-

Upcoming FOMC meeting minutes and Fed Chair Powell's speech are critical for insights into future monetary policy.

-

The uncertainty around the Fed's next moves maintains gold prices near record highs.

-

Gold has broken above the dotted blue trend lines, indicating upward momentum.

-

Strategic gold trading requires careful management during economic uncertainty and market volatility.

The recent developments in the gold market suggest higher prices as the prices are breaking the technical resistance. The upcoming FOMC meeting minutes and Fed Chair Jerome Powell's appearance later in the week are pivotal events that could provide crucial insights into the Fed's future monetary policy direction. Given the mixed signals from Fed officials, with some advocating for a cautious approach to rate cuts and others suggesting that a policy easing cycle could begin soon, traders are hesitant to take strong positions. The uncertainty surrounding the timing and scale of the Fed's next moves keeps gold prices near record highs as investors weigh the potential impact on inflation and economic growth.

Additionally, the geopolitical landscape contributes to the cautious tone of the market. Optimism around a potential ceasefire in the Middle East, following progress in negotiations between Israel and Hamas, is reducing immediate concerns about a broader conflict in the region. This has slightly diminished gold's appeal as a safe-haven asset as investors shift focus toward riskier assets in response to easing geopolitical tensions. However, the lingering uncertainty about the Fed's actions and the global economic outlook continues to support gold prices, keeping them in a tight range near record levels.

Gold strengthens as US Dollar faces breakdown risk

Gold has broken above the upper resistance of the dotted blue trend lines, as discussed earlier this week. Prices are now pushing higher, with the target of this move remaining upward. This is due to the ascending broadening wedge pattern, which indicates significant volatility and supports gold prices above the blue-dotted trend line.

This breakout and upward momentum in the gold market are driven by economic uncertainty, which has caused the USD index to drop from its triangle formation. The index is currently attempting to break down from this pattern and is trending lower. However, for further upward pressure in the gold market, the index must close below the lower support of the triangle.

Strategic Gold trading amid economic uncertainty and market volatility

Trading gold during a geopolitical crisis is a strategic move, as gold is traditionally viewed as a safe-haven asset that tends to appreciate when uncertainty rises. During such times, investors often flock to gold, driving prices higher as they seek stability amidst market volatility. It's crucial to monitor geopolitical developments closely, as news events can trigger rapid price movements. It is equally important to manage risk by setting appropriate stop-loss levels and avoiding over-leveraging. Given the uncertainty in the market regarding the interest rate decision, the gold market could react strongly ahead of the Fed's announcement. Therefore, it's essential to manage trades carefully.

