Gold records new high at $2500; Middle East tensions eyed

- Middle East crisis looms large as Iran refuses to budge on appeal for restraint.

- Safe haven rush to safety triggers Gold demand ahead of week end.

- Gold records new high at $2500

Positive sentiments from US economic data led to cooling off in Gold prices yesterday with a pullback to $2432 but geo political risk in the middle east theatre takes center stage and reignite the fierce rally.

Fears that Iran may attack Israel keep fuelling chaos as appeal for restraint fails to show signs of truce between the warring sides while Israel braces for Iranian attack.

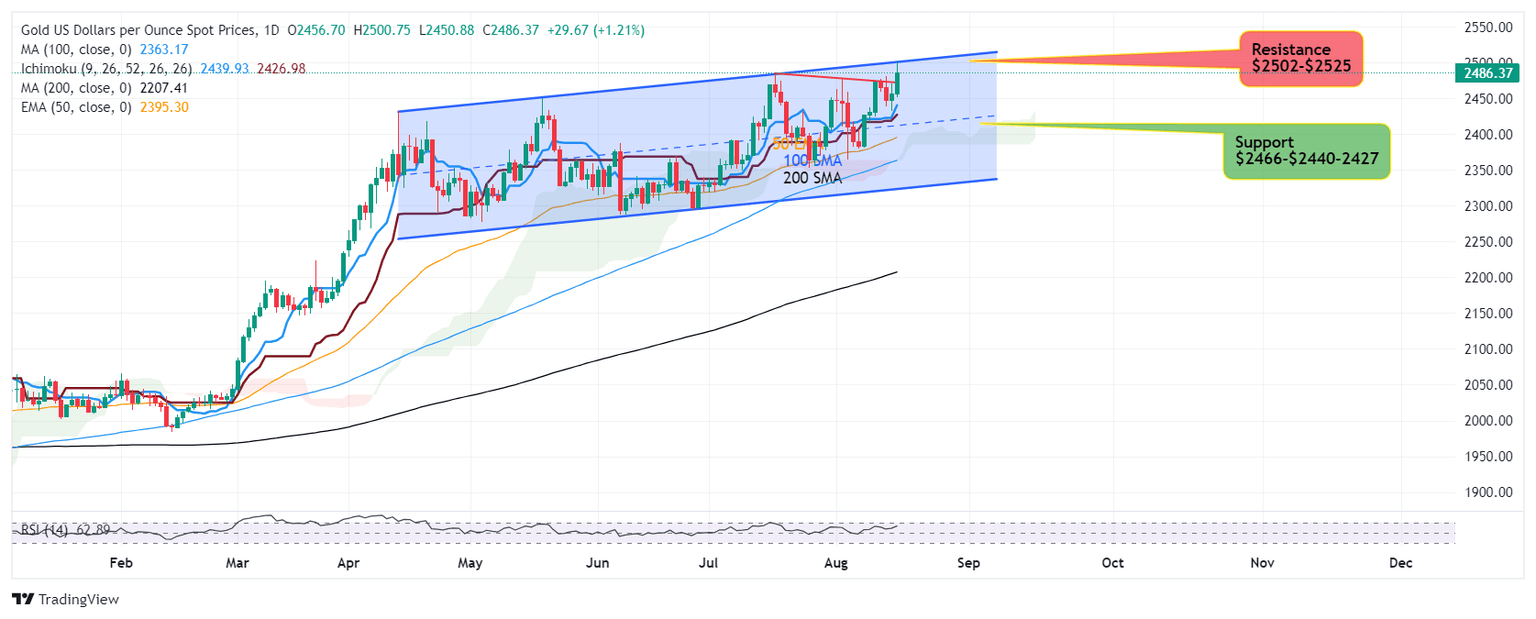

Increasing risks fuel safe haven demand for Gold which makes new record high at $2500 psychological handle and currently consolidates between $2476-$2493

Daily chart formation shows Gold tested resistance of ascending channel which traders will monitor closely as any hint of truce or Iran postponing attck will lead to reaction in Gold prices cooling off the high and a follow up retracement towards support zone may be witnessed.

On the flip siide, if Iran launches offensive against Israel which is broadly being feared, may lead to further spike in the yellow metal reaching next leg higher $2525-$2550 in no time.

Support is seen located at $2466-$2440-$2427

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.