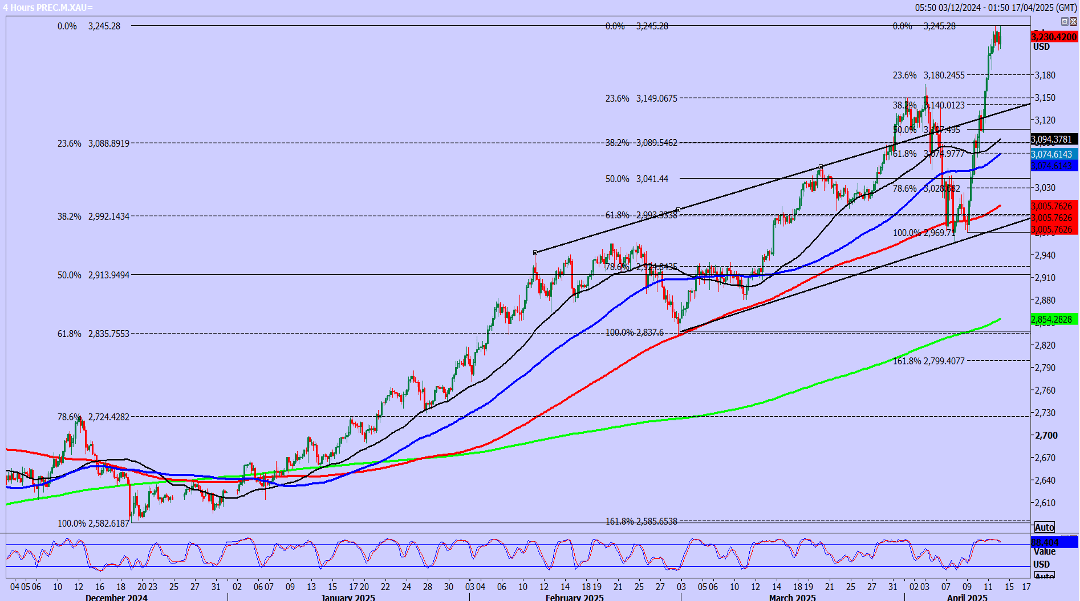

Gold soars $275 in just three days

XAU/USD

Gold beat 3164/67 for a buy signal & shot higher to the next target of 3225/29 & more than half way to 3255/60.

A break above 3260 targets 3271/74 & 3280/83.

Above 3285 look for 3300/3304.

Over the last 16 hours we saw 3 very negative candles on the 1 hour chart.

Obviously I am not taking this as a sell signal.

Just be aware that we are overbought after such strong gains with short term indicators suggesting we are slowing upside momentum.

Strong support at 3220/3216. Longs need stops below 3209.

Targets: 3230, 3238, 3242

A break lower could test strong support at 3185/3175 & longs need stops below 3170.

Targets: 3198, 3205, 3210.

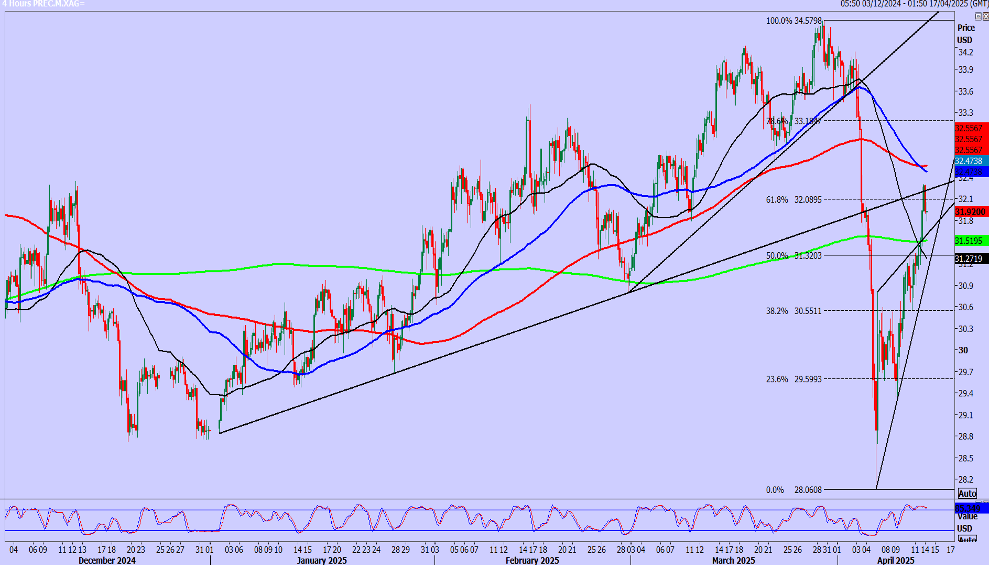

XAG/USD

Silver stalled for a long time at 3120/30 for profit taking on longs.

