Gold prices have been increasing since last Friday, driven by widespread market expectations that the Fed will maintain its interest rates in September.

The Dollar Index has remained relatively stable but at a robust level above the $105 threshold. This steadiness aligns with the prevailing sentiment in the equity markets as investors await the forthcoming Federal Reserve interest rate decision scheduled for Wednesday(September 20th). In contrast, gold prices have been on an upward trajectory since last Friday. This trend stems from widespread market expectations that the Fed will maintain its current interest rates in September. Meanwhile, oil prices have maintained their bullish momentum. Analysts are predicting that oil prices may reach $100 before the year concludes. This optimism is grounded in concerns over a supply deficit, especially considering that U.S. shale oil output has been on a decline and is forecasted to persist for the third consecutive month in October.

Market movements

Dollar index

The US dollar continues to face pressure, albeit from a position near a six-month high, as investors seize the opportunity to take profits ahead of a week brimming with pivotal events. Eyes are firmly fixed on interest rate decisions this week by the Federal Reserve, the Bank of England, and the Bank of Japan. Despite the greenback's losses, it finds solace in the reassuring statements of US Treasury Secretary Janet Yellen, who unequivocally states that there are no ominous signs of the US economy veering into a downturn.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 105.25, 106.25.

Support level: 104.25, 103.05.

XAU/USD

Escalating political risks in the United States, coupled with the looming threat of a government shutdown, have buoyed the demand for gold. Although analysts suggest the economic impact of a potential shutdown may be minimal, market participants remain watchful of developments.

Gold prices are trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the commodity might enter overbought territory.

Resistance level: 1950.00, 1975.00.

Support level: 1930.00, 1910.00.

EUR/USD

The euro found support near 1.0650 against the dollar, experiencing a slight rebound as the dollar's bullish momentum temporarily waned. This shift is driven by expectations that the Federal Reserve will keep interest rates steady in September, preventing the dollar index from maintaining its surge above $105. Additionally, the release of Eurozone Consumer Price Index (CPI) data today is under scrutiny, providing insights into the euro's strength amid ongoing economic concerns in the Eurozone.

EUR/USD has consolidated and has a rebound, but the lower high price pattern suggests that the pair is still trading in a bearish momentum. The RSI has rebounded but remains below the 50-level while the MACD still flows below the zero line, suggesting the bearish momentum is still intact.

Resistance level: 1.0700, 1.0760.

Support level: 1.0640, 1.0540.

GBP/USD

Pound Sterling maintains a downward trajectory as market anticipation builds before the Bank of England's interest rate announcement. Economists are unanimous in their expectation that this is likely the final rate hike for the BoE in the current cycle. All eyes are on the decision, with forecasts pointing toward a 25-basis point increase, propelling borrowing costs to 5.5%, a level last seen in early 2008.

Pound Sterling is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2535, 1.2735.

Support level: 1.2370, 1.2190.

NZD/USD

The New Zealand dollar has shown resilience against the robust US dollar but now faces resistance at the 0.5935 level. This resilience is attributed to expectations of a Federal Reserve interest rate pause and ongoing economic stimulus policy from the Chinese government. Additionally, market participants are anticipating New Zealand's GDP data release on Thursday (September 21st) to gain insights into potential price movements for the currency pair.

The Kiwi has a higher low against the robust dollar, suggesting that the pair might have a trend reversal from its long-term bearish trend since July. The RSI remains flat near the 50-level while the MACD flows along with the zero line, suggesting that the momentum with the pair is low.

Resistance level: 0.5980, 0.6050.

Support level: 0.5910, 0.5860.

Dow jones

In the midst of a week marked by heightened volatility, US equity markets exhibit resilience, bolstered by the ascent of Apple Inc. shares. Apple's impressive 1% surge is attributed to robust demand for its newly launched iPhone 15, particularly the higher-priced iPhone Pro and Pro Max models, as compared to initial demand for the iPhone 14. Nevertheless, investors are poised to scrutinise the forthcoming monetary pronouncements from major central banks, including the Federal Reserve, for further directional cues.

The Dow is trading higher following the prior rebound from the upward trend line. However, MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might experience technical correction since the RSI stays below the midline.

Resistance level: 34900.00, 35590.00.

Support level: 34355.00, 33720.00.

BTC/USD

Bitcoin (BTC) has recently experienced significant volatility, surging nearly 4% in the past week. This rally is associated with a notable increase in daily active addresses, indicating heightened activity among BTC whales and prompting fluctuations in the cryptocurrency market. Furthermore, BTC is approaching its next halving event, expected to substantially reduce BTC supply, potentially leading to increased BTC value.

BTC traded higher after its price consolidated near $26500, suggesting a bullish signal for BTC. The RSI as well as the MACD has been flowing at a higher region, suggesting the bullish momentum is forming for BTC.

