Gold reaches unprecedented high amid economic uncertainties

Gold trading reached a significant milestone on Thursday, with prices hitting an all-time high of $2150.00 per Troy ounce. This remarkable surge was propelled by a confluence of factors. These include the decline in US government bond yields, the weakening US dollar, and speculation about a potential interest rate cut by the US Federal Reserve in response to emerging economic challenges.

The expectation of monetary policy easing stems from the Federal Reserve's ongoing evaluation of the economy's condition, highlighted by Federal Reserve Chair Jerome Powell's hint at potential policy adjustments in 2024. The timing of such interventions is critical to achieving a balanced approach without precipitating or lagging behind the economy's actual needs.

Recent labour market data, including ADP's February employment growth figures, fell short of expectations, shifting focus to forthcoming reports on unemployment rates, Non-Farm Payroll (NFP) statistics, and average earnings. These reports are critical for assessing the employment market's condition and will significantly influence the Fed's decision-making process.

Gold's rally is further supported by its inverse relationship with the US dollar, gaining momentum from the currency's current weakness. Moreover, the surge in physical demand for gold from global central banks in January, which saw purchases double compared to December, underscores the metal's appeal as a hedge against geopolitical risks and potential economic downturns.

Technical analysis of Gold (XAU/USD)

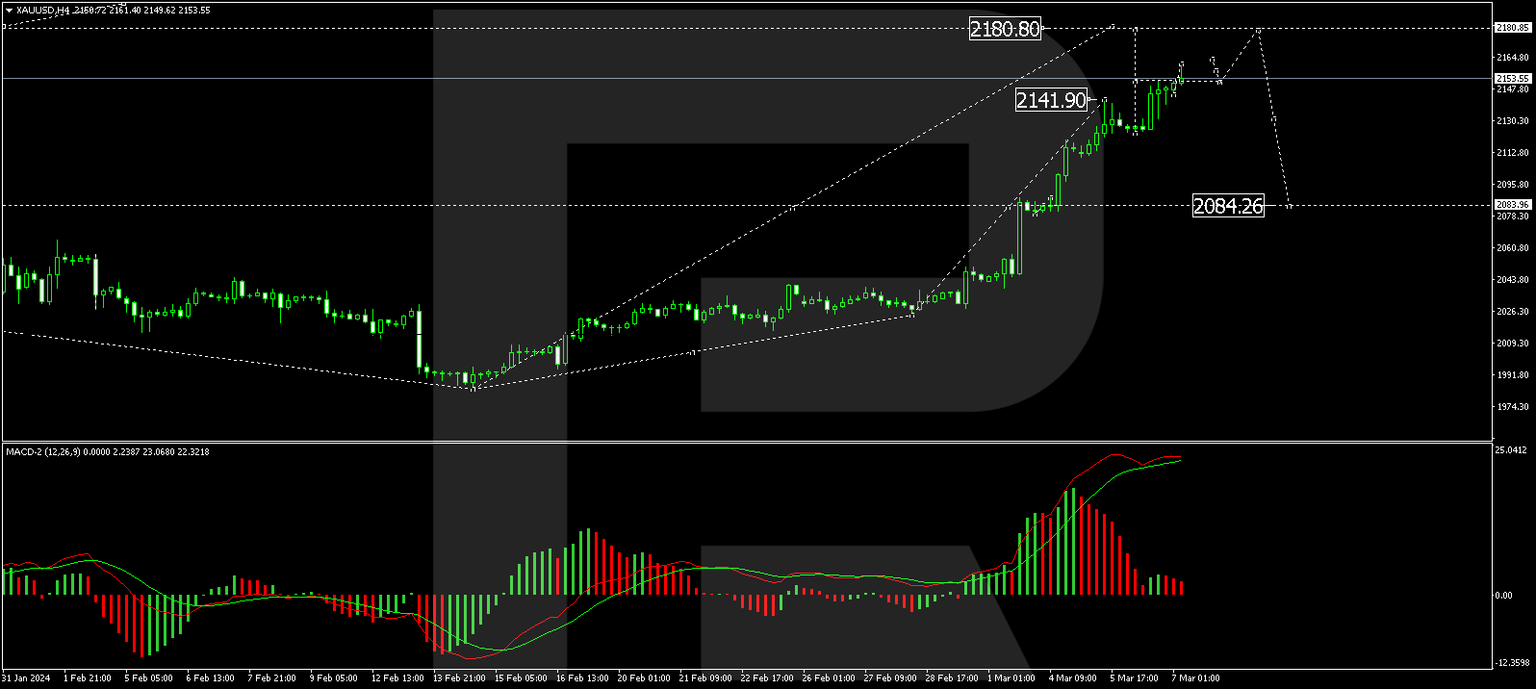

The H4 chart analysis of XAU/USD reveals the progression of the fifth growth wave, with a pivotal correction to 2124.00 following the achievement of a local target at 2141.90. Today's trading has seen the market surpassing the peak of this wave, establishing a consolidation range above the 2153.00 level. A breakout above this consolidation could signal further growth towards 2180.80, which was identified as the initial target. This bullish scenario is supported by the MACD indicator, which remains above zero, indicating sustained upward momentum.

