Gold: Still holding a medium to longer term positive outlook [Video]

![Gold: Still holding a medium to longer term positive outlook [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-gm187363896-28836378_XtraLarge.jpg)

Gold

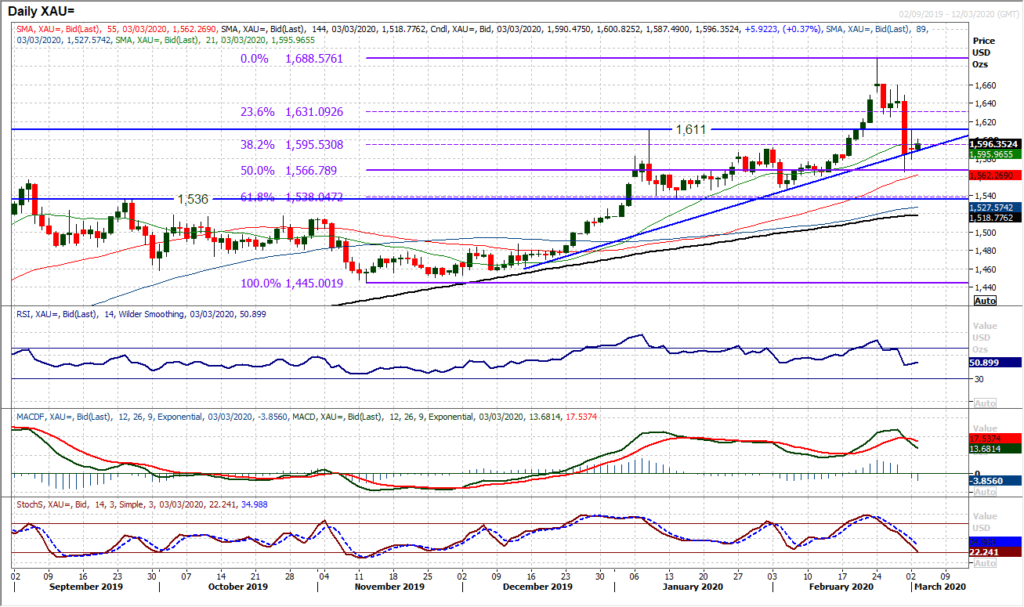

The sharp sell-off from Friday has moderated and the market is looking to rebuild again. We still hold a medium to longer term positive outlook on gold and do not see Friday’s decline as an outlook changer. On the contrary, as long as the broader market panic selling does not re-appear then gold should find support (the sell-off was apparently as a result of forced selling amidst broad portfolio margin calls, rather than a negative view on gold). So, with effectively a doji candlestick yesterday (denoting uncertainty with the recent trend lower), we see this as a stabilising signal. The market is ticking marginally higher today to add to this. The RSI is back around 50, which has been buying opportunity levels within the 10 week uptrend which is still intact. Closing back above the 38.2% Fibonacci retracement (of $1445/$1688) at $1595 would be a positive signal, but the bulls need to get back above $1611 to really suggest the positive trend is decisively resuming. Friday’s spike low of $1565 is key support, with $1579 (yesterday’s low) also a minor higher low.

Author

Richard Perry

Independent Analyst