Gold Price Weekly Forecast: XAU/USD could extend correction before next leg higher

- Gold price retreated sharply after touching its highest level since March 2022 near $2,050.

- XAU/USD's near-term technical outlook suggests that the pair could extend its correction.

- Buyers could remain interested in case $1,990/$1,980 support area stays intact.

Gold price edged lower at the beginning of the week and dropped below $2,000 on Monday. XAU/USD, however, didn’t have a difficult time regaining its traction mid-week with dovish Fed bets dominating the financial markets. After having touched its highest level in over a year near $2,050, the pair staged a sharp downward correction on Friday and erased its weekly gains in the process. Growth data from China, due to its potential impact on the yellow metal’s demand outlook, and PMI surveys from the US could drive XAU/USD’s action next week.

What happened last week?

With trading conditions normalizing following the Easter holiday, investors reacted to the mixed March jobs report from the US. As the probability of one more 25 basis points (bps) Federal Reserve (Fed) rate hike rose above 70% with the 10-year US Treasury bond yield climbing above 3.4%, XAU/USD came under renewed bearish pressure on Monday.

Market participants moved to the sidelines on Tuesday ahead of Wednesday’s highly-anticipated March inflation data and Gold price managed to stage a rebound.

The US Bureau of Labor Statistics (BLS) reported on Wednesday that inflation in the US, as measured by the Consumer Price Index (CPI), declined to 5% on a yearly basis in March from 6% in February, coming in lower than the market expectation of 5.2%. Further details of the publication revealed that the annual Core CPI, which excludes volatile food and energy prices, edged higher to 5.6% from 5.5% as expected. Although these figures had little to no effect on the probability of one more 25 basis points (Fed) Federal Reserve (Fed) rate hike in May, investors started to price in a looser Fed policy in the second half of the year. In turn, Gold price built on Tuesday’s gains and closed in positive territory.

Meanwhile, the data from China, the biggest gold consumer of the world, showed on Thursday that the trade surplus narrowed to $89.19 billion in March from $116.8 billion in February. This reading came in much better than the market expectation for a surplus of $39.2 billion and provided an additional boost to Gold price.

On Thursday, the BLS announced that the Producer Price Index (PPI) for final demand in the US declined to 2.7% on a yearly basis in March from 4.9% in February (revised from 4.6%). On a monthly basis, the PPI and the Core PPI came in at -0.5% and -0.1%, respectively. Moreover, the US Department of Labor said that the weekly Initial Jobless Claims rose to 239,000 in the week ending April 8 from 228,000 in the previous week. With these data releases feeding into dovish Fed expectations, the USD sell-off picked up steam and Gold price touched its strongest level since March 2022 near $2,050.

According to the CME Group FedWatch Tool, there is nearly an 80% chance that the Fed will raise its policy rate by 25 bps to the range of 5%-5.25% in May. However, the probability of the policy rate staying at that level by September is now less than 20%.

On Friday, the US Census Bureau reported that Retail Sales fell by 1% on a monthly basis in March to $691.7 billion. This reading came in worse than the market expectation for a contraction of 0.4%. Despite the disappointing data, hawkish Fed commentary helped the USD limit its losses ahead of the weekend. Federal Reserve Governor Christopher Waller argued the recent data show that the Fed hasn't made much progress on its inflation goal and noted that rates need to rise further. "Monetary policy will need to remain tight for a substantial period, and longer than markets anticipate,” Waller added. Finally, the one-year inflation expectation component of the University of Michigan's Consumer Sentiment Survey climbed to 4.6% in early April from 3.6% in March. In turn, the USD continued to gather strength ahead of the weekend and forced XAU/USD to erase its weekly gains.

Next week

First-quarter Gross Domestic Product (GDP) growth figure alongside March Retail Sales data will be featured in the Chinese economic docket on Tuesday. Considering the positive impact of the upbeat Chinese trade balance data on Gold price, XAU/USD could be expected to push higher on upbeat data and vice versa.

The US economic calendar will not feature any high-impact data releases. On Thursday, the weekly Initial Jobless Claims data, however, could trigger a short-lasting reaction. A significant increase in claims could weigh on the USD while a decline toward 200,000 could force XAU/USD to turn south.

