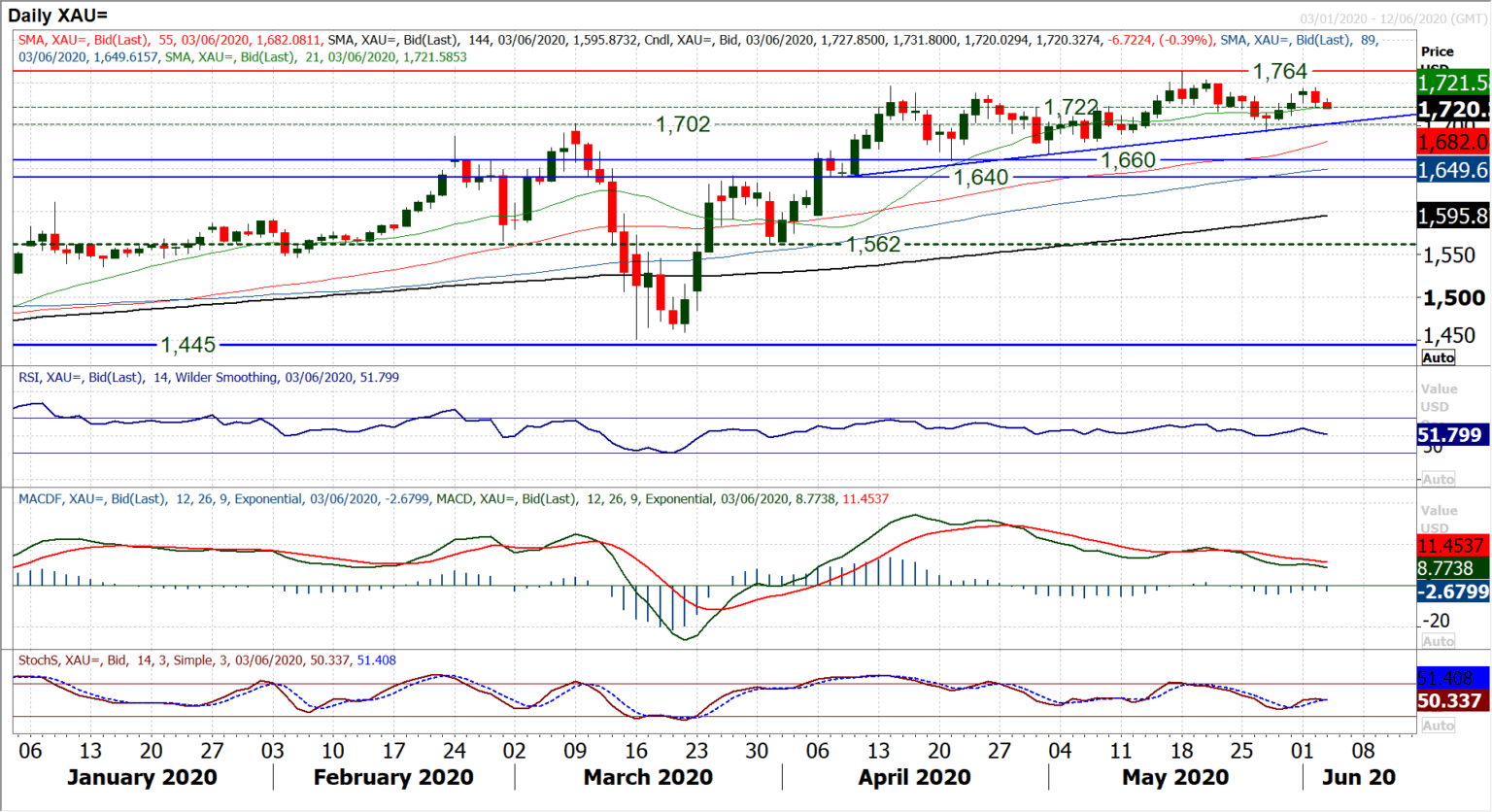

The bulls will have come away from yesterday’s session feeling that another encouraging position has been squandered. A rally of recent sessions is now being unwound. A decisive negative candle yesterday after the market had been building positively suggests that this is a market which lacks the traction to really push decisively higher now. We continue to see the uptrend of the past eight weeks as a gauge (coming in at $1702 today) and weakness is subsequently a chance to buy. However, the bullish momentum that was so evident in the moves higher in late March and through April, now has far less conviction. The RSI is above 50 but cannot sustain above 60 now, whilst MACD lines continue to drift lower. We are happy to buy into the latest weakness and once more, note that the lows of recent weeks have all been seen between the rising 21 day moving average (around $1722 today) and the eight week uptrend (at $1702 today). The hourly chart reflects the rolling over of the latest attempt to move higher and a more corrective configuration forming once more this morning. Below $1722 (an old pivot) the support is initially at $1710. Closing with a $1600 handle, the market would lose its medium term bullish outlook, with $1693 support increasingly important.

Author

Richard Perry

Independent Analyst