-

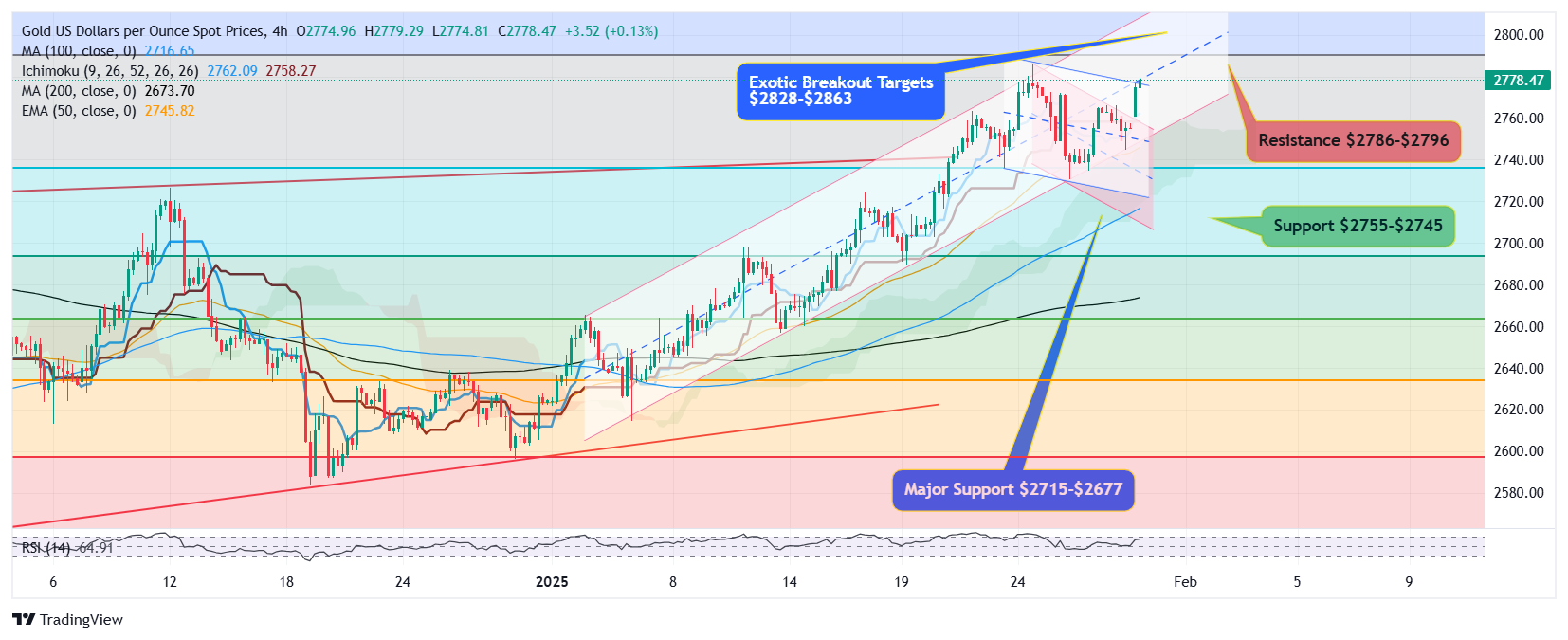

Gold bulls stay firm above initial barrier $2777.

-

Local demand coming from $2755-$2760.

-

Acceptance above $2780-$2785 to fuel rally and update new record high.

-

Markets cautious near record high and potential correction.

-

Break below $2740 will trigger deeper sell off.

As markets await key economic data releases for GDP and Initial Jobless Claims figures, Gold approaches $2779 and exercises caution as any rejection could unleash a return to base where the metal gets its local demand at $2760-$2755

If sellers press ahead and break this area, $2745-$2740 would be critical support zone which if fails to hold, a deeper sell-off may be witnessed exposing $2715-$2700 below which further rertacement may not be ruled out.

On the positive side, if buyers succeed reclaiming swing high $2786 followed by break above record $2790, next challenge comes at psychological handle $2800 above which next major potential targets would be $2827 followed by $2863 in near term.

The views of the article are based on price action studies, technical analysis and chart-based studies. The author does not hold positions on items he writes about. The views expressed are for educational purposes and are not trading advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0400 amid US tariff threats

EUR/USD holds steady above 1.0450 in the European trading hours on Thursday. Broad US Dollar underperformance supports the pair. However, tariff threats from US President Donald Trump and geopolitical tension might cap its upside. US data and Fedspeak remains in focus.

GBP/USD hovers around 1.2600, awaits US data

GBP/USD holds ground around 1.2600 in the European session on Thursday. The pair is helped by a modest US Dollar downtick but broad risk-off mood due to renewed tariff threats from US President Donald Trump could limit the risk sensitive Pound Sterling.

Gold price hits fresh record high as trade war fears continue to fuel safe-haven demand

Gold price hits a fresh all-time peak during the early European session on Thursday and confirms a breakout through a short-term trading range. US President Donald Trump's fresh threat to impose tariffs on imported goods dampens investors' appetite for riskier assets and continues to underpin demand for the safe-haven bullion.

Stellar Price Forecast: XLM’s Total Value Locked reaches over $62 million

Stellar (XLM) price trades inside a channel pattern; a breakout indicates bullish momentum. Crypto intelligence tracker DefiLlama data shows that XLM’s TVL reaches $62 million while the technical outlook projects a target of $0.74.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.