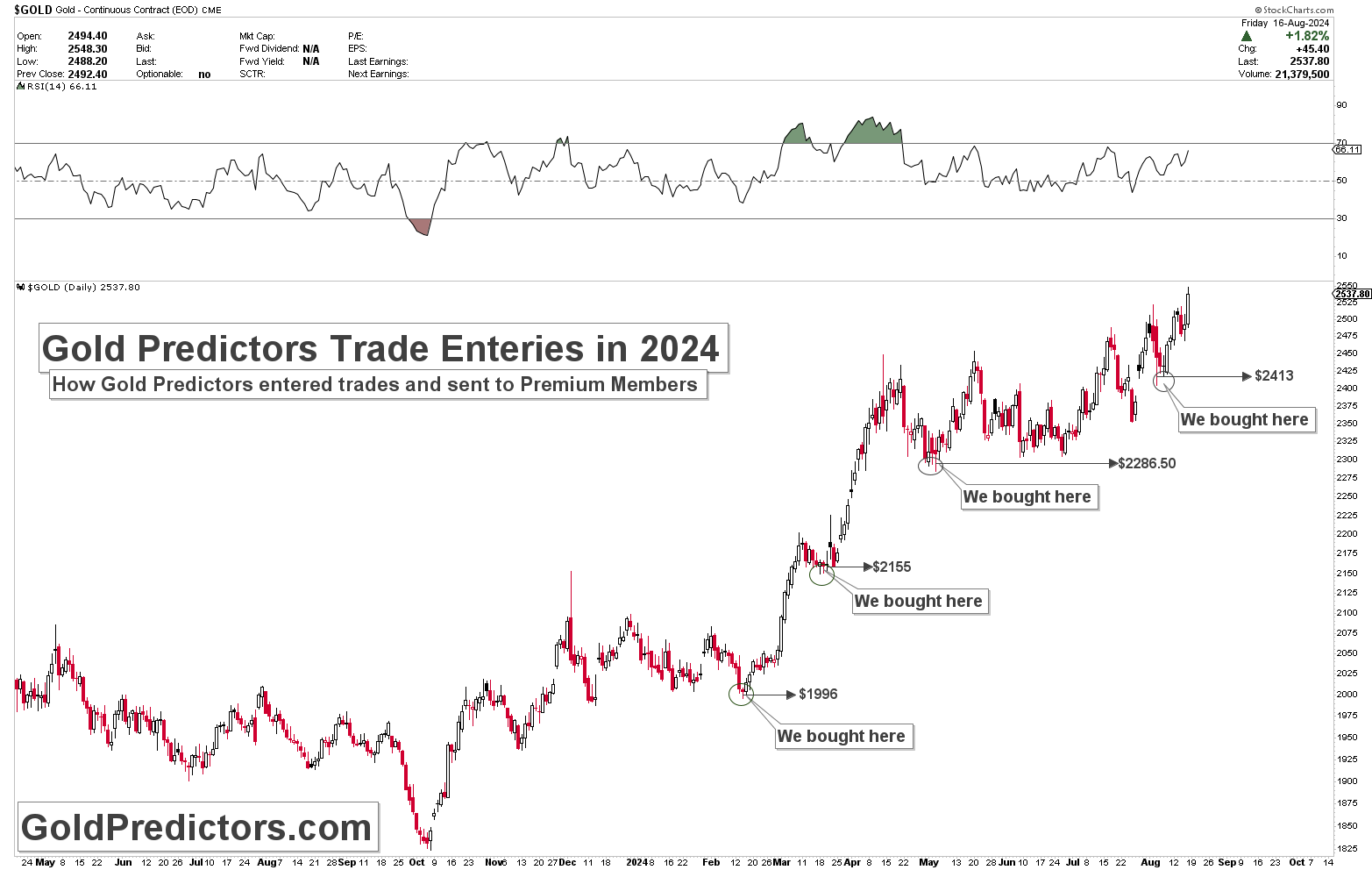

The chart below presents the gold swing trades executed during the geopolitical crisis and delivered to members. The timing of trade signals has proven highly effective, aligning closely with market lows followed by significant rallies. For example, trades in February, March, and May 2024 at $1996, $2155, and $2286.50, respectively, each marked market bottoms that led to solid surges in gold prices, with the market never returning to those entry points. The most recent trade at $2413 also resulted in a record-breaking rally. Additionally, day trades have also shown positive momentum. As geopolitical volatility increases, analyzing cycles, technical patterns, and market signals will continue to be crucial for making informed trading decisions. Investors can consider buying at the lows, tracking the stop loss as the market progresses, and then taking profits at the peak.

Conclusion

In conclusion, the gold market appears poised for continued strength, driven by both technical factors and ongoing economic uncertainties. The recent breakout above key resistance levels suggests that gold may push higher, especially as traders navigate the mixed signals from the Federal Reserve and the global geopolitical landscape. While easing tensions in the Middle East may temporarily reduce gold's appeal as a safe-haven asset, the persistent uncertainty surrounding the Fed's monetary policy decisions and the broader economic outlook continues to support gold prices near record highs. Investors should remain vigilant, carefully monitoring developments and managing trades strategically, particularly in light of the upcoming FOMC minutes and Fed Chair Powell's remarks, which could significantly impact market sentiment and gold's trajectory.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Articles/Trading signals/Newsletters distributed by GoldPredictors.com have no regard to the specific investment objectives, financial situation, or the particular needs of any visitor or subscriber. Any material distributed or published by GoldPredictors.com or its affiliates is solely for informational and educational purposes and is not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity, or related securities. Plan the strategy that is most suitable for your investment. No one knows tomorrow’s price or circumstance. The intention of the writer is only to mention his thoughts and ideas that may be used as a tool for the reader. Trading Options and futures have large potential rewards, but also large potential risks.

Recommended Content

Editors’ Picks

EUR/USD breaks below 1.1000 on stellar NFP

The buying bias in the Greenback gathers extra pace on Friday after the US economy created far more jobs than initially estimated in September, dragging EUR/USD to the area of new lows near 1.0950.

GBP/USD breaches 1.3100 after encouraging US Payrolls

The continuation of the uptrend in the US Dollar motivates GBP/USD to accelerates its losses and breaches 1.3100 the figure in the wake of the release of US NFP.

Gold rebounds from daily lows and flirts with $2,670

Following a post-NFP dip to the $2,640 region, Gold prices now embarks on an acceptable rebound and retest the area of $2,670 per ounce troy despite the marked advance in the US Dollar and rising US yields across the board.

US Payrolls surge in September, as 50bp rate cut ruled out

US payrolls data surprised on the upside in September, rising by 254k, smashing expectations of a 150k rise. The unemployment rate fell to 4.1% from 4.2%, average hourly earnings increased to a 4% YoY rate and there was a 72k upwards revision to the previous two months’ payrolls numbers.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.