- Gold price started the month of March on a firm footing.

- XAU/USD could target $1,865 if $1,840 is confirmed as support.

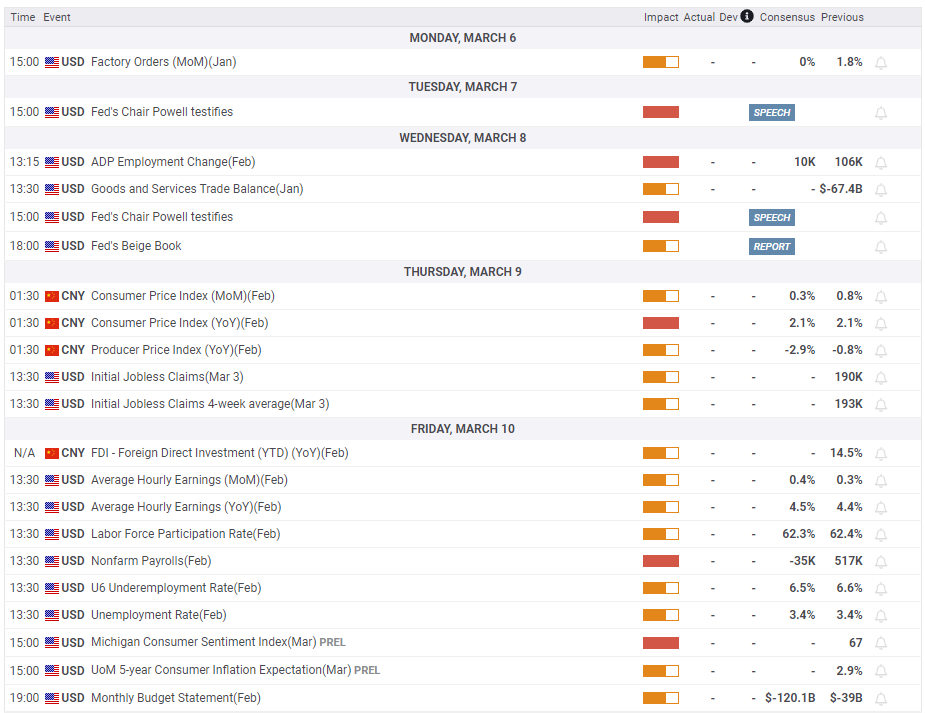

- FOMC Chairman Powell's testimony and US jobs report will be watched closely next week.

Gold price started the week on a bullish note and continued to push higher on hopes of an improving demand outlook. Despite rising US Treasury bond yields, XAU/USD climbed above $1,840 on Friday and snapped a four-week losing streak. FOMC Chairman Jerome Powell’s two-day testimony and the February jobs report from the US will drive the precious metal’s action next week.

What happened last week?

The US Census Bureau announced on Monday that Durable Goods Orders in the US declined by 4.5% on a monthly basis in January. This reading came in worse than the market expectation for a decrease of 4% and made it difficult for the US Dollar (USD) to find demand. As a result, XAU/USD registered daily gains after having closed the previous four trading days in negative territory.

Market action remained choppy on Tuesday as month-end flows distorted inter-market correlations. The Conference Board reported that the one-year consumer inflation expectation component of its Consumer Confidence Survey declined to 6.3% in February from 6.7% in January, not allowing the US Treasury bond yields to gain traction.

During the Asian trading hours on Wednesday, the data from China, the world’s biggest gold consumer, revealed that the economic activity in the manufacturing sector expanded at a stronger pace than expected in February with the NBS Manufacturing PMI improving to 52.6 from 50.1. With this data reviving optimism for an improving demand outlook for the precious metal, Gold price continued to push higher on Wednesday. Although the ISM Manufacturing PMI report from the US showed that input inflation in the manufacturing sector unexpectedly rose in February after having declined in the previous four months, XAU/USD managed to keep its footing.

On Thursday, the US Bureau of Labor Statistics’ quarterly publication revealed that Unit Labor Costs increased by 3.2% in the fourth quarter, surpassing the market expectation of 1.6% by a wide margin. Hot wage inflation data triggered a leg higher in the US Treasury bond yields and the 10-year reference reached its highest level since early November above 4%. This development caused XAU/USD bulls to move to the sidelines. In the late American session, however, Atlanta Fed President Raphael Bostic voiced his support for a 25 basis points Fed rate hike in March and said that there could be a pause in the tightening cycle in mid-to-late summer. These comments brought back risk flows and capped the USD’s gains, allowing Gold price to find support.

Early Friday, Caixin Services PMI from China came in at 55 in February, compared to the market expectation of 50.5, and provided a boost to Gold price.

Finally, the ISM announced that the Services PMI ticked up to 55.1 in February from 55.2 in January. This reading came in higher than the market expectation of 54.5. Further details of the publication showed that the Price Paid Index edged lower to 65.6, compared to the market expectation of 64.5, and the Employment Index improved to 54 from 50. On the back of the upbeat PMI survey, the USD managed to limit its losses and capped XAU/USD's upside ahead of the weekend.

Next week

FOMC Chairman Jerome Powell will testify on the Federal Reserve’s semiannual monetary policy report before the Senate Banking Committee on Tuesday and before the House Financial Services Committee on Wednesday. In the past, Powell delivered the same prepared remarks at both appearances. Hence, markets will be paying close attention to his testimony on Tuesday.

