Gold – Silver

Gold Spot volatility is decreasing in the consolidation phase, seeing hourly ranges of only about 5-10 points on average. Yesterday's range was only 16 points.

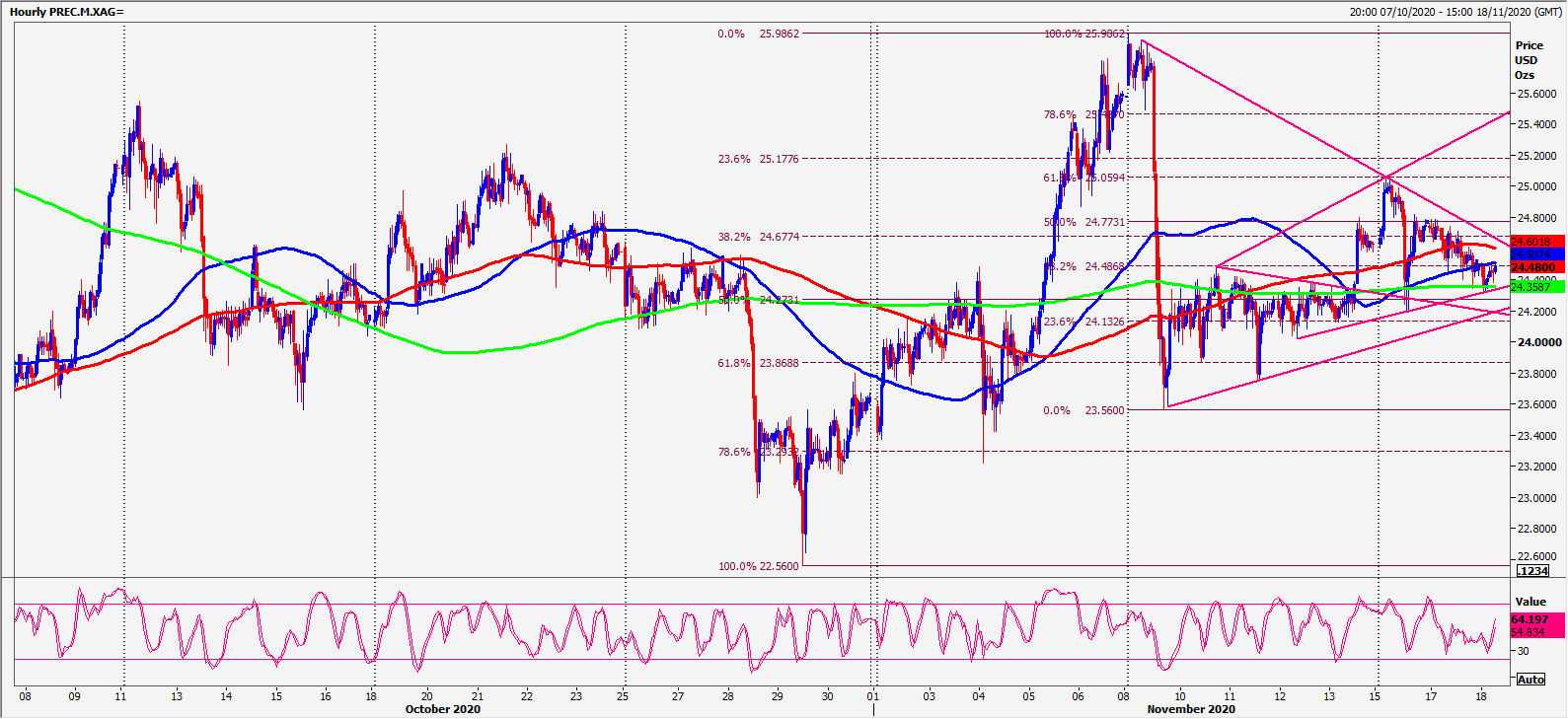

Silver Spot trades in a 2 month channel from 2320/10 up to 2600/10.

Daily Analysis

Gold meets strong resistance at 1896/1899. A break above 1901 however targets 1907/08, perhaps as far as 1916/18,. Further gains meet resistance at 1921/23.

Shorts at 1896/1899 target 1886/84 & minor support at 1879/75 (& we bottomed exactly here yesterday). If we continue lower look for 1868/66, perhaps as far as 1860/58 & 1855. A break below support at the September low at 1848/47 is a sell signal initially targeting 1835.

Silver topped exactly at minor resistance at 2480/90 but above here retests yesterday's high at 2805. A break higher targets 2517/19, perhaps as far as resistance at 2530/33.

Best support at 2535/25 being test over night. Longs need stops below 2515. A break lower is a sell signal targeting 2390/85 & perhaps as far as last week's low at 2360/55.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

Gold retreats after setting new record-high above $3,000

Gold corrects lower and trades below $3,000 after setting a new record-high above this level earlier in the day. Rising US Treasury bond yields and the upbeat market mood seems to be limiting XAU/USD's upside for the time being.

EUR/USD advances toward 1.0900 on renewed USD weakness

EUR/USD gains traction and rises toward 1.0900 in the European session on Friday. The improving risk mood makes it difficult for the US Dollar (USD) to find demand and helps the pair push higher. Markets await US consumer sentiment data for March.

GBP/USD rebounds from session lows, stays near 1.2950

GBP/USD recovers toward 1.2950 after falling below 1.2920 with the immediate reaction to the disappointing macroeconomic data releases from the UK in the early European session. The renewed USD weakness amid a positive shift seen in risk sentiment helps the pair hold its ground.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637412830902329831.png)