Resistance level: 27900, 28680.

Support level: 26250, 25740.

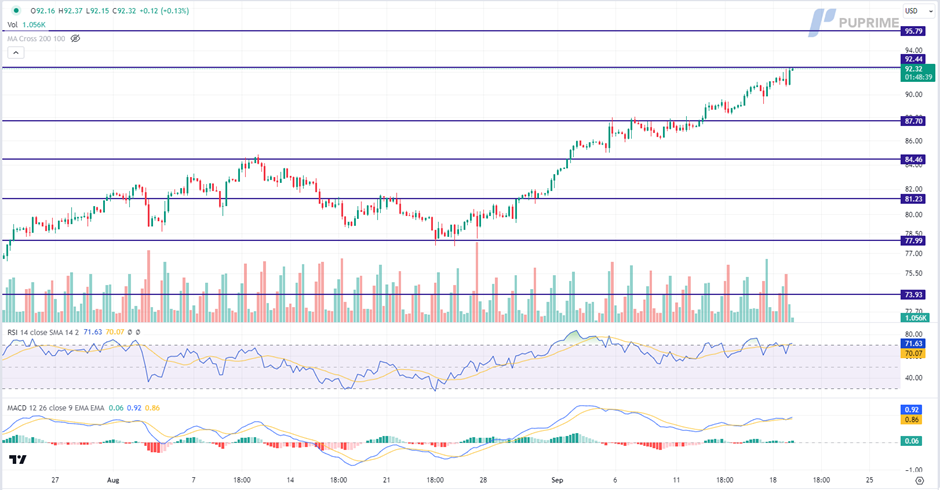

CL Oil

Oil prices continue their upward trajectory, with investors digesting the substantial production cuts implemented by the OPEC+ alliance, which have tilted the market into a significant deficit in the fourth quarter. Oil traders, however, remain attuned to central bank policy-setting meetings, recognizing the potential indirect impacts on oil prices stemming from monetary decisions.

Oil prices are trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 92.45, 95.80.

Support level: 87.70, 84.45.

Contracts for Difference (CFDs) trading carries a high level of risk to your capital and can result in losses, you should only trade with money you can afford to lose. CFDs trading may not be suitable for all investors, please ensure that you fully understand the risks involved and take appropriate measures to manage them. Please read the relevant Risk Disclosure document carefully, available here: Legal Documentation. PU Prime is a business name of Pacific Union (Seychelles) Limited. Pacific Union (Seychelles) Limited is authorised and regulated by the Financial Services Authority of Seychelles with License No. SD050. Pacific Union (Seychelles) Limited is registered and located at 9A, CT House, Providence, Mahe, Seychelles. The information on this website is not directed to residents of certain jurisdictions such as United States, Singapore, Australia and some other regions, and is not intended for distribution to, or use by, any person in any countries or jurisdictions where such distribution or use would be contrary to local law or regulation. Finzero Cap Ltd, registered in the Republic of Cyprus with registration number HE414308 and registered address at 62 Athalassas, Mezzanine, Strovolos 2012, Nicosia, Cyprus, is acting as a payment agent to Pacific Union (Seychelles) Limited for the purpose of facilitating payment services to Pacific Union (Seychelles) Limited.

Recommended Content

Editors’ Picks

Gold sits at record highs above $3,000 on escalating geopolitical tensions

Gold price is sitting at record highs beyond $3,000 early Tuesday on intensifying geopolitical Middle East tensions. Israel resumes military operations against Hamas in Gaza after the group rejected US proposals for extending ceasefire. Further US-Iran tensions add to the latest leg up in the safe-haven Gold.

EUR/USD drops to test 1.0900 ahead of German vote on spending plans

EUR/USD tunrs loswer ro near 1.0900 in early Europe on Tuesday. Escalating Middle East tensions and EU-US tariff war lift the US Dollar and weigh on the pair. Meanwhile, Euro buyers stay defensive ahead of the German vote on the fiscal spending plans.

GBP/USD falls toward 1.2950 as US Dollar rebounds on cautious markets

GBP/USD falls back toward 1.2950 in the early European trading hours on Tuesday. The pair faces headwinds from a renewed US Dollar uptick as investors run for cover amid intensifying trade and geopolitical jitters. The focus stays on mid-tier US data and Middle East tensions.

Ethereum consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Ethereum remained just below $2,000 in the Asian session on Tuesday as Standard Chartered's Global Head of Digital Assets Research, Geoffrey Kendrick, updated the bank's 2025 price forecast for ETH.

Five Fundamentals for the week: Fed leads central bank parade as uncertainty remains extreme Premium

Central bank bonanza – perhaps its is not as exciting as comments from the White House, but central banks still have sway. They have a chance to share insights about the impact of tariffs, especially when they come from the world's most powerful central bank, the Fed.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.