It looked like we could be forming a more negative rising wedge but we broke the upper trend line of the pattern.

The break above 3155 was a buy signal for Friday targeting 3200/3220 & we made a high for the day almost exactly here on Friday.

We should have support at 3200 & longs need stops below 3180.

A break above 3230 is a buy signal for this week targeting 3245/50 & even 3270/75 is likely.

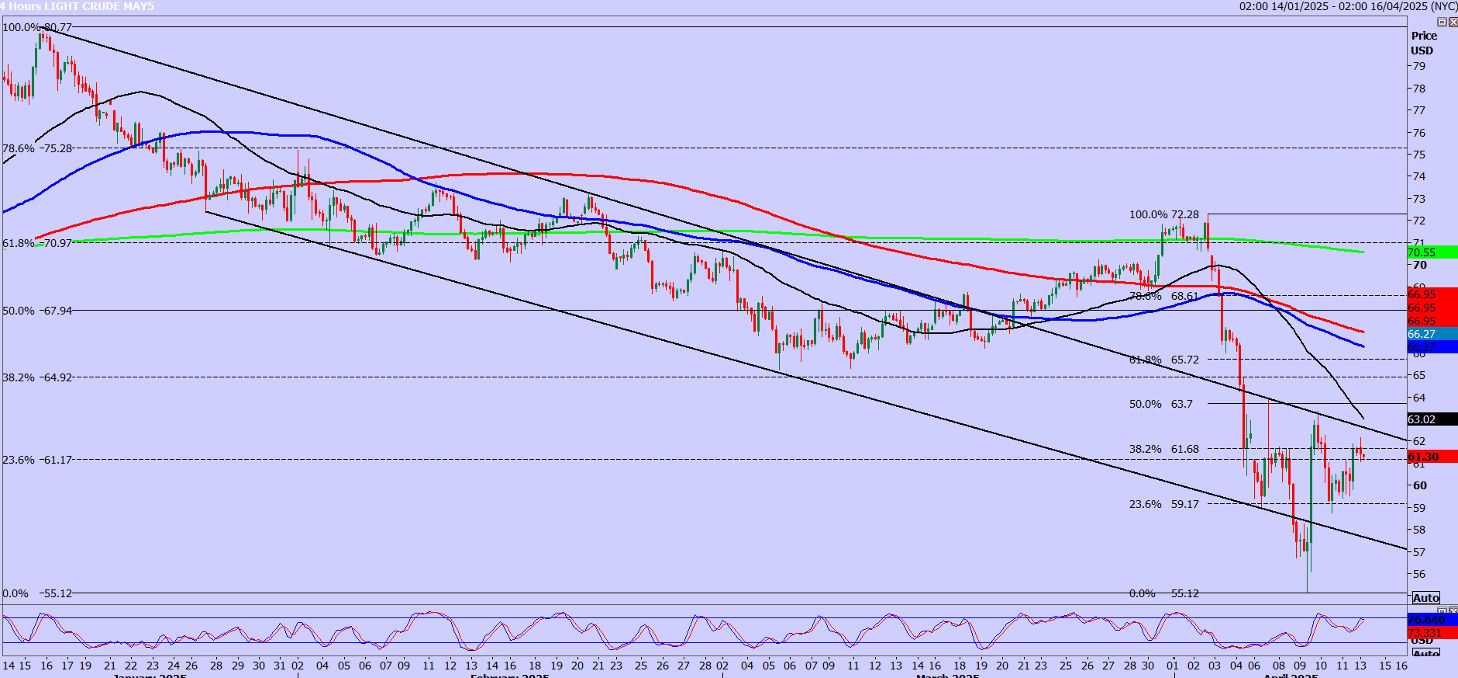

WTI

WTI Crude made a low for the day exactly at support at 5940/5900.

As predicted the move above 6070 on Friday was a buy signal targeting 6100 & minor resistance at 6140/6180.

In fact we made a high for the day at 6187.

On a retest of support at 5940/5900, longs here need stops below 5830.

A break above 6200 targets 6230/6240 & above here we can retest minor resistance at 6340/80.

Shorts need stops above 6420. A break higher can target 6550/6590 for profit taking on longs.

A break below 5830 WTI Crude could hit 5700/5680.

Author

Jason Sen

DayTradeIdeas.co.uk