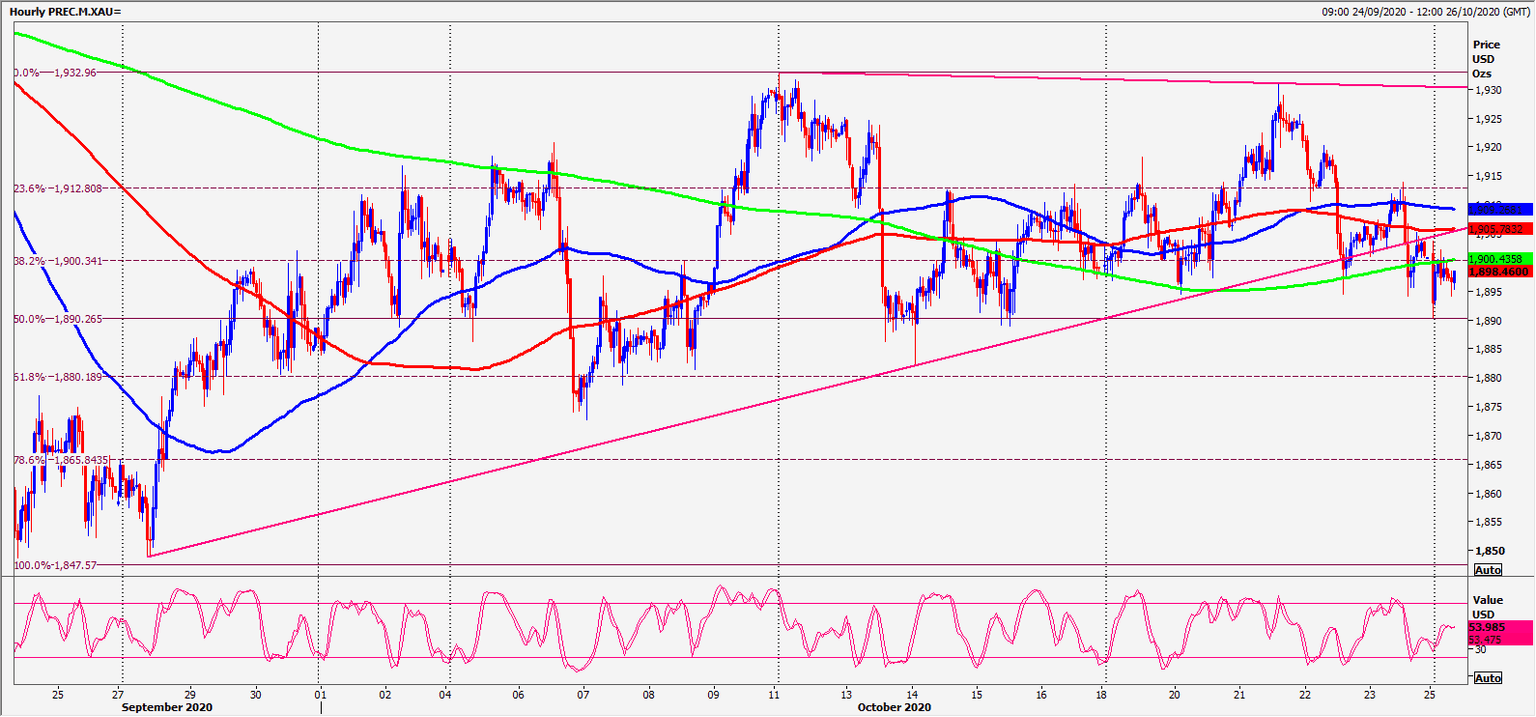

Gold spot very much remains in a sideways trend

Gold – Silver

Gold Spot very much remains in a sideways trend. On Thursday we wiped out all of Wednesday's strong gains to retest this week's low. Longs at what I thought was the best 1908/03 were unexpectedly stopped below 1895.

Clearly we remain in a sideways trend.

Silver Spot headed towards the apex of an ascending triangle.

Daily Analysis

Gold holding what should be first resistance at 1904/08 (although some times this levels holds & sometimes not in the sideways trend) is negative initially targeting 1896/95 (which held on all 3 tests last week). Further losses target 1890 before support at the 100 day moving average at 1882/80.

First resistance at 1904/08 but above here targets 1912/13. A break higher initially targets 1917/18. Above 1920 allows a recovery to 1925 & strong resistance at 1930/32.

Silver holds first support at 2450/40 (now 2445/35) all through Thursday & Friday but longs need stops below 2420. A break lower targets 2405/00 then 2360/50. On further losses look for 2310/00.

Holding holding first support at 2445/35 re-targets 2475/85 & first resistance at 2520/25. A break above 2540 is a buy signal.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk