Gold strengthens as geopolitical uncertainty grows

-

The Federal Reserve's decision to maintain its benchmark interest rate signals a cautious economic outlook, impacting the gold market.

-

Lower interest rates increase the appeal of gold by reducing the opportunity cost of holding non-yielding assets.

-

Geopolitical tensions in the Middle East have driven increased demand for gold as a safe-haven asset.

-

Investors should employ a strategic approach to geopolitical crises and market volatility periods.

The Federal Reserve's recent decision to keep its benchmark interest rate steady at 5.25%-5.50% signals a cautious approach to economic conditions, with potential implications for the gold market. Fed Chair Jerome Powell's indication of a possible rate cut in September, contingent on inflation trends, highlights a dovish stance amid concerns about a slowing labor market and subdued wage growth, as evidenced by the latest ADP report. This environment of potentially lower interest rates enhances the appeal of gold, as it reduces the opportunity cost of holding non-yielding assets. Additionally, the recent decline in the 10-year US government bond yields, reflecting investor reactions to weak economic data and the Fed's dovish outlook, has led to a weaker US Dollar, making gold more attractive and supporting its price.

Moreover, geopolitical tensions in the Middle East further drive demand for gold as a safe-haven asset. The uncertainty created by these conflicts is pushing investors toward gold, leading to a recent increase in its price. However, the future direction of gold prices remains uncertain, with market participants eyeing the upcoming US Nonfarm Payrolls report. This critical economic indicator will provide further insights into the labor market's strength. It could influence market sentiment, potentially offsetting the safe-haven demand if the data points to a stronger economy. Investors are advised to stay vigilant as these developments unfold, as they will play a crucial role in determining the near-term outlook for the gold market.

Gold price movements within the channel

The technical chart indicates that gold has initiated a strong rebound from the weekly support level of $2365, as highlighted in the previous update. Following this rebound, the gold market has shown strength, attempting to rally towards higher levels. However, the technical chart also indicates that the market is constrained within a rising trend, with increased volatility due to the geopolitical situation in the Middle East. The level of $2450, which was the highest reached on May 20, 2024, triggered a significant market drop and remains a strong resistance point. Consequently, gold may correct lower from the $2450-$2460 range. The market is uncertain and awaiting the NFP report for further direction. However, the crisis in Middle East may continue to push gold higher.

How to trade Gold during the geopolitical crisis

How to trade Gold during the geopolitical crisis

Trading the gold market during a geopolitical crisis requires a strategic approach, as market dynamics are often influenced by heightened volatility and uncertainty. Investors should closely monitor global news and geopolitical developments, as these can lead to sharp movements in gold prices. During such times, gold often acts as a safe-haven asset, attracting investors looking to hedge against risk. Traders can capitalize on this by identifying key support and resistance levels and using technical analysis to determine potential entry and exit points. It is also essential to manage risk carefully by setting appropriate stop-loss orders and avoiding over-leveraging, as geopolitical crises can lead to unpredictable market behavior.

