Gold, Stocks, Copper: New situation and new implications

So, Trump backed off a little, while China discretely flexed its muscles by halting exports of its rare earth minerals.

The latter didn’t get enough media attention, but in my view, this likely ends the dramatic series of tariff hikes – at least for some time.

Trade war may have peaked

You see, those rare earth minerals are essential to produce many high-tech goods. It’s all nice as long as the U.S. companies still have some in their inventories, but they will eventually run out of them and the regular business operations can be disrupted. Trump (or his team) knows that. And while Xi can easily get away with crashing stock market, Trump may not have this privilege.

That’s why in my view this might be the end of this tariff race. What’s likely to happen now? Both sides are likely to keep their stance in my view, and at some point (perhaps weeks or months away), some kind of deal will be made, but the tariffs will still be greater than they were a few months before.

Markets are forward looking, but in my view, they haven’t fully incorporated the above into stock/commodity/PM/currency prices just yet. So, what we’re likely to see next is the continuation of the rebound in stocks/commodity prices, which is in tune with what I wrote previously based on the technical analysis. As it is often the case, technicals preceded fundamentals. It might be difficult to agree with this, as it might make sense that the price would follow “the real world”, but in reality, it’s often the opposite. One reason might be that some market participants have insights regarding what kind of news are going to hit the market and they position themselves earlier. This could trigger various emotional and momentum-based transactions, ultimately leading to what we can detect on the charts as bullish or bearish patterns.

Anyway, it seems to me that what I wrote before remains fully up-to-date. As we’re waiting for a good moment to re-enter the short position in FCX (if I had to rank my shorting candidates according to their potential, FCX would top the list), let me start with copper, one of the key metals that FCX mines (the other is gold).

On April 10, I wrote the following:

Analysis of copper seems to indicate that the correction should be bigger, which would likely imply a bigger correction in stocks as well.

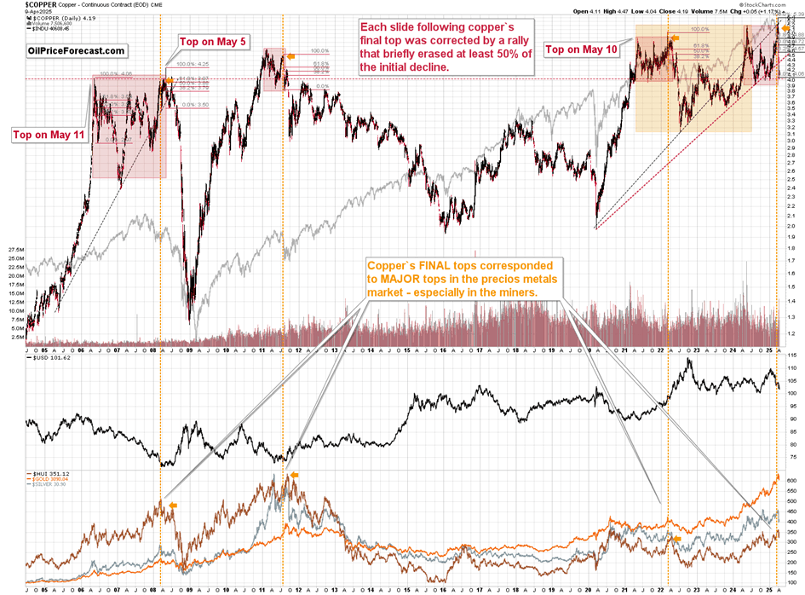

From the broad point of view, we see that the initial declines were previously followed by at least a 50% correction.

The current one was particularly sharp, so we might expect this correction to be bigger, not smaller than the previous ones.