On Friday, S&P Global will release the preliminary Manufacturing and Services PMI surveys for April. Markets grow increasingly concerned over an economic slowdown in the US and that’s why they think the Fed could reverse its policy. Hence, further USD losses are likely if PMI figures stay well below 50 and reveal ongoing contraction in the private sector’s business activity.

Market participants will also pay close attention to comments from Fed officials. Nevertheless, policymakers are likely to refrain from committing to any future decision beyond May and this past week’s market action shows that investors are more interested in what could happen later in the year.

Gold price technical outlook

With Friday's pullback, XAU/USD returned within the ascending regression channel coming from November, suggesting that the pair is staging a technical correction. Confirming that view, the Relative Strength Index (RSI) indicator on the daily chart started to edge lower after having touched 70 on Thursday.

On the downside, the $1,980/$1,990 area, where the mid-point of the ascending channel and the 20-day Simple Moving Average (SMA) are located, form key support area. A daily close below that level could open the door for an extended slide toward the next static support at $1,960 and the lower limit of the channel at $1,940.

Static resistance seems to have formed at $2,040 following the action seen in the second half of the week. Above that level, $2,050 (static level from March 2022) aligns as the next resistance ahead of $2,070 (March 8, 2022, high). It's worth noting, however, that Gold price needs to stabilize in the upper half of the channel by confirming $2,000 as support to regather its bullish momentum.

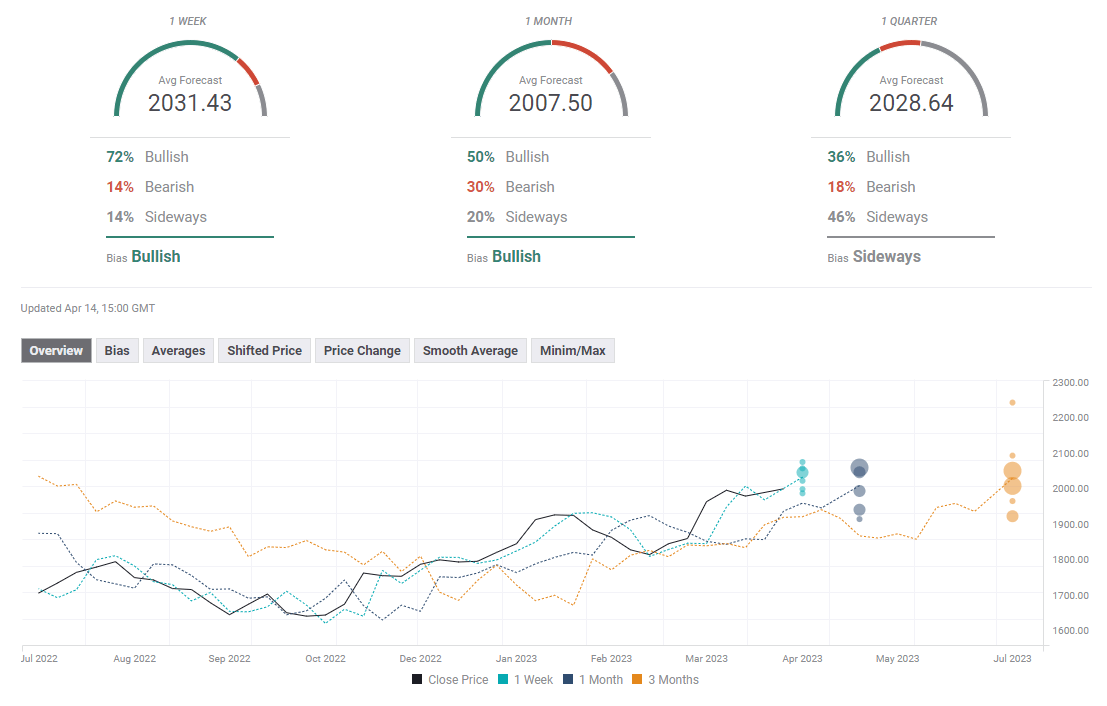

Gold price forecast poll

The FXStreet Forecast Poll points to a bullish bias in the near term with the one-week average target aligning at $2,031. The one-month outlook remains slightly bullish but the target is much closer to $2,000 in that time frame.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.