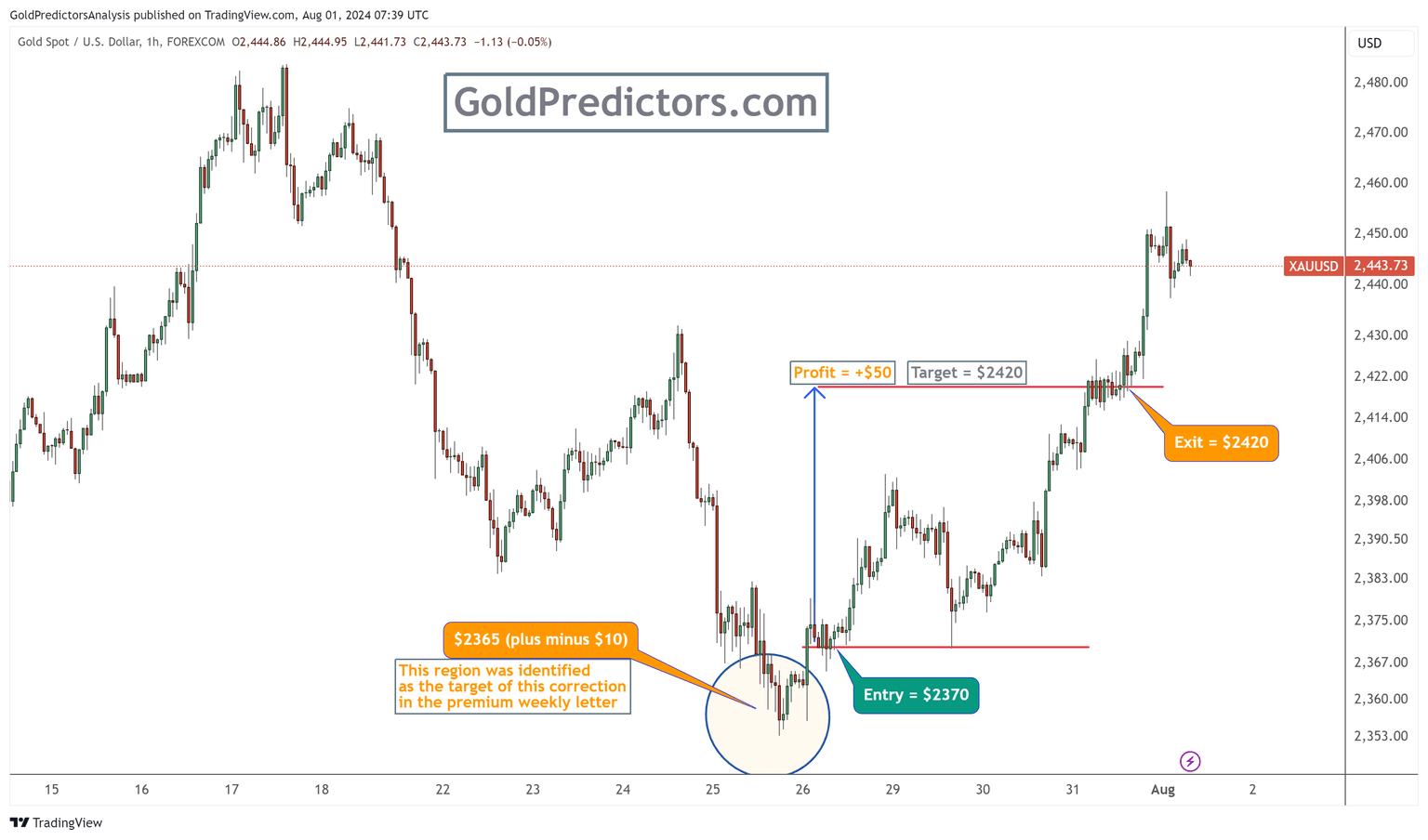

Additionally, diversifying one's portfolio to include other safe-haven assets or commodities can help mitigate risk and provide a balanced approach during geopolitical instability. For example, Gold Predictors executed a day trade in gold at the $2370 support level when gold confirmed a short-term bottom. The risk-reward ratio was favorable, and the target was $2420. The trade yielded a profit of $50, a significant gain from a day trade perspective. Given the high uncertainty associated with geopolitical crises, it is crucial to raise the stop loss on trades carefully. In this trade example, the stop loss was adjusted to breakeven to manage risk effectively. As the geopolitical crisis emerges, the volatility may remain high. The high volatility means that the price drop might be big. Therefore, traders can consider buy on dips.

Bottom line

In conclusion, the recent decisions and indications from the Federal Reserve and geopolitical tensions in the Middle East have created a complex landscape for the gold market. The Fed's steady interest rate and potential rate cuts highlight a cautious approach to economic conditions, which make gold an attractive investment along with lower bond yields. The metal's role as a safe haven during geopolitical crises further strengthens its appeal as investors seek stability amidst global uncertainties. However, the future direction of gold prices remains uncertain, particularly with the upcoming US Nonfarm Payrolls report poised to provide critical insights into the labor market's health. Investors should adopt a strategic approach, leveraging technical analysis and carefully managing risks, especially during periods of heightened volatility. By staying informed and reacting to market changes, traders can manage these challenging conditions and potentially benefit from the opportunities in the fluctuating gold market. Due to extreme volatility, traders may consider buying gold on dips.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.