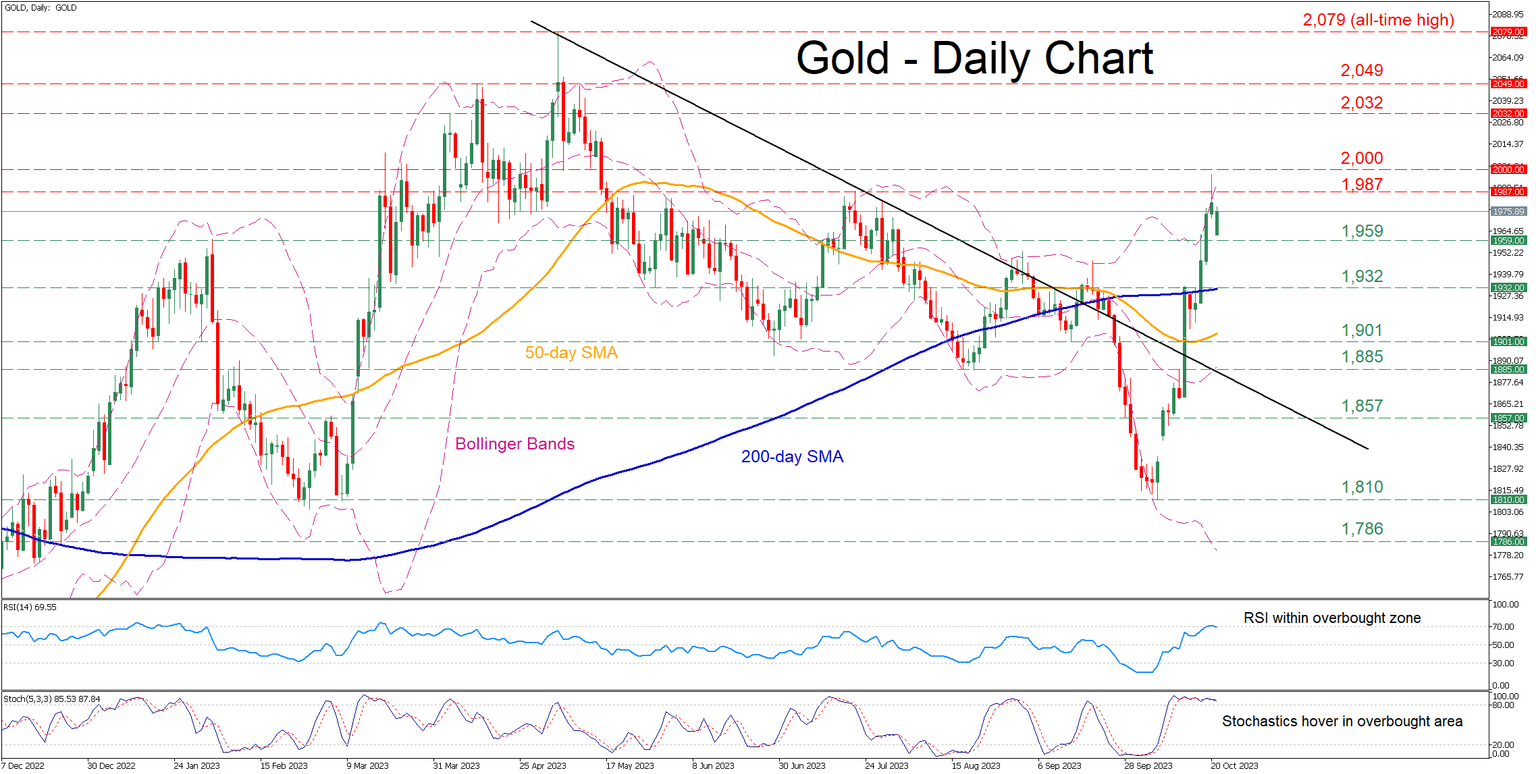

Gold pulls back after touching 2,000 [Video]

-

Gold surges to a 5-month high on geopolitical tensions.

-

Retreats slightly before claiming the 2,000 psychological mark.

-

Momentum indicators suggest overbought conditions.

![Gold pulls back after touching 2,000 [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/hand-full-of-gold-nuggets-53773200_XtraLarge.jpg)

Gold has been in a steep uptrend after bouncing off its October low, jumping back above crucial technical regions such as the 200-day simple moving average (SMA) and posting a fresh five-month peak of 1,997. However, bullion experienced a minor correction due to reaching overbought levels.

Should buying interest persist, the July peak of 1,987 could initially curb bullion's upside. Conquering this barricade, the bulls might aim at the 1,997-2,000 range that is defined by the recent five-month high and the crucial psychological mark. A break above that territory could bring the April resistance of 2,032 under examination.

On the flipside, bearish actions could send the price lower to test the February high of 1,959, which could now act as support. Sliding beneath that floor, gold could challenge the June hurdle of 1,932 that overlaps with the 200-day SMA. Should that barricade also fail, the spotlight could turn to the September support of 1,901, which also held strong in June.

All in all, gold seems to be under relentless upside pressure, which has pushed the price in overbought levels. Although the short-term oscillators are hinting that the advance is overstretched, fresh geopolitical concerns may add more fuel to the latest rally.

Author

Stefanos joined XM as a Junior Investment Analyst in September 2021. He conducts daily market research on the currency, commodity and equity markets, from a fundamental and a technical perspective.