- The US Dollar weakened amid an improvement in market sentiment.

- US data kept recession fears away and leaves the possibility of another Fed rate hike alive.

- Gold needs to break $1,980/85 to clear the way towards $2,000.

Gold prices ended a three-week negative streak, boosted by an improvement in market sentiment and lower US Treasury yields. XAU/USD rebounded after hitting the lowest level since mid-March near $1,930. In the upcoming week, no critical reports are due, as market attention turns towards the June 13-14 Federal Reserve (Fed) meeting.

Too much information

An improvement in market sentiment, backed by positive data from China and a still-strong US job market, as well as the resolution of the debt-limit issue, boosted equity prices and riskier assets. The US Dollar Index dropped after rising for three consecutive weeks, inversely to Gold prices, which rebounded from two-month lows.

Economic data from the US showed weak numbers regarding manufacturing activity (ISM Manufacturing PMI) and a solid labor market. The US official employment report exceeded expectations, with an impressive increase in Nonfarm Payrolls by 339,000 in May, and a positive revision to April's figures from 253,000 to 293,000. On the negative side, the unemployment rate rose to 3.7%. Overall, it was a positive report, in line with what ADP showed on Thursday. The job data provides evidence for those who want to raise rates further.

There are no signs of an imminent recession in the US. However, market prices continue to show some expectations that the Fed will have to start cutting interest rates before year-end. The odds, according to the CME Fed Watch Tool, are lower than a month ago.

Fed meeting looms

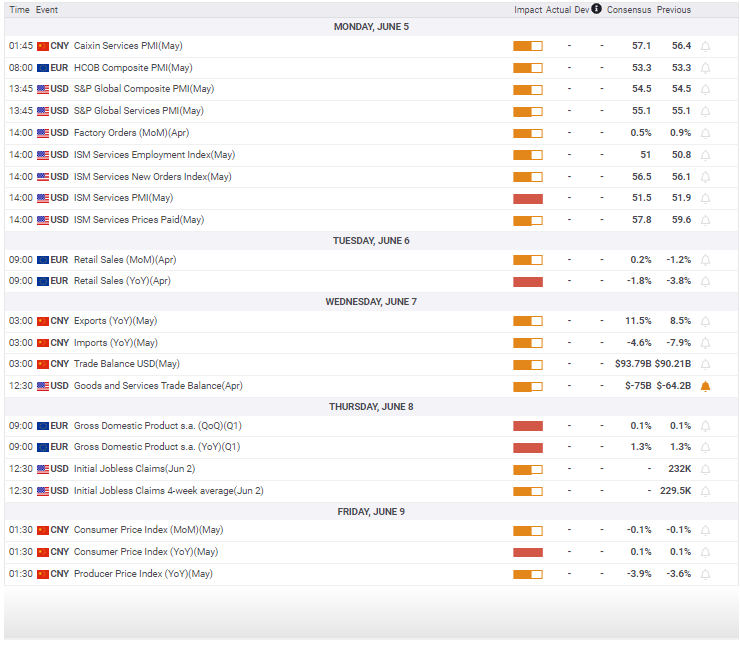

Next week looks relatively quiet in terms of economic data and could be seen as "the week before the FOMC meeting." There will be only two relevant reports in the US next week: the ISM Services PMI (Monday) and the weekly jobless claims (Thursday).

The Fed will have its monetary policy meeting on June 13-14, and market participants are anticipating a pause in the tightening cycle. The door that Chair Powell opened a few days ago by suggesting a pause was probably opened wider by recent comments from Fed officials favoring a pause. Market participants won't be hearing more comments from FOMC members as they enter the blackout period on Saturday.

For the next Fed meeting, markets anticipate a pause, but it is not guaranteed. Some analysts see the possibility of another rate hike, particularly after the latest job numbers.

While the data boosted tightening expectations, Chair Powell and other members offset the impact by signaling their willingness to "skip a meeting”. The final word will likely come from May's Consumer Price Index, which is set to be released on June 13.

