Gold shines brighter even in difficult times: What is the reason for the price increase

Gold continues its impressive streak of gains for the fourth week in a row. At the beginning of this week, the price of a troy ounce of the precious metal is around 1,973 USD.

This increase in the price of gold indicates that the market is looking for a "safe haven" from the effects of the banking crisis, which remains one of the main threats to the global economy. In addition, the US Federal Reserve's ambiguous stance on the future interest rate makes gold quite attractive to investors.

At the end of last week, the European banking sector came under pressure again, which caused an increase in anxiety in stock markets around the world. The concern was caused by the decline in the shares of the largest European bank Deutsche Bank.

Against the backdrop of this uncertainty, gold is again becoming a "safe haven" for the capital market, which makes it one of the most demanding investment assets in the face of economic uncertainty. Some analysts believe that the price of gold may continue to rise in the near future, until there is stability in the financial markets.

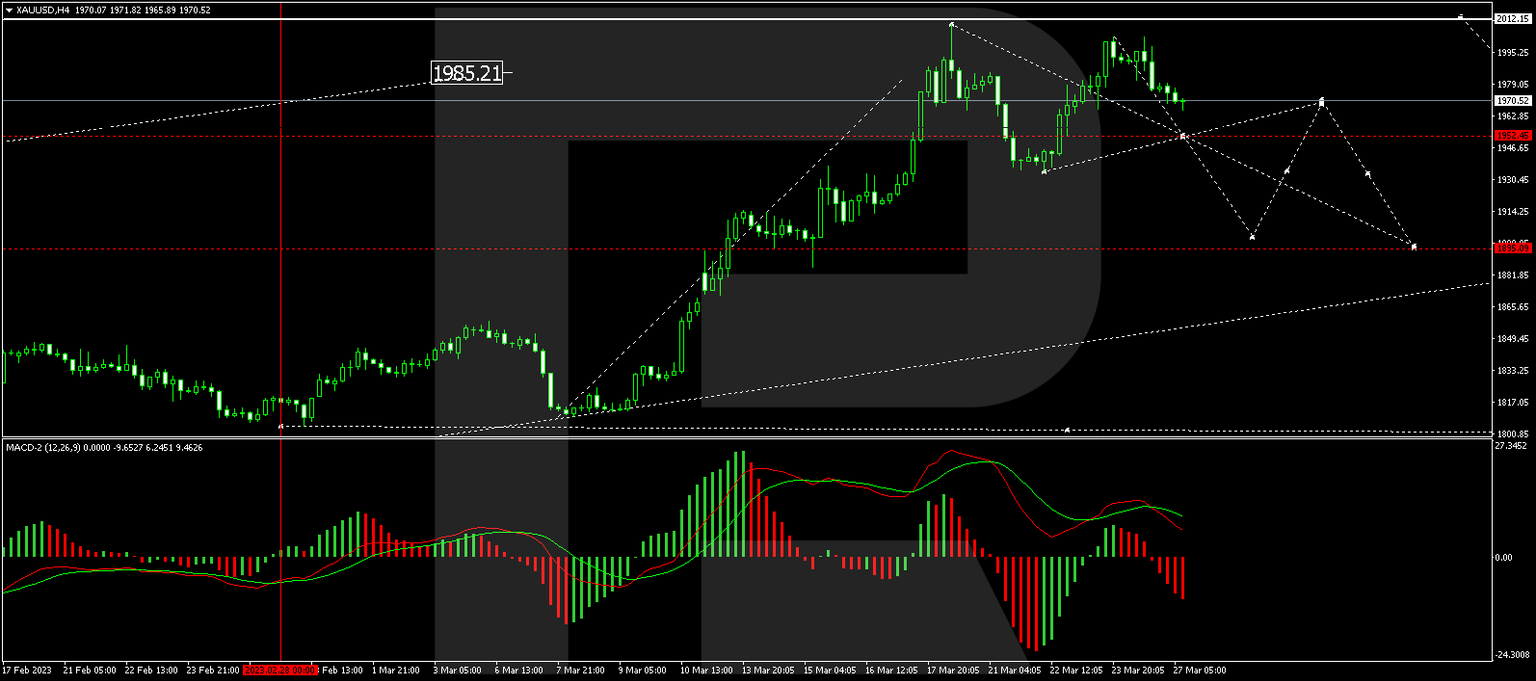

On H4, XAU/USD has performed an impulse of decline to 1934.24 and growth to 2003.30. At the moment, a consolidation range is forming at these levels. If the price breaks out of it downwards, a link of correction to 1895.00 might follow. If the price breaks through upwards, the wave might continue to 2012.12. Technically, this scenario is confirmed by the MACD. Its signal line is above zero, directed strictly down to renew the lows.