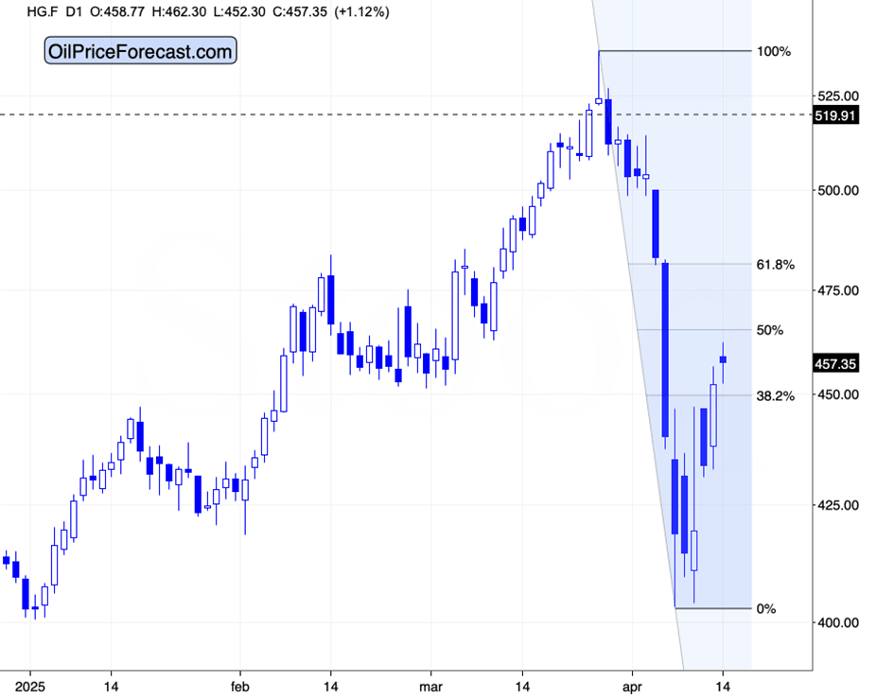

Copper moved higher since I wrote the above and here’s what its short-term chart looks like:

It’s higher, but the 50% retracement wasn’t reached yet. We’re quite close, though.

Rally nearing exhaustion point

I previously wrote that stocks and commodities are likely to get a corrective “relief” rally, and this is exactly what we see right now. Is the rally over? It seems to me that this is almost the case.

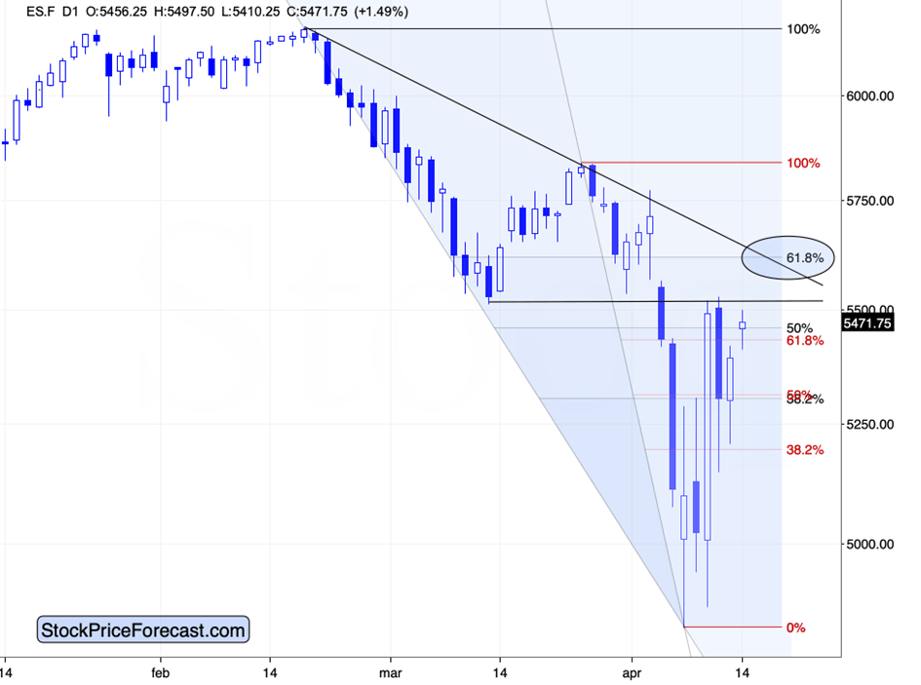

And since stocks and commodities are in this together, it’s a great idea to look for reversal signs on the S&P 500 Index (futures) chart.

Stocks moved higher (so far) this week (and after we cashed in on that rebound), and while they approached their recent highs, they haven’t moved to their target area based on the 61.8% Fibonacci retracement and the declining resistance line.

They don’t have to move there – we might as well see the top right here – close to last week’s highs and March lows. Still, a move to the target is – that is slightly above 5,600 – would in my opinion be a great moment to expect a reversal. And by that, I mean a great moment to get back on the short side of the market (FCX, silver). FCX is higher today, and well above the low $30-ish levels, at which we took profits from the previous short positions.

“What about silver?” – you might ask, as that’s also where I wrote that I’d be willing to open a short position.

