Gold seeks new buyers to trim rapid downfall

-

Gold turns up again after brutal downfall.

-

Short-term risk is positive, but caution required near 2,430-2,438.

-

US S&P Global PMIs could generate fresh volatility at 13:45 GMT.

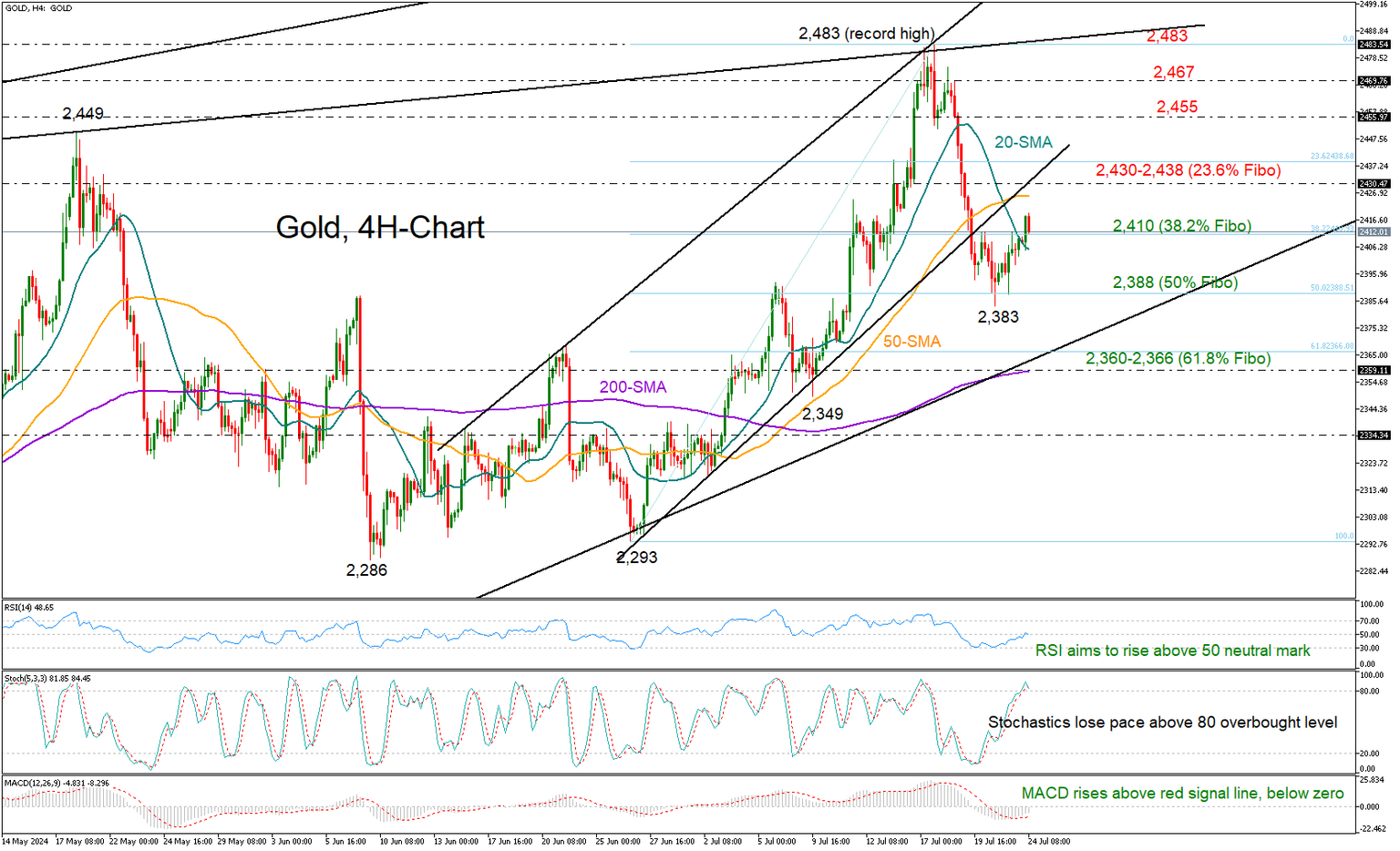

Gold found fresh buying interest after its aggressive pullback from a record high of 2,483 paused at 2,383. The precious metal is currently looking to gain more ground following its close above the 20-period simple moving average (SMA) and the 38.2% Fibonacci retracement of the latest upleg at 2,410.

From a technical perspective, the risk is skewed to the upside as the RSI is set to cross above its 50 neutral mark and the MACD, although negative, is showing some recovery above its red signal line. Nevertheless, with the stochastic oscillator nearing its previous highs in the overbought region, any potential rises may be gradual.

The 50-period SMA and the broken ascending trendline drawn from June's low at 2,430 will be hard to miss before the 23.6% Fibonacci mark of 2,438 comes into view. If the bulls breach the latter, they might initially head for May’s peak of 2,449 and then for the 2,467 barrier. Further up, the price could push for new higher highs above the all-time high of 2,483.

Should the bears press the price below the 38.2% Fibonacci of 2,410 and the 20-period SMA, support could immediately come from the 50% Fibonacci of 2,388, where the price bottomed out earlier this week. Additional declines from there could face a tougher hurdle near the 200-period SMA and the ascending trendline from the February low, currently seen near the 61.8% Fibonacci of 2,366.

In short, gold’s ongoing upturn could gather more strength, though buyers are expected to show greater interest once the price surpasses the barrier at 2,430-2,438.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.