Gold set for gains amid recession fears and weaker US Dollar

-

The rising Sahm Rule Recession Indicator and declining KC Fed Labor Market Conditions Index suggest that a recession may be approaching.

-

If the Federal Reserve lowers interest rates to stimulate the economy, the U.S. dollar could weaken.

-

A weaker U.S. dollar would make gold more attractive to investors, potentially driving its price higher.

The rising Sahm Rule Recession Indicator and the declining KC Fed Labor Market Conditions Index suggest that a recession may be on the horizon, which could have a significant impact on the gold market. As economic conditions worsen and unemployment rises, investors typically turn to gold as a safe-haven asset to protect against economic uncertainty and potential declines in equity markets. Additionally, if the Federal Reserve lowers interest rates to stimulate the economy, the U.S. dollar could weaken, making gold more attractive and driving its price higher. Therefore, these indicators pointing to a potential recession and lower interest rates could lead to increased demand and a bullish outlook for gold.

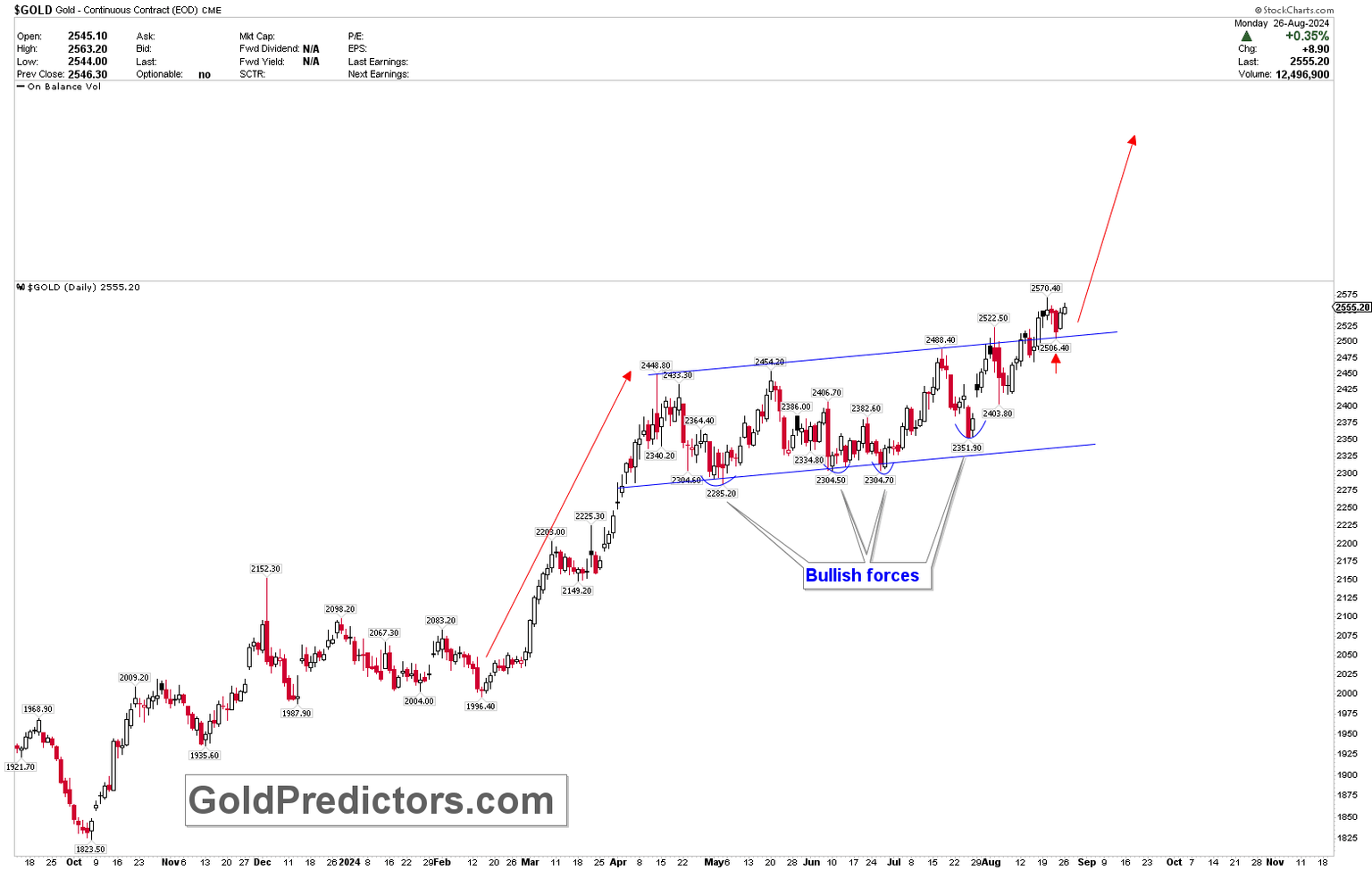

The strength of gold is already evident in the technical chart, indicating that gold is on its way to much higher levels. The chart shows the formation of a channel that has been broken, and prices are consolidating after the breakout. This consolidation highlights price strength, suggesting that gold will continue to trade higher. Additionally, the reversal from the bottom also indicates bullish pressure in the gold market. Therefore, the foundation of bullish forces, followed by the breakout from the key region, suggests a continuation of bullish momentum in the gold market.

Bottom line

In conclusion, the combination of economic indicators pointing to a potential recession and the recent technical signals of strength in the gold market suggests a bullish outlook for gold. As investors seek safe-haven assets amidst economic uncertainty and a possible weakening of the U.S. dollar due to lower interest rates, gold is likely to see increased demand. The consolidation and breakout patterns in the technical chart further support the continuation of this bullish momentum, indicating that gold prices may continue to rise in the coming months.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.