While I’ll leave the details of the trading position to my subscribers, I can tell you that the outlook here doesn’t look good.

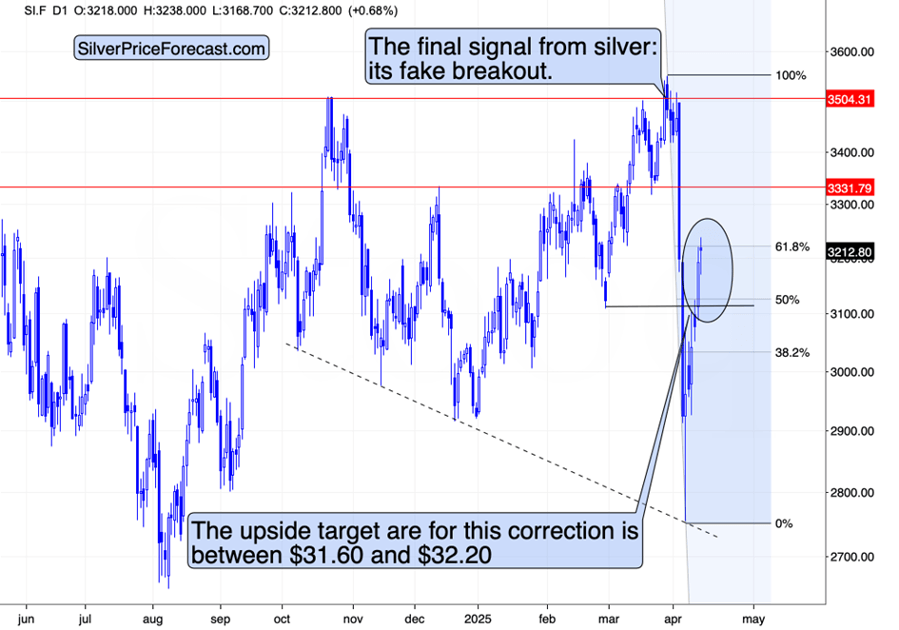

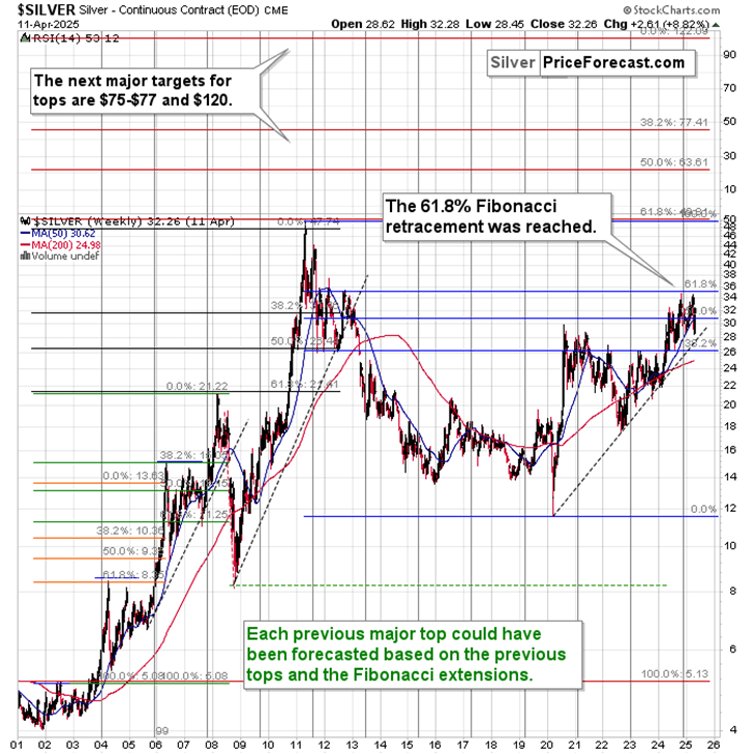

Silver moved higher – to the upper border of my target area for this correction, and it moved slightly above its 61.8% Fibonacci retracement level. Silver is known for taking breakouts (that’s how it topped just recently), so the tiny breakout above this retracement and its invalidation only makes the bearish case stronger.

Silver is also outperforming gold on an immediate-term basis here – gold futures are down today.

Together all this paints a bearish picture for the white metal in the short run. And given the situation in the USD Index, stocks, and how strongly silver reacted to the first wave of selling, it seems that much bigger declines are just around the corner.

Also, given silver’s long-term technical picture, it can fall far and hard.

