Gold prices ahead of NFP: Key factors driving market sentiment

Gold prices continue to climb as global economic and geopolitical uncertainties underpin demand for the safe-haven asset. Recent developments, including China's retaliatory tariffs and weak US labor market data, have bolstered the precious metal's appeal. With the upcoming Nonfarm Payrolls (NFP) report, gold traders are eyeing the next potential catalyst for price movements.

Economists predict that Nonfarm Payrolls will rise by 170,000 jobs in January, following a 256,000-job increase in December. The Unemployment Rate is anticipated to remain steady at 4.1% during the same period. Average hourly earnings, a key indicator of wage inflation, are expected to show a 3.8% year-over-year growth in January, slightly below the 3.9% increase recorded in December. After the January policy meeting, the Federal Reserve kept the benchmark rate within the 4.25%-4.50% range. However, the tone of the policy statement shifted slightly to a more hawkish stance. The Fed removed the previous acknowledgment that inflation had made progress toward the 2% goal and instead emphasized that price increases remain elevated.

Impact of geopolitics and economic data on Gold prices

China's tariffs on US goods have escalated tensions between the two largest economies. This move comes in response to US President Donald Trump's 10% levy on Chinese imports. The trade war fuels market uncertainty, prompting investors to flock to gold as a safe-haven asset.

The US labour market also adds to the mixed sentiment. The Department of Labor reported a rise in initial jobless claims, reaching 219K for the week ending February 1. This suggests potential weakness in the labour market, increasing the likelihood of Federal Reserve rate cuts. US Treasury Secretary Scott Bessent's remarks about lowering 10-year Treasury yields further support this outlook. Falling yields make gold more attractive due to its non-yielding nature.

Federal Reserve officials remain divided on monetary policy. Chicago Fed President Austan Goolsbee noted that inflation appears stable but warned of overheating risks. Dallas Fed President Lorie Logan highlighted progress on inflation but emphasized a strong labour market, which limits the chances of immediate rate cuts. These mixed signals add to market uncertainty, benefiting gold.

Technical analysis ahead of NFP

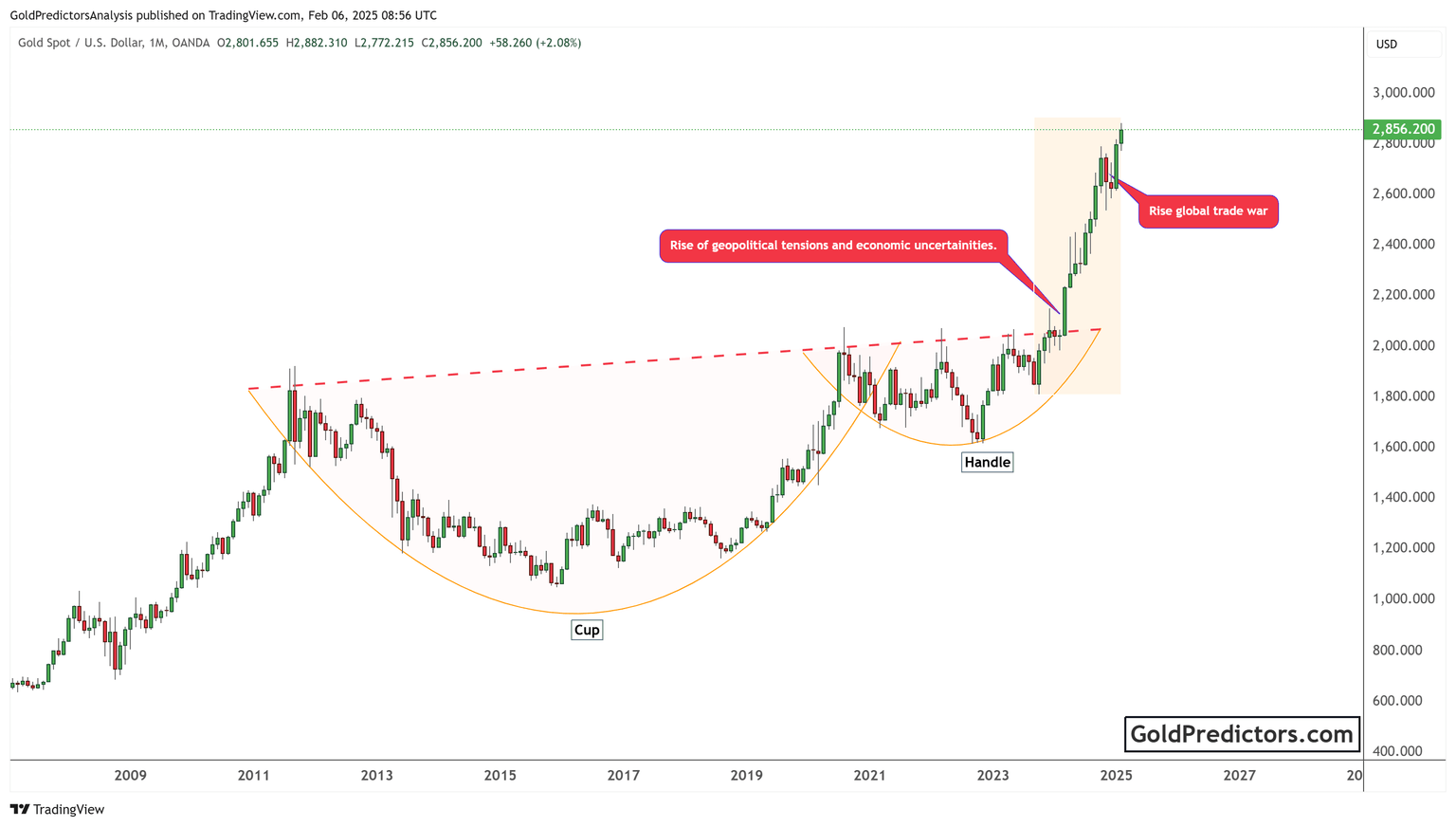

The technical chart below for gold shows a classic "cup and handle" pattern. This pattern often signals a bullish continuation in price trends. Gold recently broke out of the handle, confirming the bullish sentiment.

The breakout coincided with rising geopolitical tensions and economic uncertainties. The chart highlights a steady rise in gold prices fueled by these factors. The drop in 10-year Treasury yields has further amplified the bullish momentum. As gold approaches the $2,900 mark, traders anticipate the nearest potential resistance levels near $3,000. The ongoing strength in the gold market shows no signs of correction and prices are likely to remain elevated. The Nonfarm Payroll data will be crucial in examining its impact on the gold market.

The strong upward trajectory aligns with bets on Federal Reserve rate cuts. Gold's technical setup and fundamental drivers suggest continued strength. However, any significant shift in economic data or policy could alter the trend.

Conclusion

Gold prices remain supported by global trade tensions, US labour data, and dovish expectations for Federal Reserve policy. The upcoming NFP report will be critical in shaping market expectations and gold's direction. Traders should monitor key economic indicators and geopolitical developments to assess potential price movements.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.