Gold shines at fresh all-time high

-

Gold ends sideways trajectory; enters uncharted territory.

-

Short-term bias positive but overbought signals suggest some caution.

-

A close above 2,480 might be necessary to boost buying confidence.

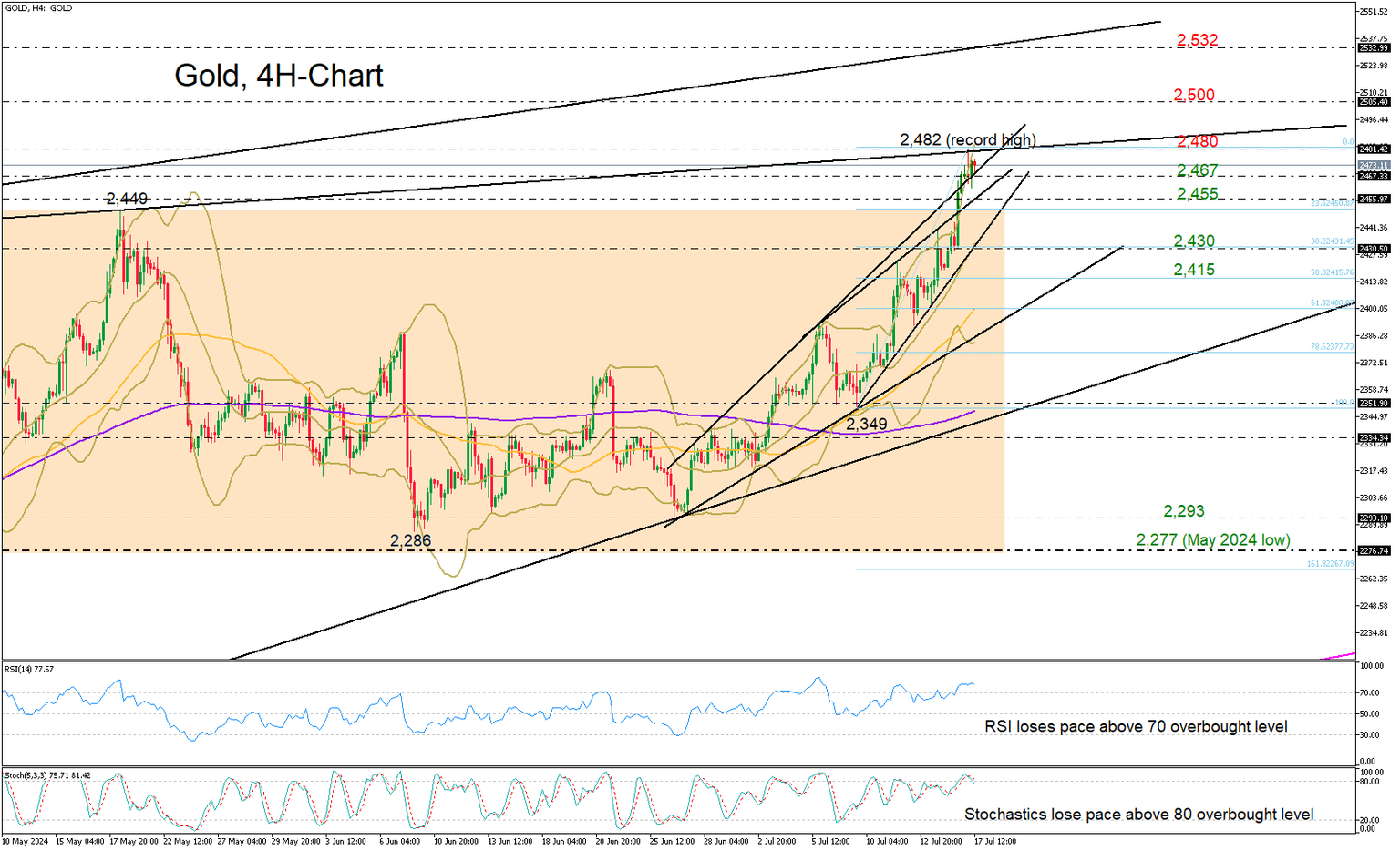

Gold bulls powered ahead to finally exit the three-month range and chart an all-time high of 2,482 on Wednesday.

The bullish breakout has placed the precious metal back into an uptrend, which may continue to attract buyers in the upcoming sessions. However, caution is necessary as the price has already exceeded the upper Bollinger band, and both the RSI and stochastic oscillator are currently in the overbought zone on the four-hour chart.

Perhaps a close above the ascending line, which connects the April and May highs at 2,480, could be the key for an advance towards the 2,500 psychological level. Further up, the bulls could face another critical battle near the resistance line drawn from August 2022 around 2,532.

Should the price retreat beneath 2,467, initial support could emerge near 2,455. Failure to pivot there could upset traders, motivating a decline towards the 20-period SMA (middle Bollinger band) at 2,430 and back into the previous neutral zone. Note that the 38.2% Fibonacci retracement of the upleg started on July 9 is in the region. Hence, another violation there could activate more selling, likely towards the 50% Fibonacci of 2,415.

Overall, although gold’s positive outlook has returned, traders might wait for a breakthrough above 2,480 to reach the 2,500 milestone.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.