- Gold price ended a volatile week little changed.

- XAU/USD continues to trade in between key technical levels.

- Fedspeak next week could help XAU/USD find direction.

Gold price declined below $1,930 on Thursday, its lowest level in three months, but reversed its direction ahead of the weekend as the US Dollar (USD) faced heavy selling pressure. Next week’s economic docket will not be featuring any high-impact data releases, so the market pricing around the Federal Reserve’s (Fed) rate outlook could drive XAU/USD action.

What happened last week?

Following a quiet trading day on Monday, XAU/USD turned south early Tuesday after the Chinese central bank, the People’s Bank of China (PBoC), cut the 7-day Reverse Repo Rate from 2.0% to 1.90%. This decision revived concerns over an economic slowdown in China, the biggest gold consumer in the world, and its potential negative impact on the yellow metal’s demand outlook.

Later in the day, data from the US showed that inflation, as measured by the Consumer Price Index (CPI), declined to 4% on a yearly basis in May from 4.9% in April. With this reading essentially confirming a pause in the Fed’s tightening cycle in June, the USD started to weaken against its rivals, helping XAU/USD find support.

On Wednesday, the Fed opted to hold the policy rate steady at the range of 5-5.25%. However, the revised Summary of Projections (SEP), the so-called dot plot, showed that the terminal rate forecast for end-2023 rose to 5.6% from the 5.1% projected in March. Although the dot plot also pointed to a total of 100 basis points (bps) rate cuts in 2024, FOMC Chairman Jerome Powell explained that it will only be appropriate to cut rates when inflation comes down and noted that non a single policymaker expected a rate cut this year. On a dovish note, Powell refrained from committing to a return to rate hikes as early as July when asked about it. Nevertheless, the hawkish dot plot provided a boost to US Treasury bond yields and supported the USD in the late American session, not allowing XAU/USD to gain traction.

Early Thursday, the PBoC lowered the one-year Medium-term Lending Facility (MLF) rate, the medium-term policy rate, to 2.65% from 2.75%. In the meantime, US yields continued to stretch higher in the Fed aftermath, dragging Gold price to below $1,930, its weakest level since mid-March. In the second half of the day, the broad-based USD weakness paved the way for a decisive rebound in XAU/USD. The European Central Bank’s (ECB) hawkish tone and the dismal weekly US Initial Jobless Claims data, which showed that there were 262,000 first-time applications for unemployment benefits in the week ending June 3, caused capital outflows out of the USD. While XAU/USD gained nearly 1% on the day, XAU/EUR closed in negative territory, suggesting that the USD selloff was the primary driver of the XAU/USD’s rebound rather than stronger demand for gold.

Gold price struggled to build on Thursday's recovery gains ahead of the weekend as US Treasury bond yields rebounded. Consumer sentiment in the US improved in early June, with the University of Michigan's (UoM) Consumer Confidence Index rising to 63.9 from 59.2 in May. The publication further revealed that the long-run inflation expectation remained virtually unchanged at 3%.

Next week

On Tuesday, the PBoC will release the one-year and five-year Loan Prime Rates. At this point, it shouldn’t come as a surprise if the PBoC lowers these rates as well. Since the PBoC doesn’t release a policy statement alongside the rate decision, the market reaction should remain short-lived.

The US Department of Labor’s weekly Initial Jobless Claims data will be watched closely by market participants on Thursday given its stronger-than-usual impact on the USD’s valuation lately. A significant decline, of more than 30,000, should support the USD and weigh on XAU/USD. On the other hand, a third straight reading above 250,000 is likely to have the opposite effect on the pair.

On the last trading day of the week, S&P Global will release the preliminary Manufacturing and Services PMI reports for June. Business activity in the manufacturing sector is forecast to continue to contract, while the service sector is expected to remain in expansion territory. If the underlying details of Services PMI report point to a softening input inflation in the service sector, the USD could lose strength and vice versa.

In the meantime, market participants will pay close attention to comments from Fed policymakers, including Chairman Powell during the two-day testimony, throughout the week. Powell said that July will be a “live” meeting. According to the CME Group FedWatch Tool, markets are pricing in a more than 70% probability of a 25 bps rate increase in July. A pushback against this market positioning could help Gold price gather bullish momentum. Confirmation of one more interest-rate hike next month, on the other hand, should support the USD.