Powell will surely be asked about inflation and the possibility of the US economy tipping into recession as a result of the US central bank’s policy tightening. In case Powell communicates that it is unlikely to return to larger, 50 bps, rate hikes in the near future, the USD could come under selling pressure and open the door for further gains in XAU/USD. According to the CME Group FedWatch Tool, markets are pricing in a nearly 30% probability of a 50 bps rate increase at the next meeting, suggesting that there is room on the downside for US T-bond yields and the USD if investors are convinced that the next rate hike will be 25 bps.

On the other hand, Powell could opt to refrain from committing to the size of the next rate increase and reiterate the data-dependent approach. In that scenario, market action is likely to remain choppy ahead of Friday’s February jobs report.

During Powell’s testimony, comments on disinflation and growth outlook will also be important. Investors will pay attention to Wall Street’s reaction as well. A risk rally following this event should hurt the USD and lift XAU/USD.

Nonfarm Payrolls (NFP) in the US are forecast to decline by 35,000 in February following January’s impressive increase of 517,000. If NFP surprises to the upside once again and comes in above 100,000, the USD could gather strength on Friday, especially if Powell sticks to the data-dependent approach as explained above. On the flip side, a negative reading could trigger a USD-selling wave with the immediate reaction and help Gold price stretch higher.

Market participants will scrutinize the underlying details of the labor market report as well. On a yearly basis, wage inflation, as measured by the Average Hourly Earnings, is forecast to edge higher to 4.5% from 4.4% in January. The Fed is concerned that rising wages will feed into higher inflation expectations and will make it difficult for them to bring price pressures down. Hence, a decline in this component should weigh on the USD and vice versa. Finally, the Labor Force Participation Rate is projected to tick down to 62.3% from 62.4%. In case there is a significant improvement in this data, that would suggest that employers might not have to be forced to offer higher salaries to potential employees with more people looking for work. In turn, that could be assessed as a USD-negative development.

Gold price technical outlook

Gold price climbed above $1,830, where the Fibonacci 38.2% retracement level of the latest uptrend is located, and managed to hold there. Once XAU/USD stabilizes above $1,840 (20-day Simple Moving Average) it could target $1,865 (50-day SMA) and $1,880 (Fibonacci 23.6% retracement).

On the other hand, sellers could take action if XAU/USD makes a daily close below $1,830. In that scenario, $1,810 (static level) aligns as interim support ahead f $1,800 (psychological level, 100-day SMA) and $1,790 (Fibonacci 50% retracement).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart is about to rise above 50, suggesting that sellers stay on the sidelines for the time being.

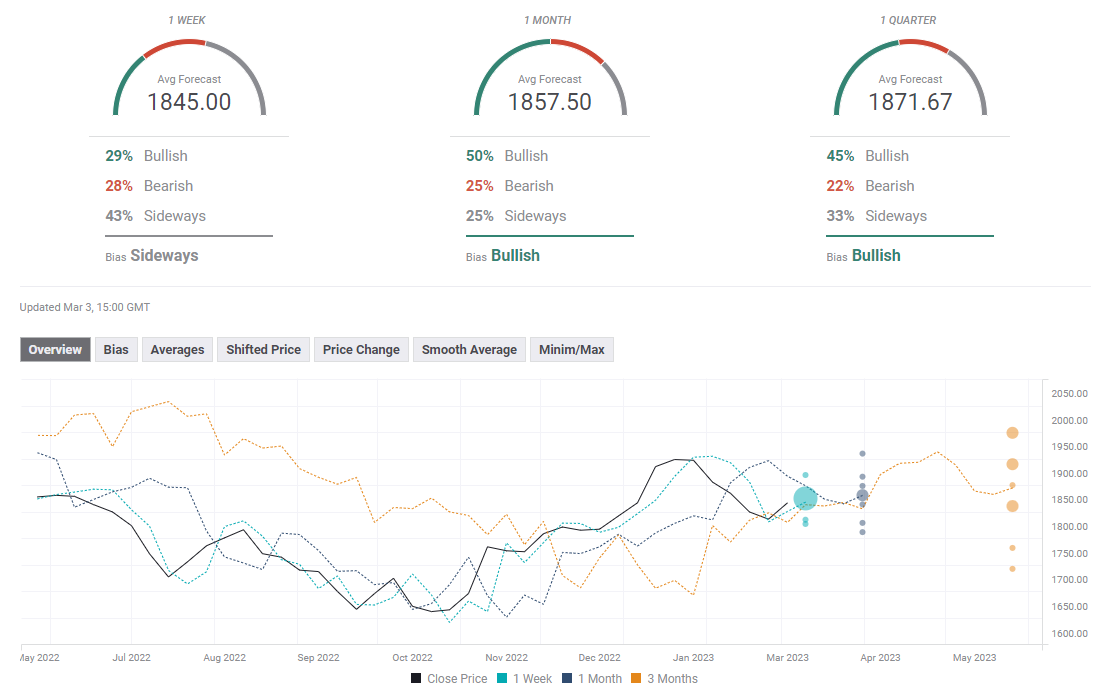

Gold price forecast poll

The FXStreet Forecast Poll paints a mixed picture for XAU/USD in the near term, with the one-week average target sitting at $1,845. The bullish bias stays intact in the one-month view.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD remains firm, struggles to retest 1.1400 and above

By the end of the week, EUR/USD had cooled off from its multi-year peak above 1.1400, settling robustly around 1.1360. Meanwhile, the Greenback remains on the back foot after lacklustre data, stagflation concerns, and global trade war fears.

GBP/USD trims gains, recedes to the 1.3070 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.