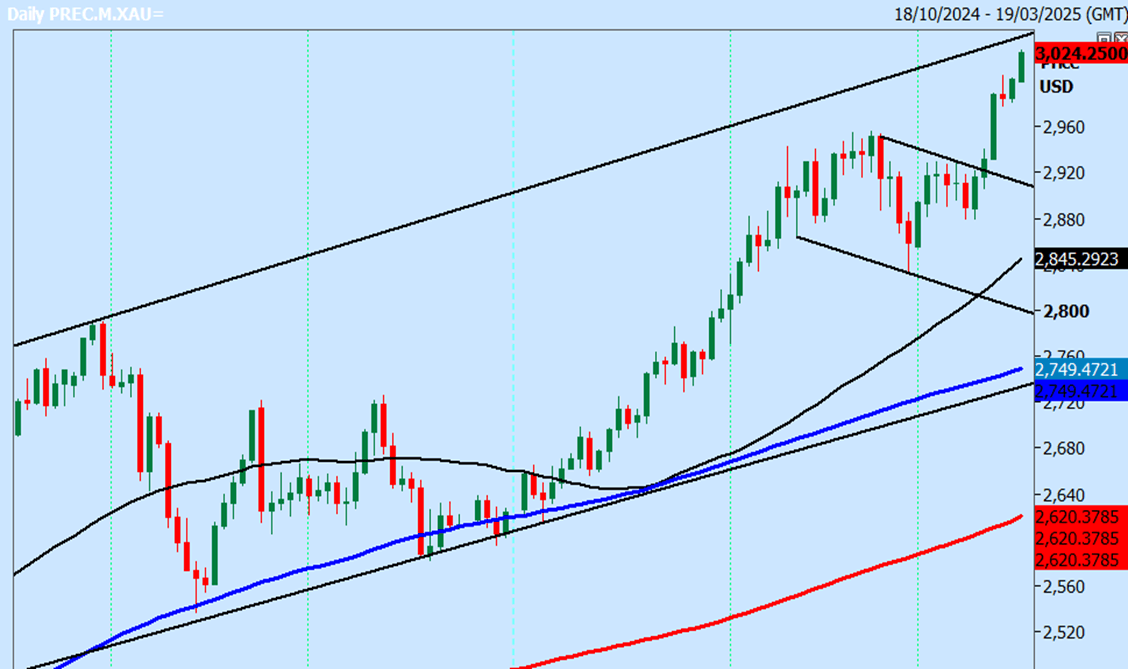

Gold soars again

Gold

-

Gold made a low for the day at 2982, unfortunately just above support at 2980/77.

-

Longs need stops below 2974 if tested today

-

We beat resistance at 3000/3004 which was not a surprise & the buy on a break above 3007 hit target 3010/12, probably as far as 3018/20 today.

-

If we continue higher look for 3026/28.

-

Support at 3002/2997 &longs need stops below 2992.

-

Support again at 2983/80 & longs need stops below 2975.

Silver

-

Silver has recovered & did retest last week's high at 3341, with the break above 3345 now having the potential to target the recent 2024 high at 3487.

-

First support at 3355/50 was tested yesterday with a low for the day at 3340.

-

Better support at 3330/3320 could see a low for the day if tested today but longs need stops below 3310.

-

Targets: 3360, 3380

-

The best buying opportunity for this week is at 3290/80 should we fall this far & longs need stops below 3270.

WTI Crude April future

Last session low & high: 6725 - 6837.

(To compare the spread with the contract that you trade).

WTI Crude shorts at my sell opportunity at 6740/60 did not work this time as we unfortunately spiked above 6810 before reversing from 6837.

If we continue higher look for strong resistance at 6880/6900 & shorts need stops above 6940. Targets: 6835 & 6775

Support at 6530/20 held again last week. A break below 6500 is a sell signal targeting 6445/35 & 6395/75.

Author

Jason Sen

DayTradeIdeas.co.uk