Gold technical outlook

The 100-day Simple Moving Average (SMA), currently located at $1,940, proved to be a tough support this week as XAU/USD closed above that level after having declined well below it on Thursday. The technical outlook, however, is yet to point to a buildup of bullish momentum, with the Relative Strength Index (RSI) indicator on the daily chart staying below 50.

In case XAU/USD falls below $1,940 and makes a daily close there, an extended slide toward $1,925 (static level) and $1,900 (Fibonacci 38.2% retracement, psychological level) could be witnessed.

To attract bulls, XAU/USD needs to confirm $1,950 (Fibonacci 23.6% retracement, 20-day SMA) as support. In that scenario, $1,980 (50-day SMA) and $2,000 (psychological level, static level) could be set as the next targets on the upside.

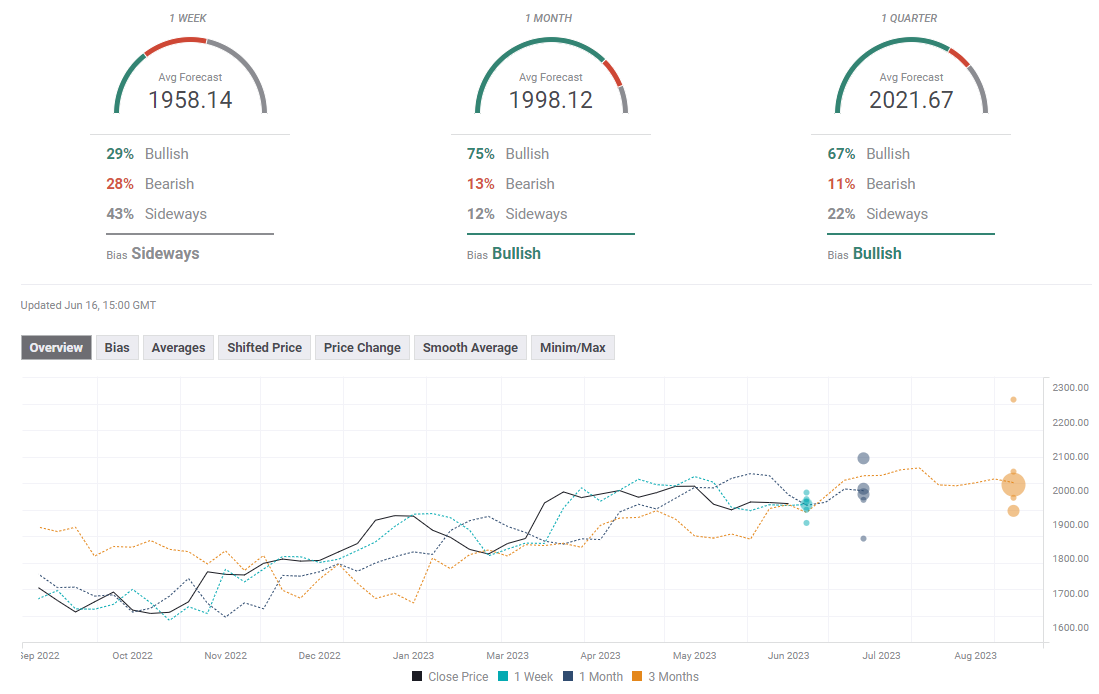

Gold forecast poll

FXStreet Forecast Poll shows that there is no directional consensus among investors in the near term. The one-month outlook, however, remains bullish with the average target aligning near $2,000.

(An earlier version of this story said that the US Federal Reserve stress tests were expected this week. This reference has been removed as results are expected on June 28.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steady near 0.6250 ahead of RBA Minutes

The AUD/USD pair trades on a flat note around 0.6250 during the early Asian session on Monday. Traders brace for the Reserve Bank of Australia Minutes released on Monday for some insight into the interest rate outlook.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold price bulls seem non-committed around $2,620 amid mixed cues

Gold price struggles to capitalize on last week's goodish bounce from a one-month low and oscillates in a range during the Asian session on Monday. Geopolitical risks and trade war fears support the safe-haven XAU/USD. Meanwhile, the Fed's hawkish shift acts as a tailwind for the elevated US bond yields and a bullish USD, capping the non-yielding yellow metal.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.