Beyond the US, there will also be a relatively quiet week. Chinese data will be scrutinized closely for more signs of how its economy is performing. Releases include the Caixin Services PMI (Monday), trade data (Wednesday), and the Consumer Price Index (Friday). If activity continues to show signs of stagnation, speculation about some action from the People's Bank of China will grow, particularly if inflation confirms another negative reading for May.

The Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) will have their monetary policy meetings, but no changes in rates are expected. Central banks are far from declaring victory in the fight against inflation, but the tightening cycle looks like it is nearing its end. That means no more rate hikes and favors the demand for government bonds, which could end up pushing yields to the downside, a positive scenario for Gold.

If the improvement seen in the recent session in market sentiment continues and weighs on the US Dollar, XAU/USD could receive another boost. It will be crucial for bulls that Treasury yields continue to trend lower or experience limited rebounds. The road to the upside is complex for Gold. It might need more signs of inflation slowing down and downbeat US economic data.

Gold price technical outlook

The rebound in XAU/USD from the $1,930 area ran into resistance near the $1,985 zone, where the 20-day Simple Moving Average (SMA) stands. As long as it trades below this level, the yellow metal seems vulnerable to sharp corrections that could find support at $1,950 and $1,930. Consolidation above $1,985 would be key for a test of $2,000, with the next target at $2,010.

The weekly chart offers a positive perspective as XAU/USD manages to remain above the 20-week SMA, which is flattening at $1,935. A weekly close below that line would be a strong bearish sign.

The technical outlook for Gold shows mixed clues for the time being. After falling for three consecutive weeks, the sharp rebound evidenced some signs of downward exhaustion. A firm break above $1,985 is needed, and the price has to remain above $1,945 to avoid extra bearish pressure.

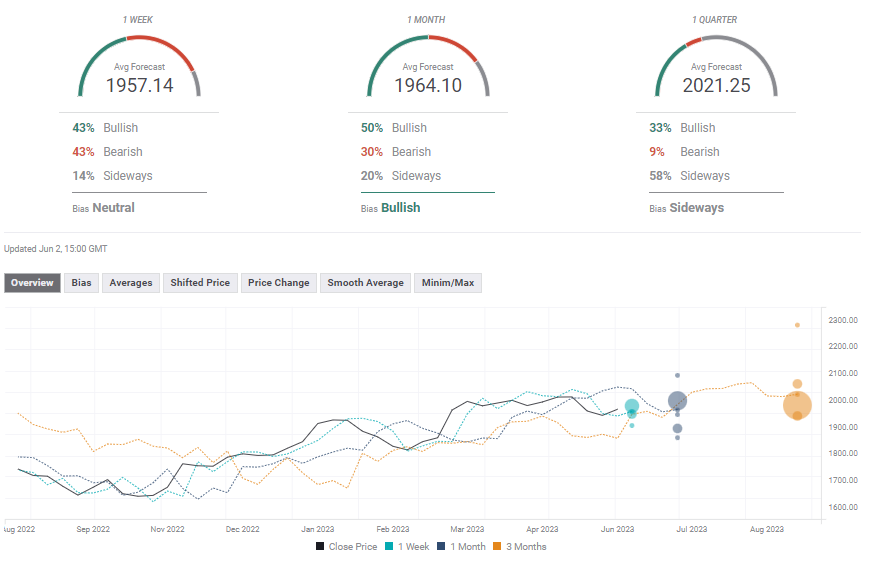

Gold price forecast poll

The FXStreet Forecast Poll shows a mixed picture for XAU/USD in the near term, with divergence on the trend. The one-month target is around the current price level. However, on a three-month perspective, the majority of polled experts see Gold back above $2,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after weak Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY stages a solid recovery toward 143.00 on US-Japan trade optimism

USD/JPY holds the impressive rebound from seven-month lows of 141.61, directed toward 143.00 in the Asian session on Thursday. The pair tracks the US Dollar rebound, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery also aids the pair's upswing.

Gold price corrects from record highs of $3,358

Gold price retreats from a fresh all-time peak of $3,358 reached earlier in the Asian session on Thursday. Despite the pullback, tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing will likely cishion the Gold price downside.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-638213168101057315.png)