Gold set to surge on Fed volatility

-

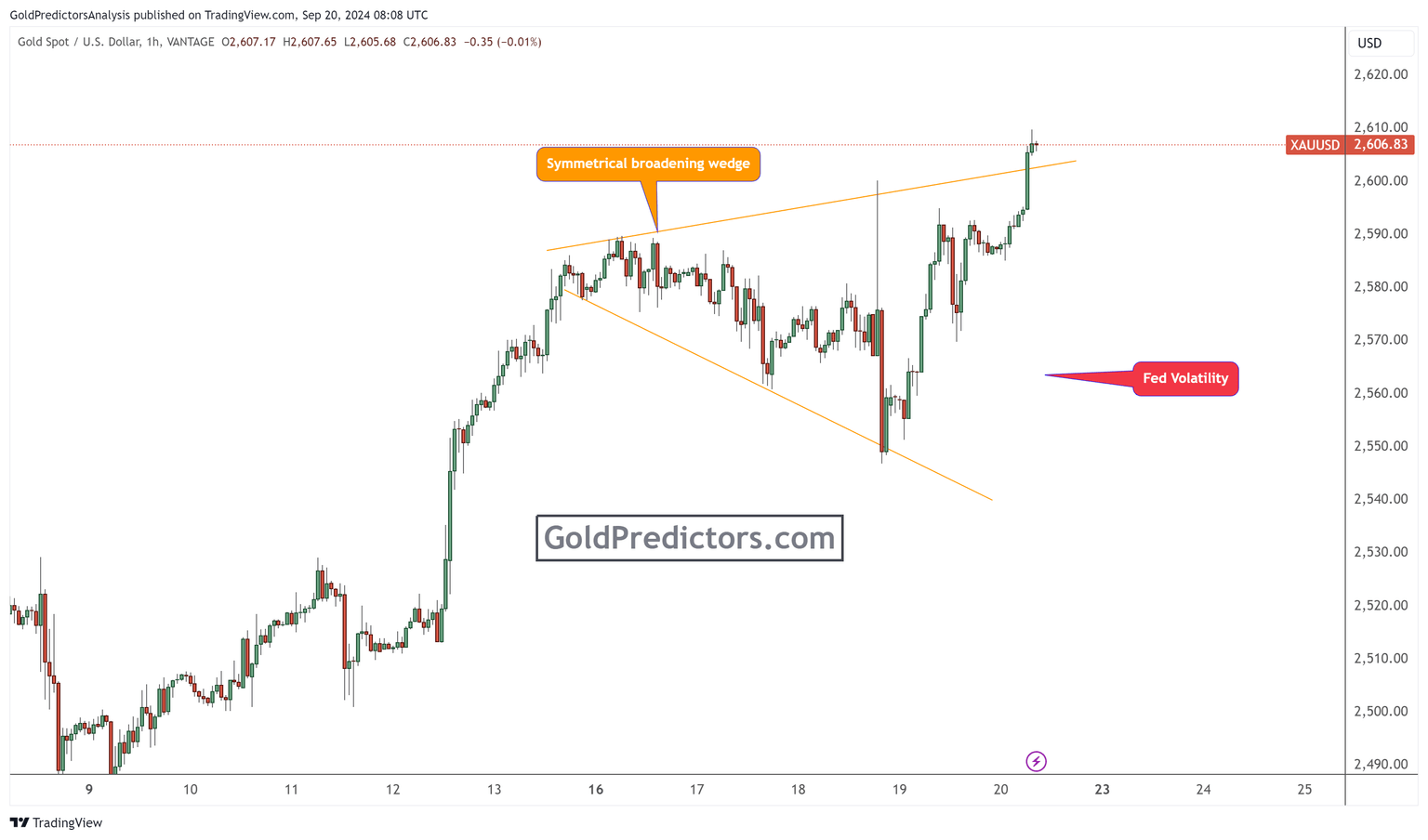

Gold prices surged above $2,600 as the Fed eased monetary policy.

-

The technical charts points to continued surge in the gold market.

-

Investors and traders are likely to buy gold on dips as technical charts point to continued upward momentum.

The recent 50-basis-point rate cut by the Federal Reserve is setting the stage for a bullish run in the gold market. As the Fed eases monetary policy, gold prices have surged above $2600. Typically, lower interest rates reduce the appeal of interest-bearing assets like bonds, making non-yielding assets such as gold more attractive to investors. Even though U.S. Treasury yields rose, gold's allure remains strong, signaling investor confidence in the metal’s ability to hold value during uncertain economic conditions. With the Fed signaling that inflation is moving closer to its 2% target, the market is positioning itself for more rate cuts, which traditionally boosts gold's appeal as a hedge against inflation and currency devaluation.

In addition, the Fed’s focus on maintaining labor market strength, alongside a less urgent approach to normalizing policy, supports the bullish outlook for gold. As the Fed continues to prioritize employment and remain cautious about pulling back on its easing cycle, gold is likely to benefit from an extended period of lower interest rates and economic uncertainty. Historically, gold thrives in such environments, where loose monetary policy and concerns about inflation drive demand for safe-haven assets. With projections indicating that U.S. interest rates could end 2024 lower than previously expected, the conditions for a sustained gold rally are well in place.

Gold has been trading within a symmetrical broadening wedge since the Federal Reserve meeting on Wednesday. The gold price fluctuated between the upper and lower levels of the wedge before eventually breaking higher. This movement was anticipated, as the initial hours following the Fed's decision were expected to cause volatility in the financial markets. However, the long-term outlook for the gold market remains positive, with expectations for further gains. The daily, weekly, and monthly charts all indicate the potential for continued upward momentum. As a result, investors and traders are likely to see opportunities to buy gold on dips, expecting prices to climb further.

Bottom line

In conclusion, the Federal Reserve's recent 50-basis-point rate cut has created a favourable environment for a bullish run in the gold market. Lower interest rates have enhanced gold's appeal as a non-yielding asset, and despite rising U.S. Treasury yields, the metal's value as a safe haven remains strong. With the Fed indicating more rate cuts ahead and inflation nearing its target, gold is expected to benefit from ongoing economic uncertainty and loose monetary policy. The technical outlook for gold, supported by daily, weekly, and monthly chart patterns, points to further upward momentum, offering investors opportunities to capitalize on price dips as the precious metal continues its ascent.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.