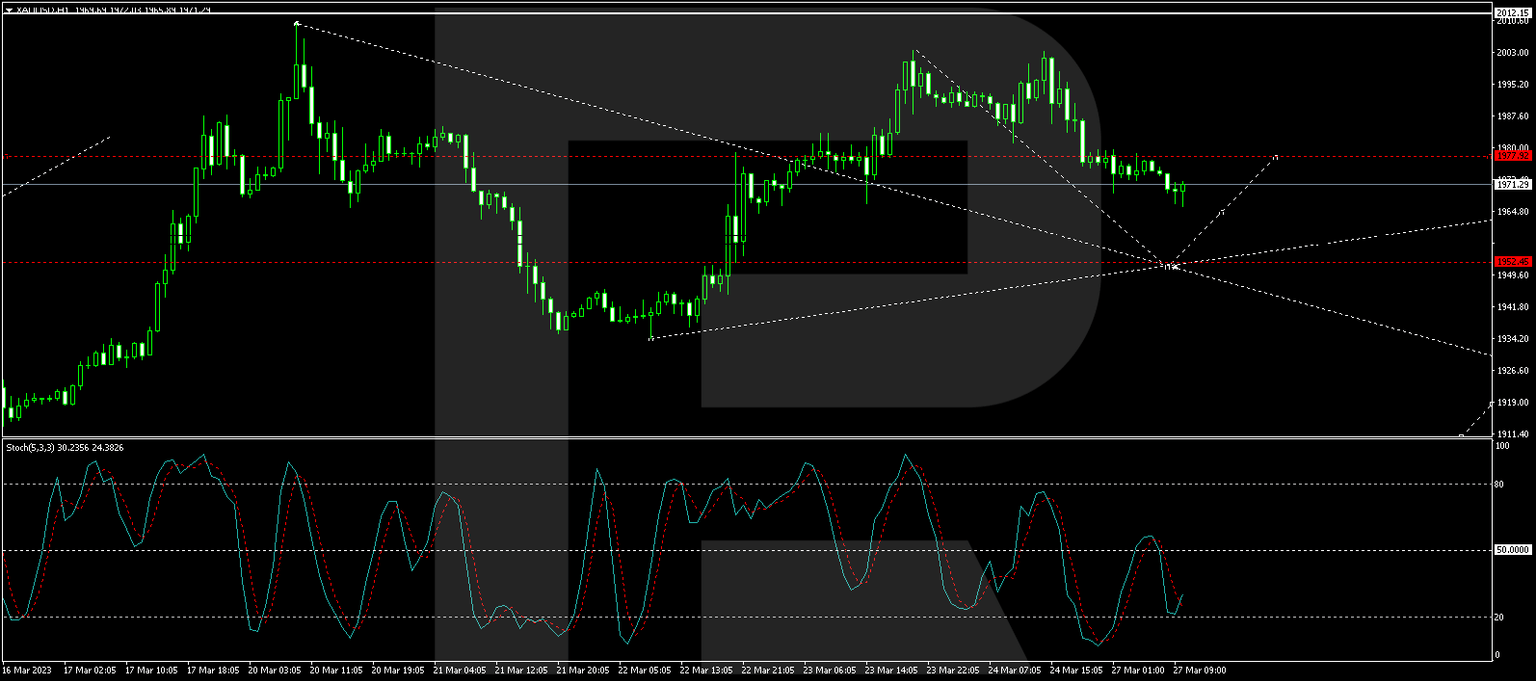

On H1, XAU/USD has performed a structure of decline to 1977.90. At the moment, a consolidation range is forming around it. With an escape from it downwards, the wave might continue to 1952.50. Then growth to 1977.90 might follow, and then — a decline to 1927.00. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is above 20, aiming strictly upwards.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.