Gold testing 1900-1920 area, waiting for price correction after geopolitical risks recede

News about the conflict between Russia and Ukraine continued to be updated over the weekend. For now, although the geopolitical risks have not eased, the two sides' stated attitude to avoid escalating the situation is helping to stabilize market sentiment. If the conflict between the two sides is eased, it could put a damper on gold and crude oil.

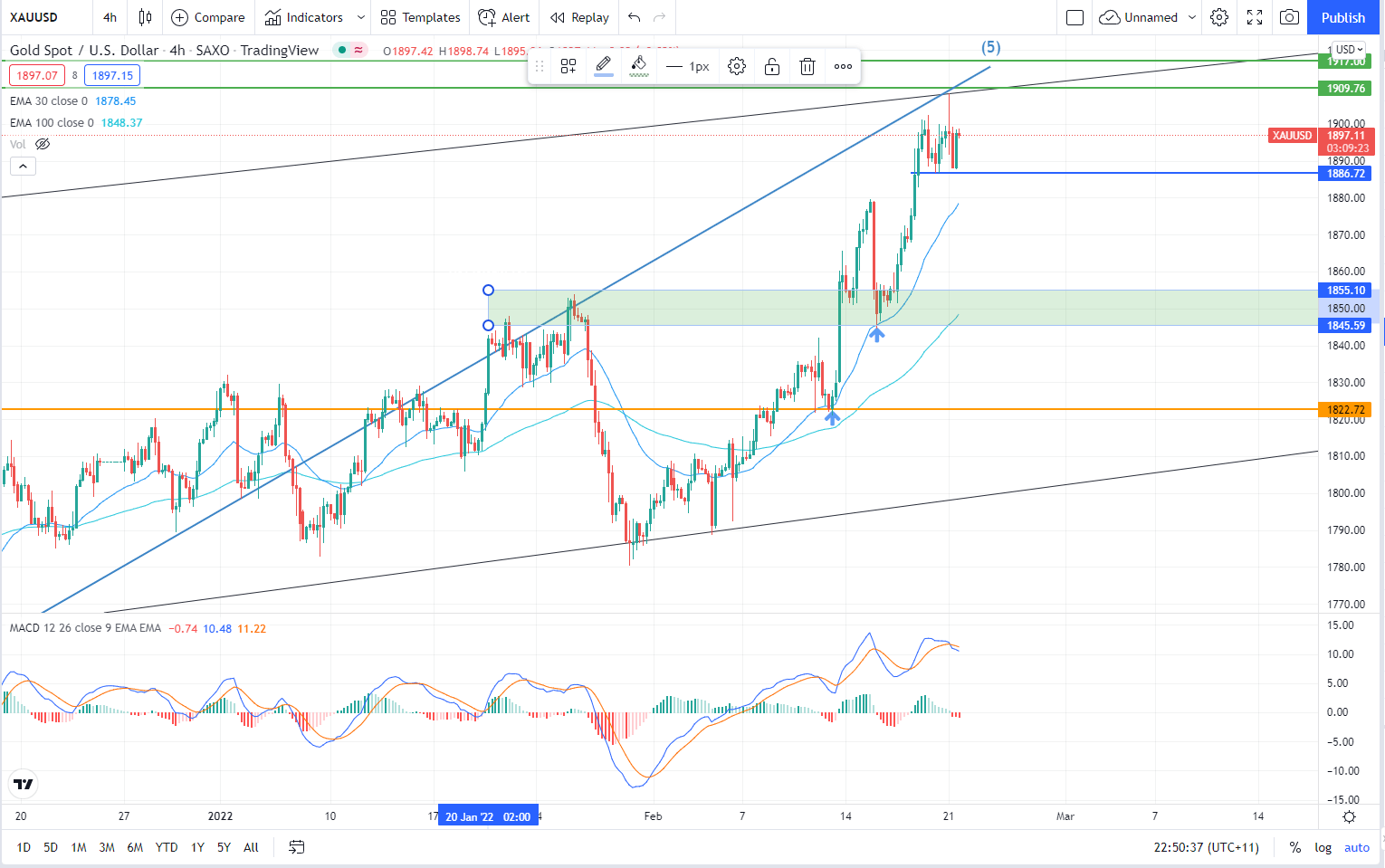

First, look at the daily chart of gold, the Elliott five-wave structure running from 1680 has reached its end, and the price of gold is now approaching the vital pressure area of 1910-1920.

Let's switch our eyes to the 4-hour chart. Although gold fell back immediately after hitting 1908 in the Asian session today, we can note that there is clear support near 1885. Traders who want to go short should also pay attention to the 30-period EMA. In this round of uptrend, when the price falls back to the 30-period EMA, it will immediately proceed to the next wave of climb with support points at 1822 and 1845, respectively.

If the price of gold can subsequently fall below both 1885 and the 30-period EMA, it will mean that the current uptrend has been successfully ended, and the bulls will retreat to the next support area in 1845-1855 range for defence.

Author

Brian Wang

Independent Analyst

Based in Melbourne, Brian joined Capital.com in 2022 as a Dealer.