Gold retreats from new record $2,532 – FOMC Minutes awaited

-

Gold cooling off the record $2532.

-

Traders await FOMC minutes for clues.

-

Dollar Index plunges to 50 Month EMA.

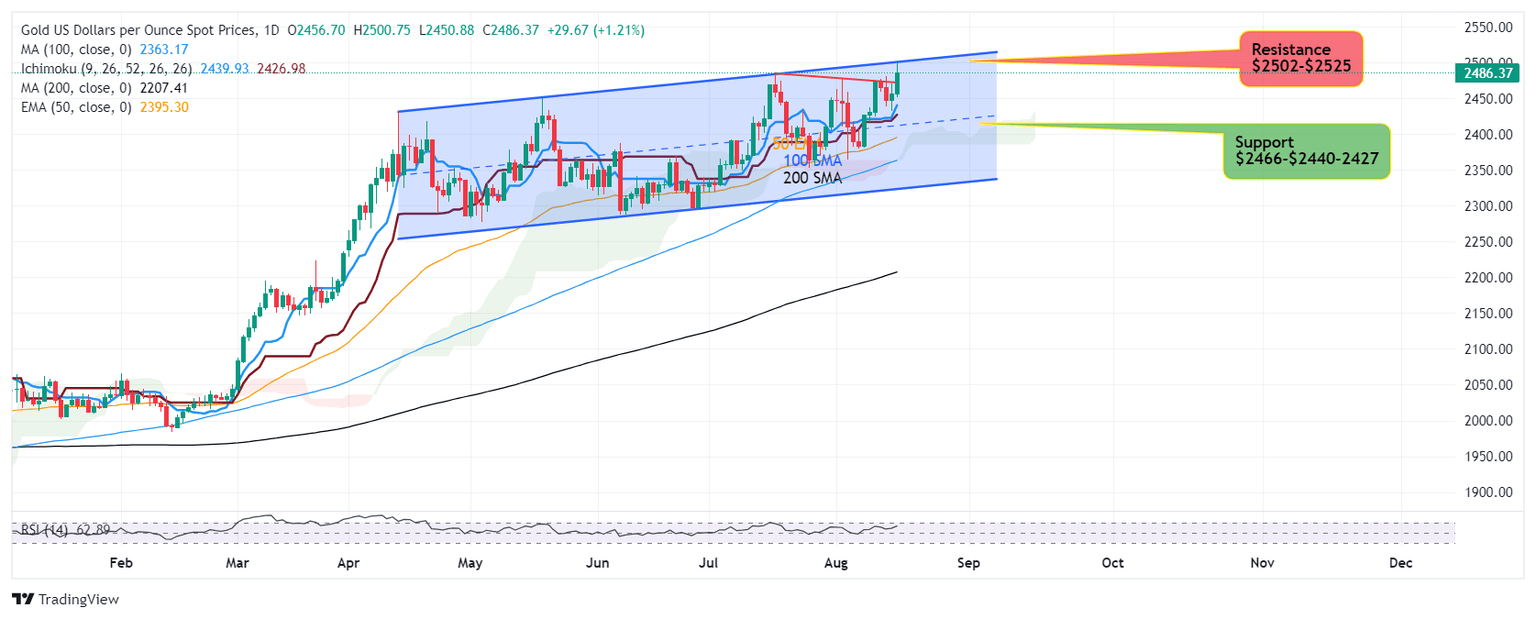

Gold is seen consolidating after reaching new record high $2532 and some retracement is visible ahead of upcoming FOMC meeting minutes which may provide some clues for further direction on the course of the precious metal in the short term.

Tomorrow initial jobless claims is scheduled to release critical numbers which may furter impact short-term range.

The metal is facing some resistance at $2515-$2520 which is required to be cleared for retesting $2532 above which next leg higher comes at $2550-$2560.

Immediate support is seen positioned at $2500 which if breached, can extend decline to next downside potential $2492-$2482.

If $2482 is broken, downward retracement is likely to extend to $2472.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.