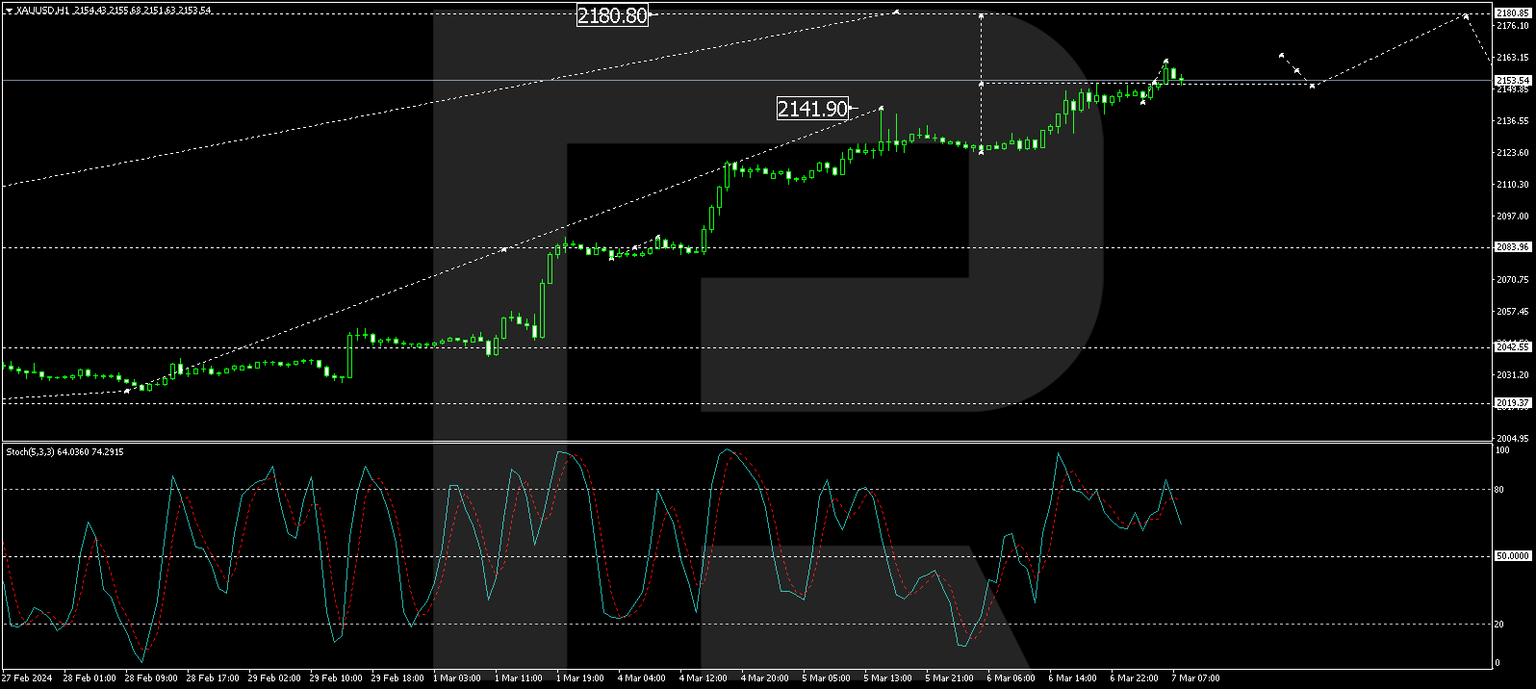

On the H1 chart, gold prices have consolidated around the 2152.00 mark. An upward move from this consolidation phase is expected to initiate a growth wave towards 2160.60. Subsequent correction to 2152.00 and a potential rise to 2180.00 are anticipated. The Stochastic oscillator supports this outlook, suggesting a brief retreat to 50 before rallying back to 80, reflecting continued bullish sentiment in the market.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.