Yes, like many of you, I like silver (also for the IRA), and I think it has great long-term potential. But also see that silver topped at its long-term turning point (vertical lines) and that it’s about to reach (breach) its rising long-term support line (dashed line).

This line is based on several very important lows, so a breakdown below it will be a very important development from the technical point of view.

Why wouldn’t silver rebound after moving to it? Theoretically, it could, but in practice, if it was that strong, then it wouldn’t be around its 50% retracement based on the 2011-2020 decline and it would be well above its 2011 highs just like gold is (sentiment is red hot here – the searches for “gold and silver IRA investments near me” are booming). Also, it wouldn’t have declined as much recently.

No – silver is not strong here, and given very likely declines in stocks and other commodities (based on Trump’s handbrake on world trade) we’re likely to see a major breakdown. This, in turn, is likely to be followed by significant declines.

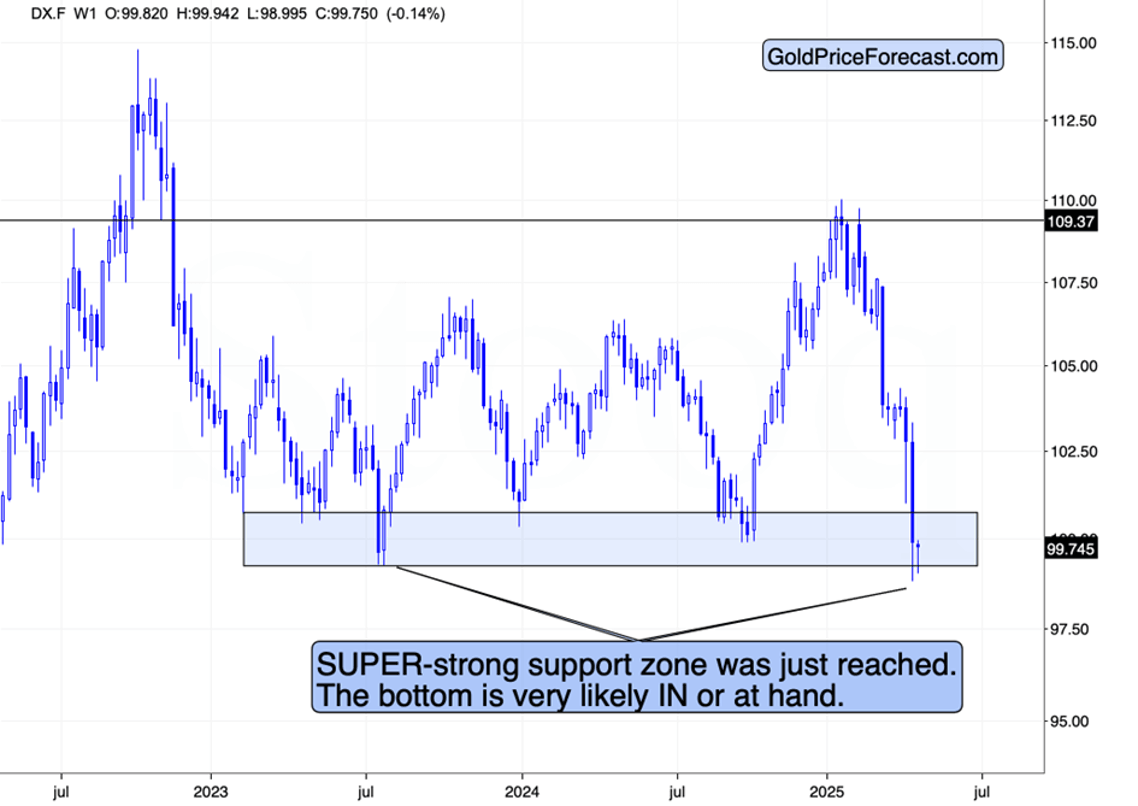

Also, please remember that the USD Index hasn’t rallied yet.

The USDX invalidated its move below the 2023 lows, which is a strong buy signal, especially that we see it after such a sharp slide. Just because we haven’t seen a rally yet, it doesn’t mean that it’s not coming.

This makes it likely that we’ll see a big rally in it soon, and that we’ll get a sizable decline in commodities and precious metals.

All that is likely needed is… nothing. In particular, no new extreme and surprising news from Trump. And as I wrote in the opening paragraphs of today’s analysis, that’s exactly what we might get here – a pause in all extreme and surprising news.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any